Answered step by step

Verified Expert Solution

Question

1 Approved Answer

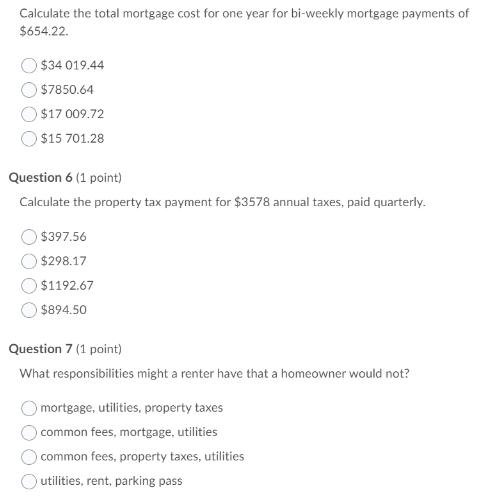

Calculate the total mortgage cost for one year for bi-weekly mortgage payments of $654.22. $34 019.44 $7850.64 $17 009.72 $15 701.28 Question 6 (1

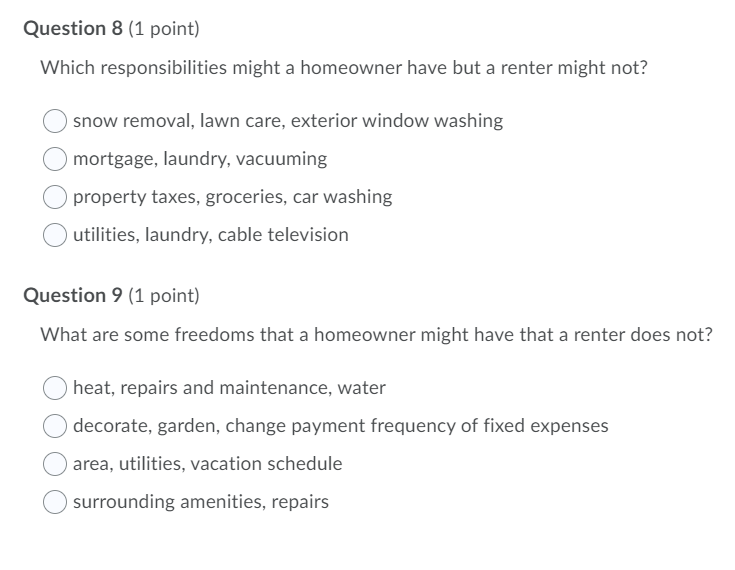

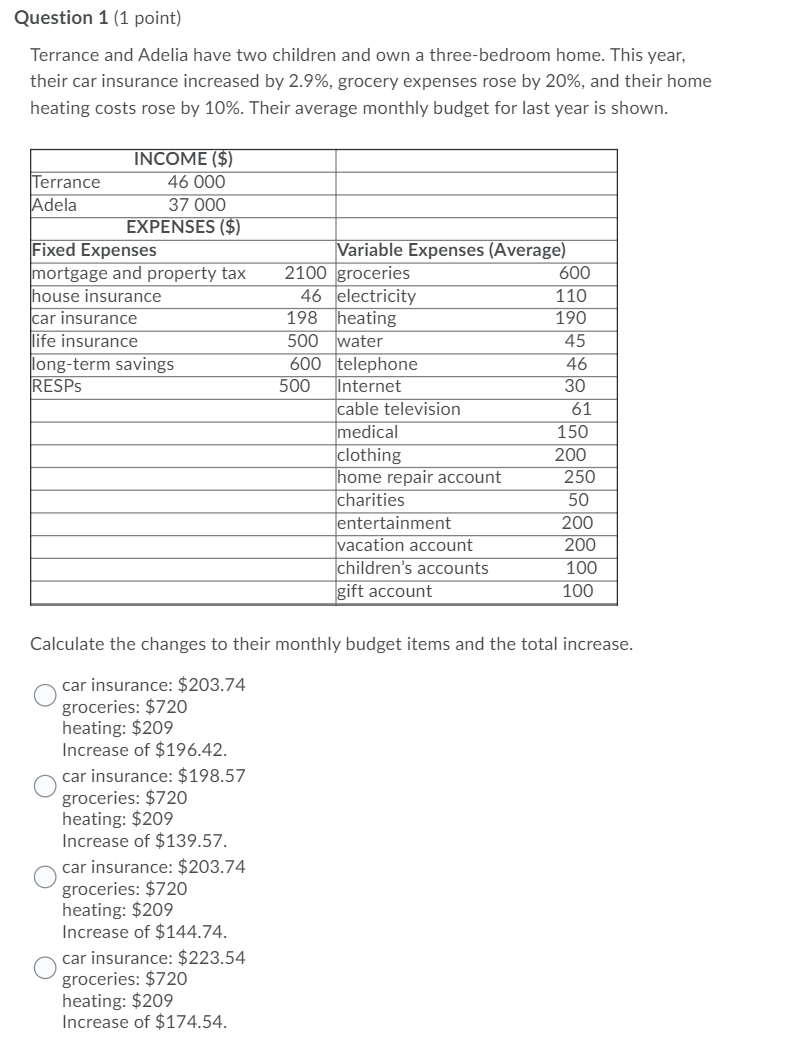

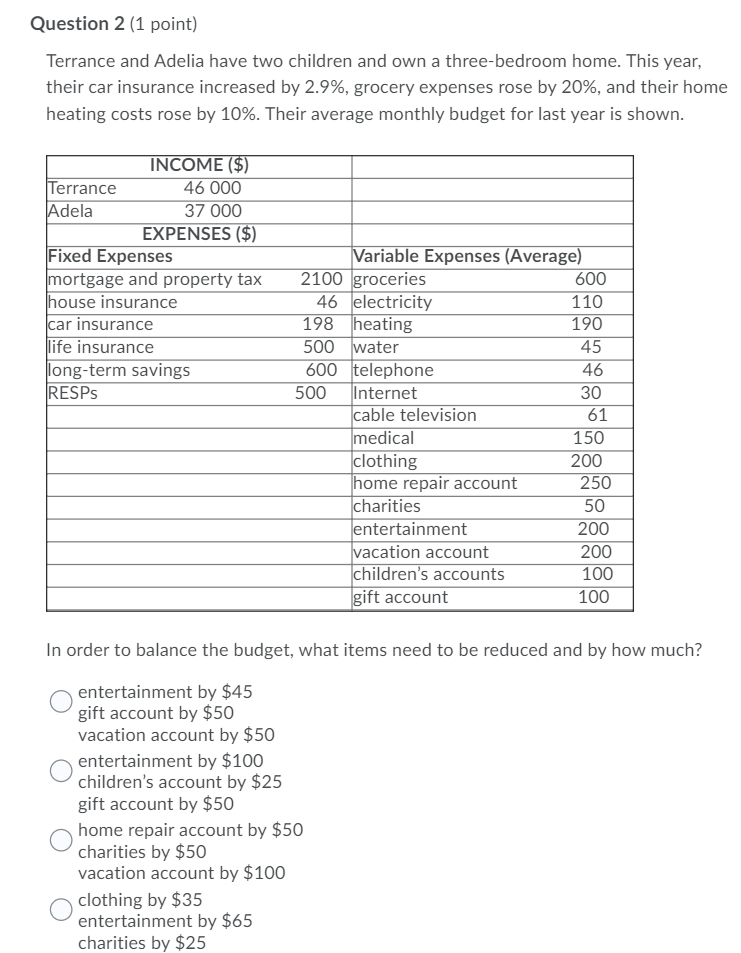

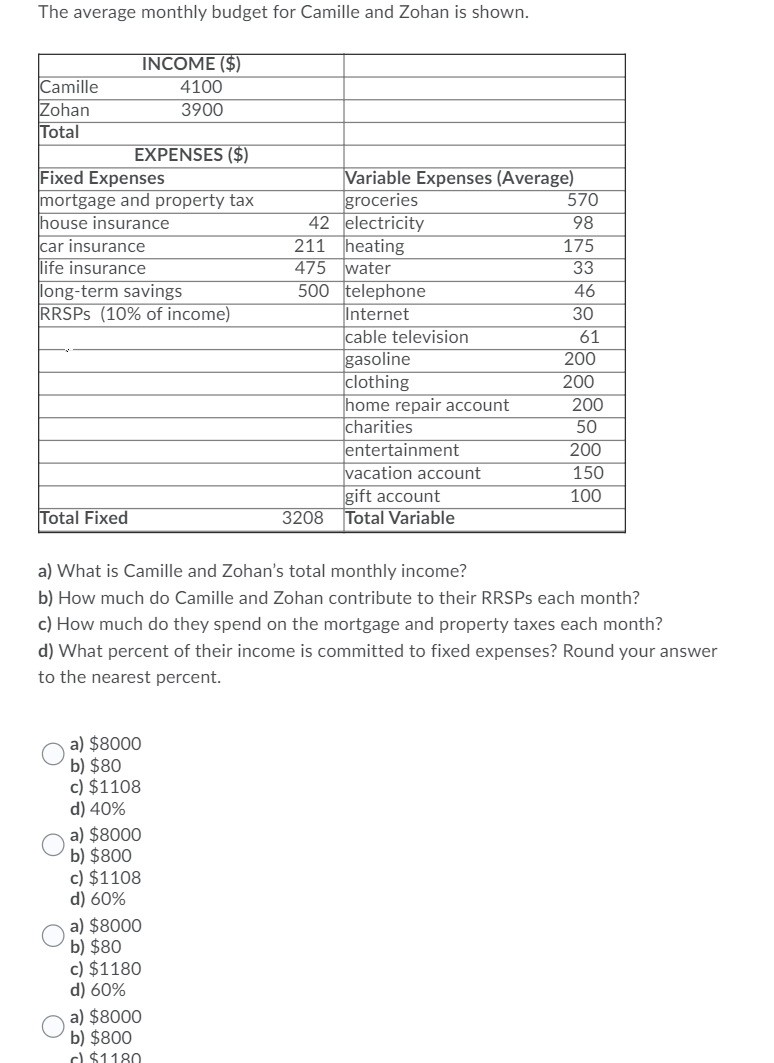

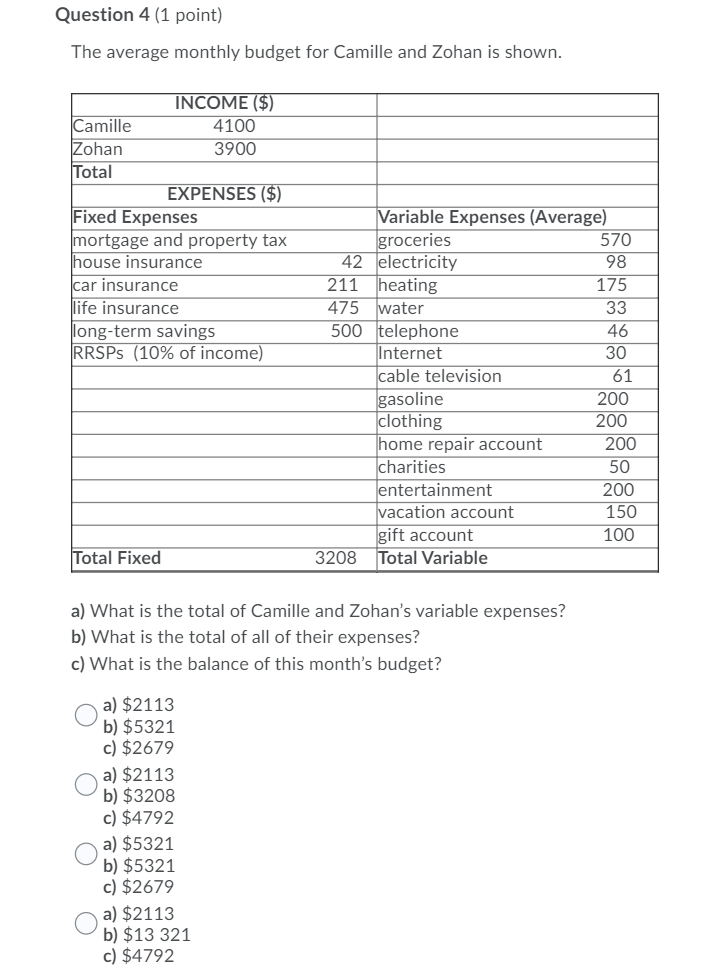

Calculate the total mortgage cost for one year for bi-weekly mortgage payments of $654.22. $34 019.44 $7850.64 $17 009.72 $15 701.28 Question 6 (1 point) Calculate the property tax payment for $3578 annual taxes, paid quarterly. $397.56 $298.17 $1192.67 $894.50 Question 7 (1 point) What responsibilities might a renter have that a homeowner would not? mortgage, utilities, property taxes common fees, mortgage, utilities common fees, property taxes, utilities Outilities, rent, parking pass Question 8 (1 point) Which responsibilities might a homeowner have but a renter might not? snow removal, lawn care, exterior window washing mortgage, laundry, vacuuming property taxes, groceries, car washing utilities, laundry, cable television Question 9 (1 point) What are some freedoms that a homeowner might have that a renter does not? heat, repairs and maintenance, water decorate, garden, change payment frequency of fixed expenses