Answered step by step

Verified Expert Solution

Question

1 Approved Answer

-Calculate the Senor note price as a % of par -can you show an Excel formula? Note 4-Debt Short-Term Borrowings The Company maintains various short-term

-Calculate the Senor note price as a % of par

-can you show an Excel formula?

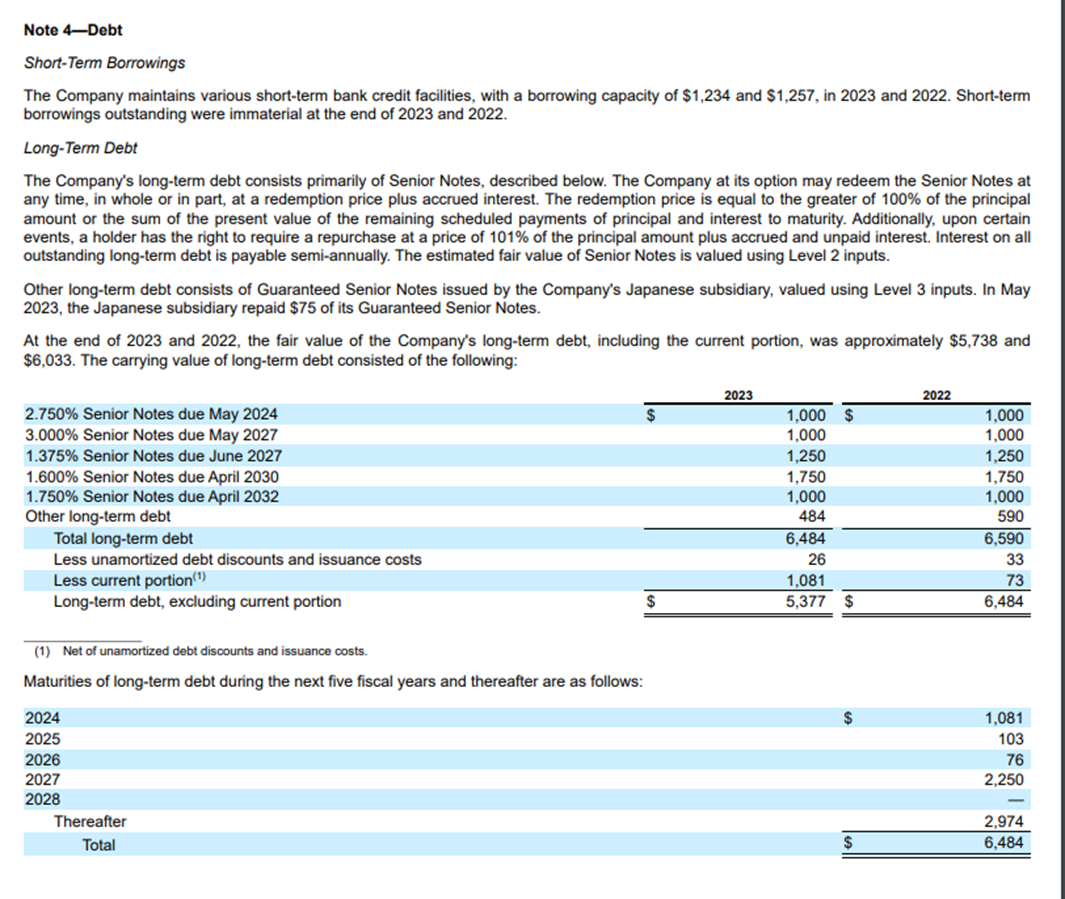

Note 4-Debt Short-Term Borrowings The Company maintains various short-term bank credit facilities, with a borrowing capacity of $1,234 and $1,257, in 2023 and 2022 . Short-term borrowings outstanding were immaterial at the end of 2023 and 2022. Long-Term Debt The Company's long-term debt consists primarily of Senior Notes, described below. The Company at its option may redeem the Senior Notes at any time, in whole or in part, at a redemption price plus accrued interest. The redemption price is equal to the greater of 100% of the principal amount or the sum of the present value of the remaining scheduled payments of principal and interest to maturity. Additionally, upon certain events, a holder has the right to require a repurchase at a price of 101% of the principal amount plus accrued and unpaid interest. Interest on all outstanding long-term debt is payable semi-annually. The estimated fair value of Senior Notes is valued using Level 2 inputs. Other long-term debt consists of Guaranteed Senior Notes issued by the Company's Japanese subsidiary, valued using Level 3 inputs. In May 2023 , the Japanese subsidiary repaid $75 of its Guaranteed Senior Notes. At the end of 2023 and 2022, the fair value of the Company's long-term debt, including the current portion, was approximately $5,738 and $6,033. The carrying value of long-term debt consisted of the following: (1) Net of unamortized debt discounts and issuance costs. Maturities of long-term debt during the next five fiscal years and thereafter are as follows

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started