Answered step by step

Verified Expert Solution

Question

1 Approved Answer

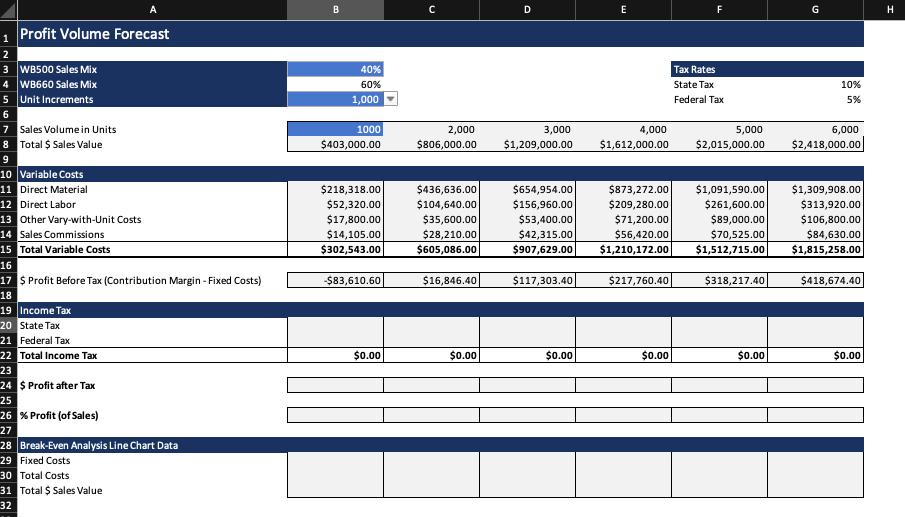

Calculate the state tax incurred for each sales volume using the rate at the top of the sheet. If the profit was zero or below,

Calculate the state tax incurred for each sales volume using the rate at the top of the sheet. If the profit was zero or below, the calculation should return O. (Do NOT just type 0 as the volumes can change.) Apply appropriate cell referencing so that the formula can be dragged down and then across to complete the tax table.

B E F Profit Volume Forecast 2 3 WB500 Sales Mix 4 WB660 Sales Mix 5 Unit Increments 40% Tax Rates 60% State Tax 10% 1,000 Federal Tax 5% 6 7 Sales Volume in Units 8 Total $ Sales Value 1000 2,000 3,000 4,000 5,000 6,000 $403,000.00 $806,000.00 $1,209,000.00 $1,612,000.00 $2,015,000.00 $2,418,000.00 10 Variable Costs 11 Direct Material 12 Direct Labor 13 Other Vary-with-Unit Costs 14 Sales Commissions 15 Total Variable Costs $218,318.00 $52,320.00 $17,800.00 $14,105.00 $302,543.00 $436,636.00 $654,954.00 $873,272.00 $209,280.00 $1,091,590.00 $1,309,908.00 $104,640.00 $156,960.00 $261,600.00 $313,920.00 $35,600.00 $28,210.00 $605,086.00 $53,400.00 $71,200.00 $89,000.00 $70,525.00 $106,800.00 $42,315.00 $907,629.00 $56,420.00 $1,210,172.00 $84,630.00 $1,815,258.00 $1,512,715.00 16 17 S Profit Before Tax (Contribution Margin - Fixed Costs) -$83,610.60 $16,846.40 $117,303.40 $217,760.40 $318,217.40 $418,674.40 18 19 Income Tax 20 State Tax 21 Federal Tax 22 Total Income Tax 23 24 $ Profit after Tax $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 25 26 % Profit (of Sales) 27 28 Break-Even Analysis Line Chart Data 29 Fixed Costs 30 Total Costs 31 Total $ Sales Value 32

Step by Step Solution

★★★★★

3.31 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

60915c5d9fedf_208472.pdf

180 KBs PDF File

60915c5d9fedf_208472.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started