area, utilities, vacation schedule surrounding amenities, repairs Question 1 (1 point) Terrance and Adelia have two children and own a three-bedroom home. This year, their car insurance increased by 2.9%, grocery expenses rose by 20%, and their home heating costs rose by 10%. Their average monthly budget for last year is shown. Terrance Adela INCOME ($) 46 000 37 000 EXPENSES ($) Fixed Expenses mortgage and property tax house insurance car insurance life insurance long-term savings RESPS Variable Expenses (Average) 2100 groceries 46 electricity car insurance: $203.74 groceries: $720 heating: $209 Increase of $144.74. car insurance: $223.54 groceries: $720 heating: $209 Increase of $174.54. 198 heating 500 water 600 telephone 500 Internet cable television medical clothing home repair account charities entertainment vacation account children's accounts gift account 600 110 190 45 46 30 61 150 200 250 50 200 200 100 100 Calculate the changes to their monthly budget items and the total increase. car insurance: $203.74 groceries: $720 heating: $209 Increase of $196.42. car insurance: $198.57 groceries: $720 heating: $209 Increase of $139.57. Question 2 (1 point) Terrance and Adelia have two children and own a three-bedroom home. This year, their car insurance increased by 2.9%, grocery expenses rose by 20%, and their home heating costs rose by 10%. Their average monthly budget for last year is