Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculate the value of the stock of Andrew Motors based on P/E for FY 2017, 2018 & 2019. Is the stock price of Andrew Motors

Calculate the value of the stock of Andrew Motors based on P/E for FY 2017, 2018 & 2019. Is the stock price of Andrew Motors overpriced?

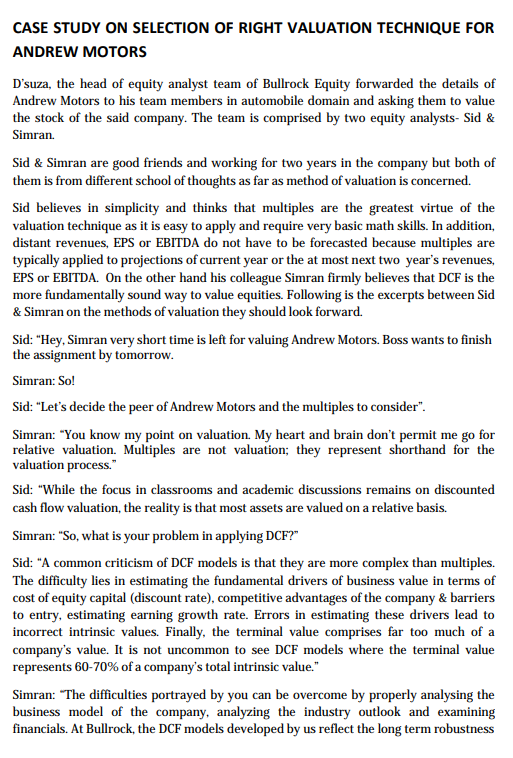

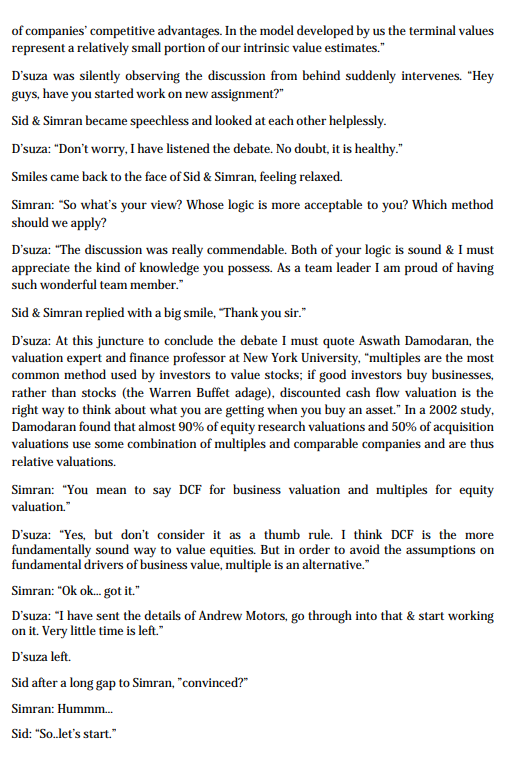

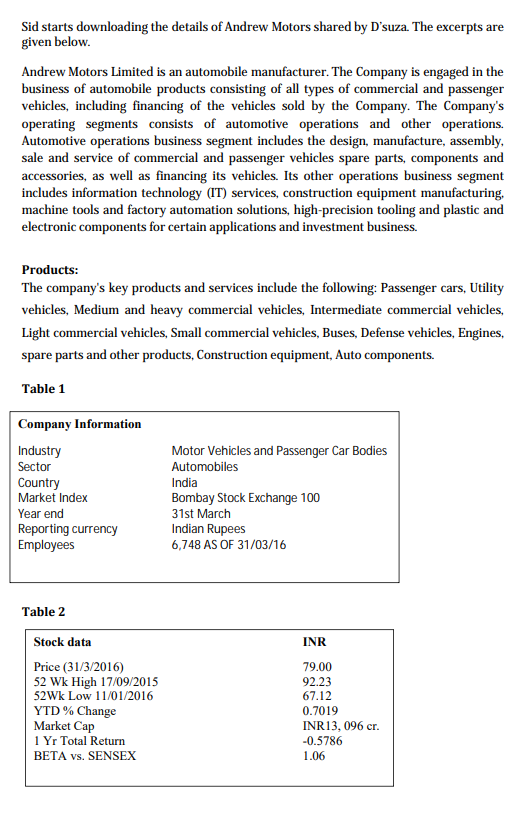

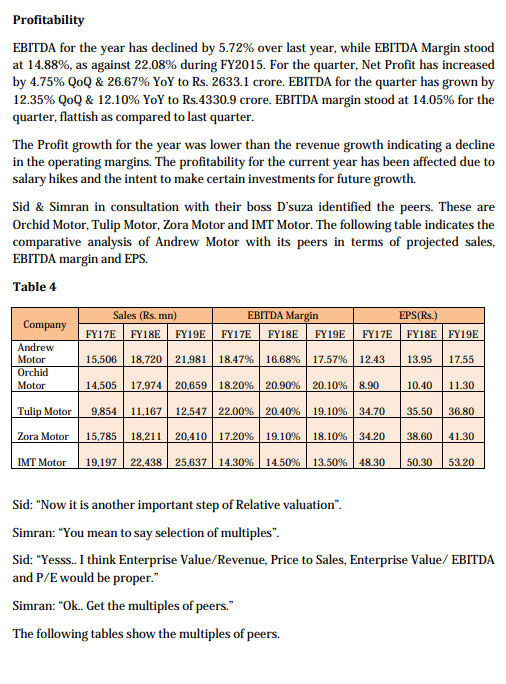

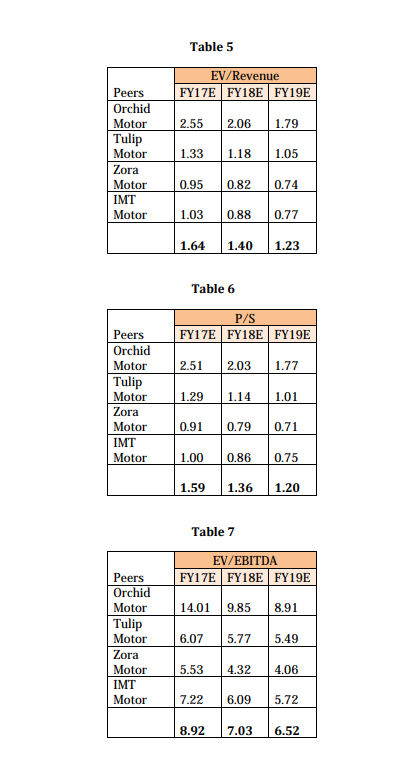

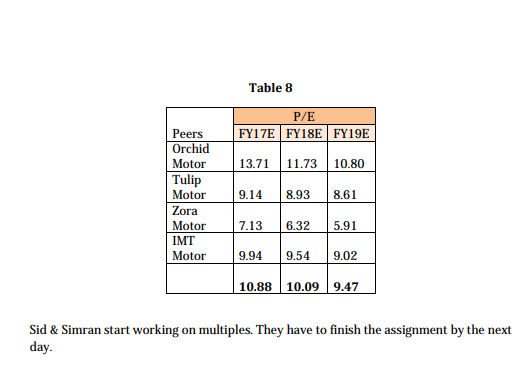

CASE STUDY ON SELECTION OF RIGHT VALUATION TECHNIQUE FOR ANDREW MOTORS D'suza, the head of equity analyst team of Bullrock Equity forwarded the details of Andrew Motors to his team members in automobile domain and asking them to value the stock of the said company. The team is comprised by two equity analysts- Sid \& Simran. Sid \& Simran are good friends and working for two years in the company but both of them is from different school of thoughts as far as method of valuation is concerned. Sid believes in simplicity and thinks that multiples are the greatest virtue of the valuation technique as it is easy to apply and require very basic math skills. In addition, distant revenues, EPS or EBITDA do not have to be forecasted because multiples are typically applied to projections of current year or the at most next two year's revenues, EPS or EBITDA. On the other hand his colleague Simran firmly believes that DCF is the more fundamentally sound way to value equities. Following is the excerpts between Sid \& Simran on the methods of valuation they should look forward. Sid: "Hey, Simran very short time is left for valuing Andrew Motors. Boss wants to finish the assignment by tomorrow. Simran: So! Sid: "Let's decide the peer of Andrew Motors and the multiples to consider". Simran: "You know my point on valuation. My heart and brain don't permit me go for relative valuation. Multiples are not valuation; they represent shorthand for the valuation process." Sid: "While the focus in classrooms and academic discussions remains on discounted cash flow valuation, the reality is that most assets are valued on a relative basis. Simran: "So, what