Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Palm Resorts acquired its 70 percent interest in Sun City on January 1, 2017, for $41,750,000. The fair value of the 30 percent noncontrolling

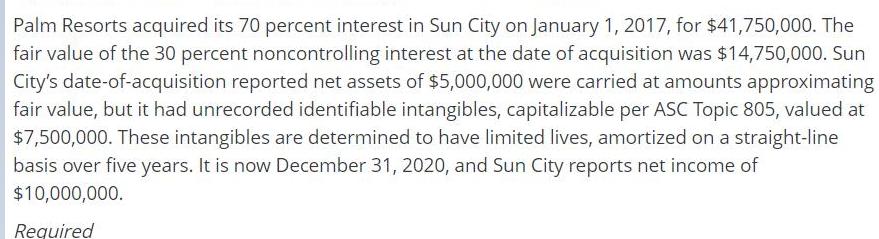

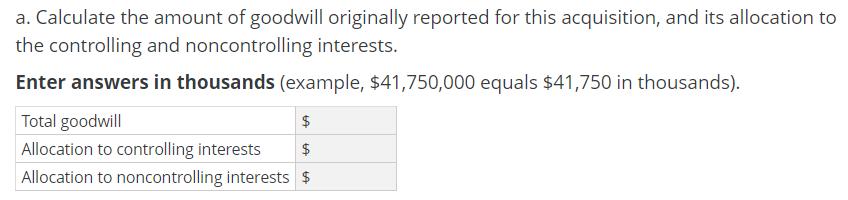

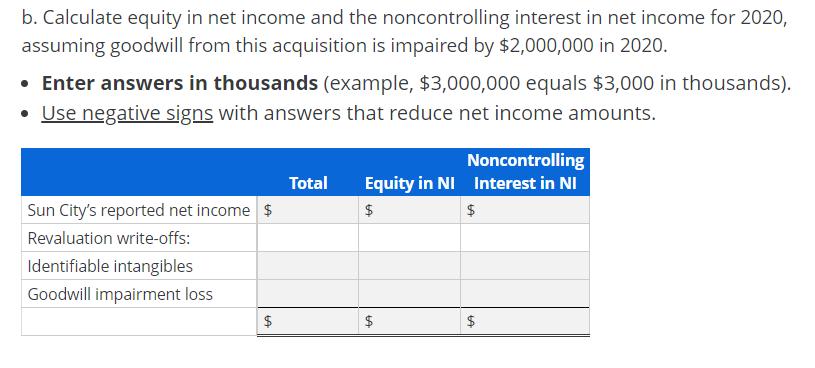

Palm Resorts acquired its 70 percent interest in Sun City on January 1, 2017, for $41,750,000. The fair value of the 30 percent noncontrolling interest at the date of acquisition was $14,750,000. Sun City's date-of-acquisition reported net assets of $5,000,000 were carried at amounts approximating fair value, but it had unrecorded identifiable intangibles, capitalizable per ASC Topic 805, valued at $7,500,000. These intangibles are determined to have limited lives, amortized on a straight-line basis over five years. It is now December 31, 2020, and Sun City reports net income of $10,000,000. Required a. Calculate the amount of goodwill originally reported for this acquisition, and its allocation to the controlling and noncontrolling interests. Enter answers in thousands (example, $41,750,000 equals $41,750 in thousands). Total goodwill Allocation to controlling interests $ Allocation to noncontrolling interests $ b. Calculate equity in net income and the noncontrolling interest in net income for 2020, assuming goodwill from this acquisition is impaired by $2,000,000 in 2020. Enter answers in thousands (example, $3,000,000 equals $3,000 in thousands). Use negative signs with answers that reduce net income amounts. Noncontrolling Equity in NI Interest in NI Total Sun City's reported net income $ Revaluation write-offs: Identifiable intangibles Goodwill impairment loss 2$ $ %24 %24

Step by Step Solution

★★★★★

3.34 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Answers Calculate the amount of goodwill as follows Acquisition Cost Fair Valu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started