shown. Terrance Adela INCOME ($) 46 000 37 000 EXPENSES ($) Fixed Expenses mortgage and property tax house insurance car insurance life insurance long-term savings RESPs entertainment by $100 children's account by $25 gift account by $50 Variable Expenses (Average) 2100 groceries entertainment by $65 charities by $25 46 electricity 198 heating 500 water 600 500 home repair account by $50 charities by $50 vacation account by $100 clothing by $35 telephone Internet cable television medical clothing home repair account charities entertainment vacation account children's accounts gift account 600 110 190 45 46 30 61 150 200 In order to balance the budget, what items need to be reduced and by how much? entertainment by $45 gift account by $50 vacation account by $50 250 50 200 200 100 100 The average monthly budget for Camille and Zohan is shown. Camille Zohan Total EXPENSES ($) Fixed Expenses mortgage and property tax house insurance car insurance life insurance long-term savings RRSPs (10% of income) Total Fixed a) $8000 b) $80 c) $1108 d) 40% INCOME ($) 4100 3900 a) $8000 b) $800 c) $1108 d) 60% a) $8000 b) $80 c) $1180 d) 60% Variable Expenses (Average) groceries 42 electricity a) $8000 b) $800 c) $1180 211 heating 475 water 500 telephone Internet 3208 a) What is Camille and Zohan's total monthly income? b) How much do Camille and Zohan contribute to their RRSPs each month? cable television gasoline clothing home repair account charities entertainment vacation account gift account Total Variable c) How much do they spend on the mortgage and property taxes each month? d) What percent of their income is committed to fixed expenses? Round your answer to the nearest percent. 570 98 175 33 46 30 61 200 200 200 50 200 150 100 Question 4 (1 point) The average monthly budget for Camille and Zohan is shown. Camille Zohan Total EXPENSES ($) Fixed Expenses mortgage and property tax house insurance INCOME ($) 4100 3900 car insurance life insurance long-term savings RRSPs (10% of income) Total Fixed a) $2113 b) $5321 c) $2679 a) $2113 b) $3208 c) $4792 a) $5321 b) $5321 c) $2679 a) What is the total of Camille and Zohan's variable expenses? b) What is the total of all of their expenses? c) What is the balance of this month's budget? Variable Expenses (Average) groceries 42 electricity heating water a) $2113 b) $13 321 c) $4792 211 475 500 telephone Internet cable television gasoline clothing home repair account charities entertainment vacation account gift account 3208 Total Variable 570 98 175 33 46 30 61 200 200 200 50 200 150 100

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Lets break down these questions one by one Question 6 Calculate the property tax payment for 3578 annual taxes paid quarterly To calculate quarterly p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started