Answered step by step

Verified Expert Solution

Question

1 Approved Answer

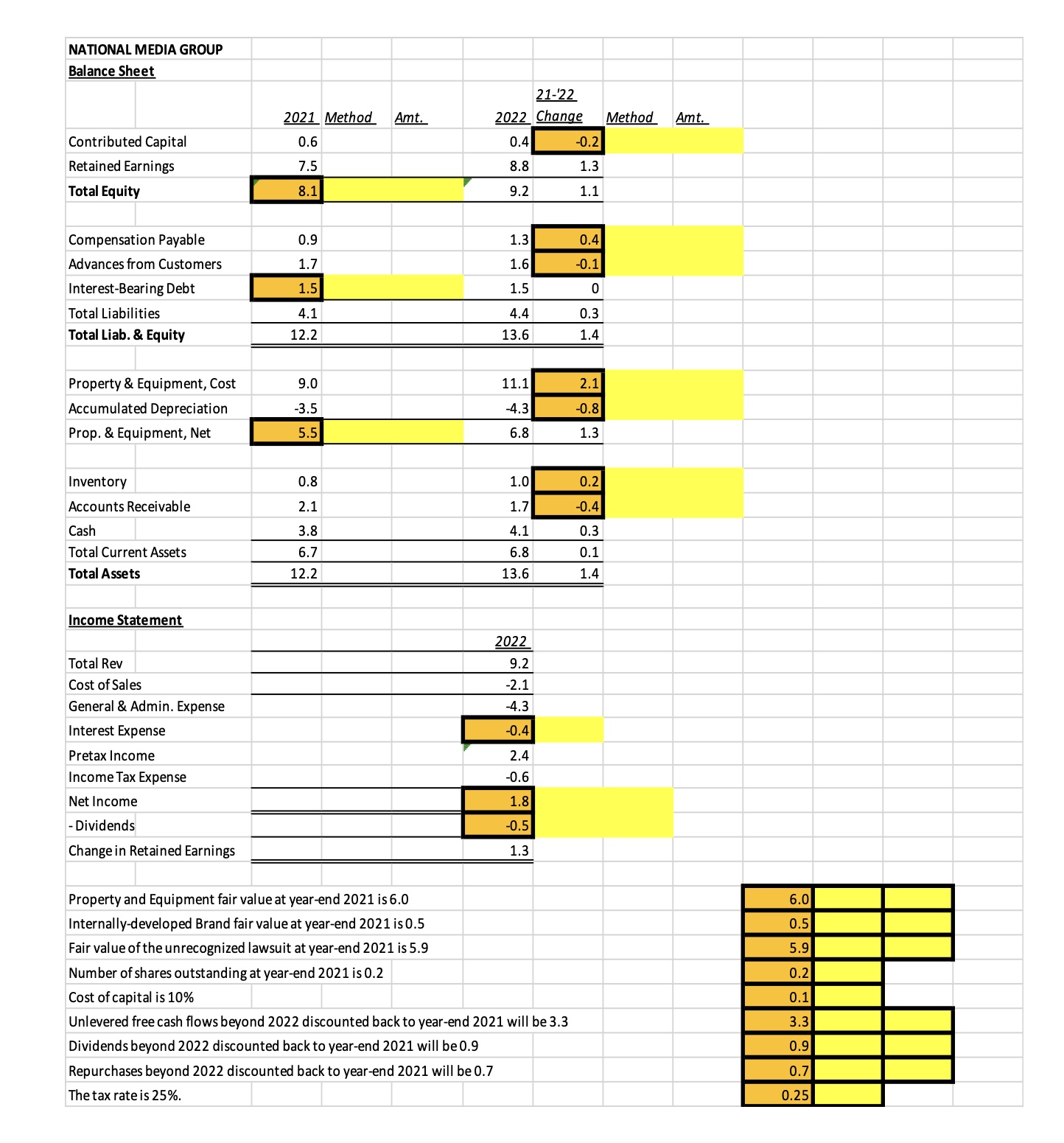

Calculate the value of a NMG share using the Dividend Discount Model? Compute the value of a NMG share using the Discounted Cash Flow Model?

Calculate the value of a NMG share using the Dividend Discount Model? Compute the value of a NMG share using the Discounted Cash Flow Model? Compute the value of a NMG share using the Balance Sheet Model

NATIONAL MEDIA GROUP Balance Sheet 21-22 2021 Method Amt. 2022 Change Method Amt. Contributed Capital 0.6 0.4 -0.2 Retained Earnings 7.5 8.8 1.3 Total Equity 8.1 9.2 1.1 Compensation Payable 0.9 1.3 0.4 Advances from Customers 1.7 1.6 -0.1 Interest-Bearing Debt 1.5 1.5 0 Total Liabilities 4.1 4.4 0.3 Total Liab. & Equity 12.2 13.6 1.4 Property & Equipment, Cost 9.0 11.1 2.1 Accumulated Depreciation -3.5 -4.3 -0.8 Prop. & Equipment, Net 5.5 6.8 1.3 Inventory 0.8 1.0 0.2 Accounts Receivable 2.1 1.7 -0.4 Cash 3.8 4.1 0.3 Total Current Assets 6.7 6.8 0.1 Total Assets 12.2 13.6 1.4 Income Statement Total Rev Cost of Sales General & Admin. Expense Interest Expense Pretax Income Income Tax Expense Net Income - Dividends Change in Retained Earnings 2022 9.2 -2.1 -4.3 -0.4 2.4 -0.6 1.8 -0.5 1.3 Property and Equipment fair value at year-end 2021 is 6.0 Internally-developed Brand fair value at year-end 2021 is 0.5 Fair value of the unrecognized lawsuit at year-end 2021 is 5.9 Number of shares outstanding at year-end 2021 is 0.2 Cost of capital is 10% Unlevered free cash flows beyond 2022 discounted back to year-end 2021 will be 3.3 Dividends beyond 2022 discounted back to year-end 2021 will be 0.9 Repurchases beyond 2022 discounted back to year-end 2021 will be 0.7 The tax rate is 25%. 6.0 0.5 5.9 0.2 0.1 3.3 0.9 0.7 0.25

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started