Answered step by step

Verified Expert Solution

Question

1 Approved Answer

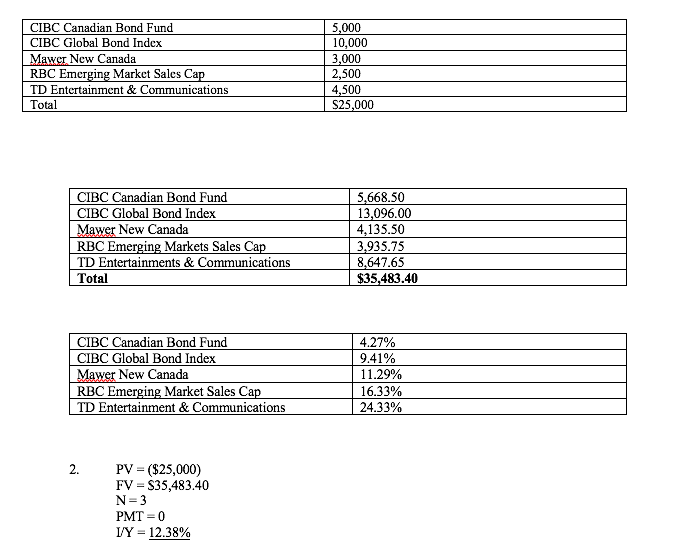

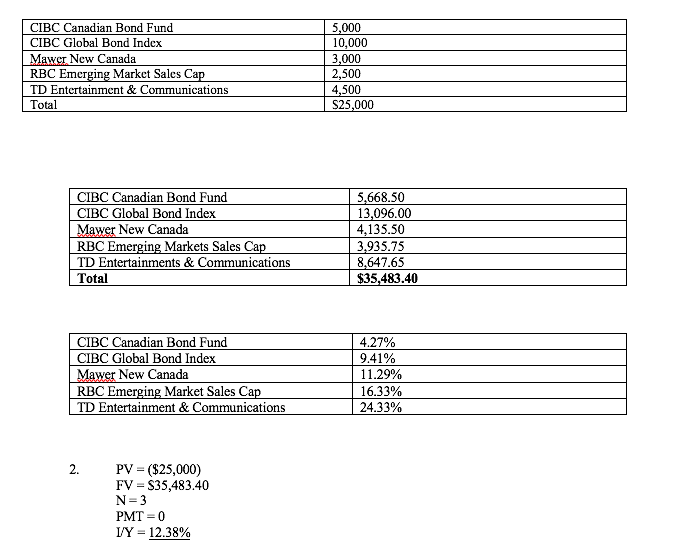

Calculate the simple average weighted return per fund on the initial allocation within the portfolio and comment as to why the portfolio return (calculated in

Calculate the simple average weighted return per fund on the initial allocation within the portfolio and comment as to why the portfolio return (calculated in #2) is different than the sum of the weighted average returns of the funds that make up the portfolio

CIBC Canadian Bond Fund CIBC Global Bond Index Mawer New Canada RBC Emerging Market Sales Cap TD Entertainment & Communications Total 5,000 10,000 3,000 2,500 4,500 $25,000 CIBC Canadian Bond Fund 5,668.50 CIBC Global Bond Index 13,096.00 Mawer New Canada 4,135.50 RBC Emerging Markets Sales Cap 3,935.75 TD Entertainments & Communications 8,647.65 Total $35,483.40 CIBC Canadian Bond Fund 4.27% CIBC Global Bond Index 9.41% Mawer New Canada 11.29% RBC Emerging Market Sales Cap 16.33% TD Entertainment & Communications 24.33% 2. PV = ($25,000) FV = $35,483.40 N=3 PMT=0 I/Y = 12.38%

Step by Step Solution

★★★★★

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

1 Weighted Average Return per Fund To calculate the weighted average return per fund on the initial ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started