Answered step by step

Verified Expert Solution

Question

1 Approved Answer

calculate the value of Brie using the capitalized EBITDA multiple approach b) calculate the value of Brie using the discounted cash flow approach Hint:

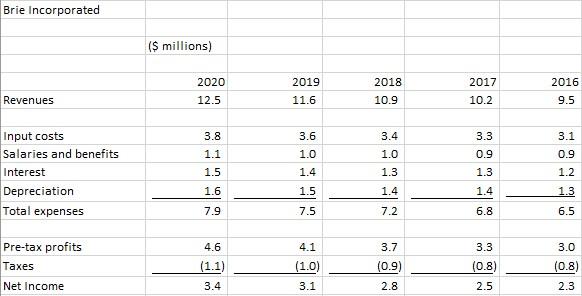

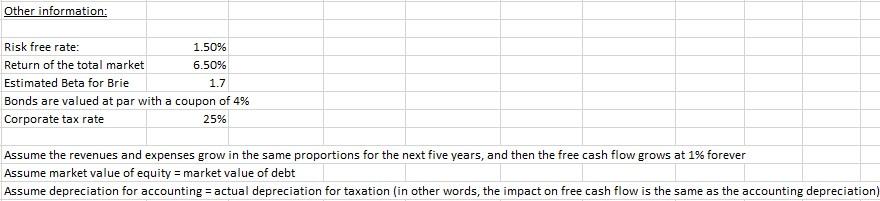

calculate the value of Brie using the capitalized EBITDA multiple approach b) calculate the value of Brie using the discounted cash flow approach Hint: estimate the next five years free cash flow using the previous five years trend Brie Incorporated Revenues Input costs Salaries and benefits Interest Depreciation Total expenses Pre-tax profits Taxes Net Income ($ millions) 2020 12.5 3.8 1.1 1.5 1.6 7.9 4.6 (1.1) 3.4 2019 11.6 3.6 60 1.0 1.4 1.5 in in 7.5 4.1 (1.0) 3.1 2018 10.9 3.4 1.0 1.3 1.4 7.2 3.7 (0.9) 2.8 2017 10.2 3.3 0.9 1.3 1.4 6.8 3.3 (0.8) 2.5 2016 9.5 mo 3.1 0.9 1.2 1.3 6.5 3.0 (0.8) 2.3 Other information: Risk free rate: Return of the total market 1.50% 6.50% Estimated Beta for Brie 1.7 Bonds are valued at par with a coupon of 4% Corporate tax rate 25% Assume the revenues and expenses grow in the same proportions for the next five years, and then the free cash flow grows at 1% forever Assume market value of equity = market value of debt Assume depreciation for accounting = actual depreciation for taxation (in other words, the impact on free cash flow is the same as the accounting depreciation) Information on Brie's competitors ($) Lucky Inc. Chucky Ltd. Moose Corp. Goose Inc. Share price 14 23 19 11 Value of debt EBITDA 1,200,000,000 50,000,000 1,053,125,000 900,000,000 75,000,000 1,198,557,692 1,100,000,000 93,750,000 1,369,157,609 2,900,000,000 30,000,000 2,970,005,250 # shares

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer Therefore t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started