Answered step by step

Verified Expert Solution

Question

1 Approved Answer

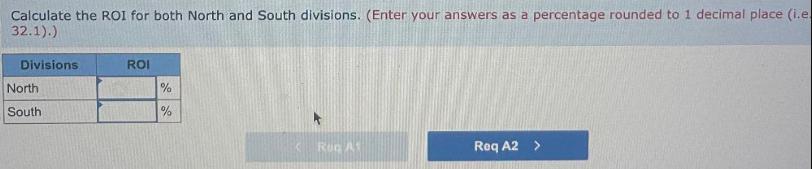

Calculate the ROI for both North and South divisions. (Enter your answers as a percentage rounded to 1 decimal place (i.e. 32.1).) Divisions North

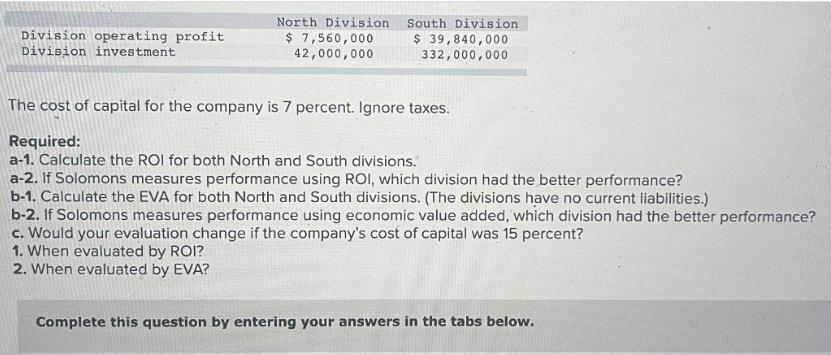

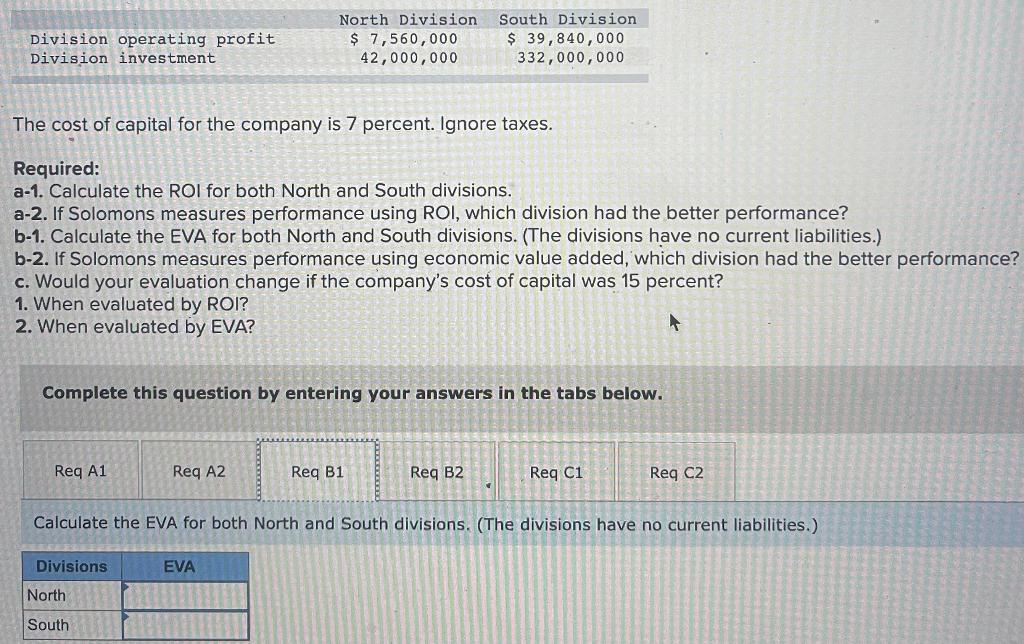

Calculate the ROI for both North and South divisions. (Enter your answers as a percentage rounded to 1 decimal place (i.e. 32.1).) Divisions North South ROI % % Run A Req A2 > Division operating profit Division investment North Division $ 7,560,000 42,000,000 South Division $ 39,840,000 332,000,000 The cost of capital for the company is 7 percent. Ignore taxes. Required: a-1. Calculate the ROI for both North and South divisions. a-2. If Solomons measures performance using ROI, which division had the better performance? b-1. Calculate the EVA for both North and South divisions. (The divisions have no current liabilities.) b-2. If Solomons measures performance using economic value added, which division had the better performance? c. Would your evaluation change if the company's cost of capital was 15 percent? 1. When evaluated by ROI? 2. When evaluated by EVA? Complete this question by entering your answers in the tabs below. Division operating profit Division investment The cost of capital for the company is 7 percent. Ignore taxes. Required: a-1. Calculate the ROI for both North and South divisions. a-2. If Solomons measures performance using ROI, which division had the better performance? b-1. Calculate the EVA for both North and South divisions. (The divisions have no current liabilities.) b-2. If Solomons measures performance using economic value added, which division had the better performance? c. Would your evaluation change if the company's cost of capital was 15 percent? 1. When evaluated by ROI? 2. When evaluated by EVA? Req A1 Complete this question by entering your answers in the tabs below. North Division $ 7,560,000 42,000,000 Divisions Reg A2 North South South Division. $ 39,840,000 332,000,000 EVA Req B1 Req B2 Calculate the EVA for both North and South divisions. (The divisions have no current liabilities.). Req C1 Reg C2

Step by Step Solution

★★★★★

3.50 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

a1 Calculate the ROI for both North and South divisions North Division ROI Division Operating Profit Division Investment ROI 7560000 42000000 ROI 018 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started