Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculate the U.S. tax due by Robin. Hint: U.S. does not have a treaty with Argentina. Determine if Robin is subject to the BEAT

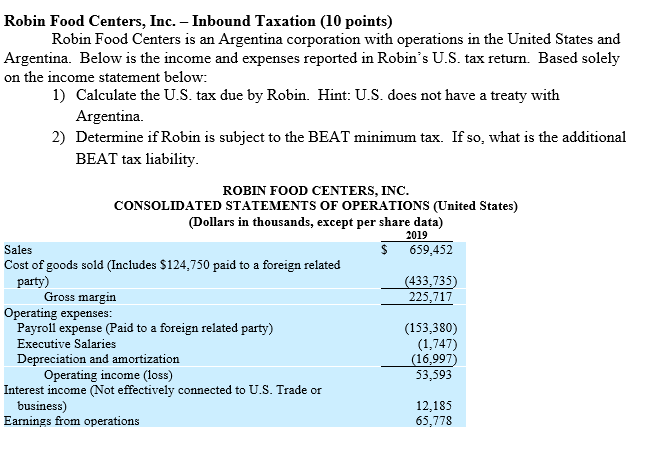

Calculate the U.S. tax due by Robin. Hint: U.S. does not have a treaty with Argentina. Determine if Robin is subject to the BEAT minimum tax. If so, what is the additional BEAT tax liability. Robin Food Centers, Inc. - Inbound Taxation (10 points) Robin Food Centers is an Argentina corporation with operations in the United States and Argentina. Below is the income and expenses reported in Robin's U.S. tax return. Based solely on the income statement below: 1) Calculate the U.S. tax due by Robin. Hint: U.S. does not have a treaty with Argentina. 2) Determine if Robin is subject to the BEAT minimum tax. If so, what is the additional BEAT tax liability. ROBIN FOOD CENTERS, INC. CONSOLIDATED STATEMENTS OF OPERATIONS (United States) (Dollars in thousands, except per share data) 2019 $ 659,452 Sales Cost of goods sold (Includes $124,750 paid to a foreign related party) Gross margin Operating expenses: Payroll expense (Paid to a foreign related party) Executive Salaries Depreciation and amortization Operating income (loss) Interest income (Not effectively connected to U.S. Trade or business) Earnings from operations (433,735) 225,717 (153,380) (1,747) (16,997) 53,593 12,185 65,778

Step by Step Solution

★★★★★

3.55 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the US tax due by Robin Food Centers Inc we need to determine the taxable income based ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started