Answered step by step

Verified Expert Solution

Question

1 Approved Answer

DOS Corporation is considering two possible investments and needs your help in determining which will be the better financial option. Perform the necessary calculations

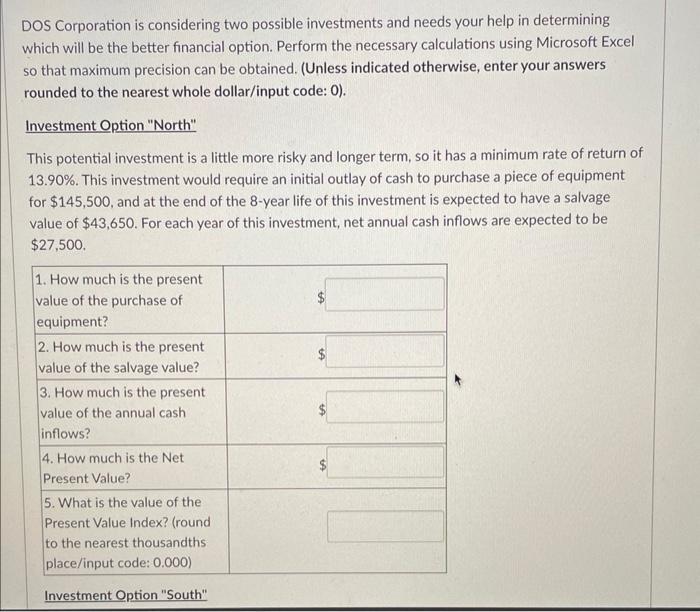

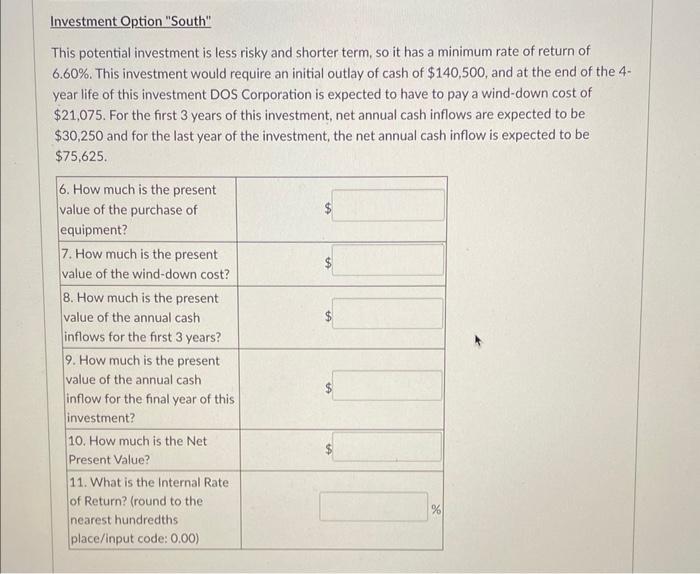

DOS Corporation is considering two possible investments and needs your help in determining which will be the better financial option. Perform the necessary calculations using Microsoft Excel so that maximum precision can be obtained. (Unless indicated otherwise, enter your answers rounded to the nearest whole dollar/input code: 0). Investment Option "North" This potential investment is a little more risky and longer term, so it has a minimum rate of return of 13.90%. This investment would require an initial outlay of cash to purchase a piece of equipment for $145,500, and at the end of the 8-year life of this investment is expected to have a salvage value of $43,650. For each year of this investment, net annual cash inflows are expected to be $27,500. 1. How much is the present value of the purchase of equipment? 2. How much is the present value of the salvage value? 3. How much is the present value of the annual cash inflows? 4. How much is the Net Present Value? 5. What is the value of the Present Value Index? (round to the nearest thousandths place/input code: 0.000) Investment Option "South" Investment Option "South" This potential investment is less risky and shorter term, so it has a minimum rate of return of 6.60%. This investment would require an initial outlay of cash of $140,500, and at the end of the 4- year life of this investment DOS Corporation is expected to have to pay a wind-down cost of $21,075. For the first 3 years of this investment, net annual cash inflows are expected to be $30,250 and for the last year of the investment, the net annual cash inflow is expected to be $75,625. 6. How much is the present value of the purchase of equipment? 7. How much is the present value of the wind-down cost? 8. How much is the present value of the annual cash inflows for the first 3 years? 9. How much is the present value of the annual cash inflow for the final year of this investment? 10. How much is the Net Present Value? 11. What is the Internal Rate: of Return? (round to the nearest hundredths place/input code: 0.00) %

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

NPV is a technique of capital budgeting It is excess of present value of annual cash flow over the present value of cash outflow A positive NPV is alw...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started