is your problem in applying DCF?" Sid: "A common criticism of DCF models is that they are more complex than multiples. The difficulty lies in estimating the fundamental drivers of business value in terms of cost of equity capital (discount rate), competitive advantages of the company \& barriers to entry, estimating earning growth rate. Errors in estimating these drivers lead to incorrect intrinsic values. Finally, the terminal value comprises far too much of a company's value. It is not uncommon to see DCF models where the terminal value represents 6070% of a company's total intrinsic value." Simran: "The difficulties portrayed by you can be overcome by properly analysing the business model of the company, analyzing the industry outlook and examining financials. At Bullrock, the DCF models developed by us reflect the long term robustness of companies' competitive advantages. In the model developed by us the terminal values represent a relatively small portion of our intrinsic value estimates." D'suza was silently observing the discussion from behind suddenly intervenes. "Hey guys, have you started work on new assignment?" Sid \& Simran became speechless and looked at each other helplessly. D'suza: "Don't worry, I have listened the debate. No doubt, it is healthy." Smiles came back to the face of Sid \& Simran, feeling relaxed. Simran: "So what's your view? Whose logic is more acceptable to you? Which method should we apply? D'suza: "The discussion was really commendable. Both of your logic is sound \& I must appreciate the kind of knowledge you possess. As a team leader I am proud of having such wonderful team member." Sid \& Simran replied with a big smile, "Thank you sir." D'suza: At this juncture to conclude the debate I must quote Aswath Damodaran, the valuation expert and finance professor at New York University, "multiples are the most common method used by investors to value stocks; if good investors buy businesses, rather than stocks (the Warren Buffet adage), discounted cash flow valuation is the right way to think about what you are getting when you buy an asset." In a 2002 study, Damodaran found that almost 90% of equity research valuations and 50% of acquisition valuations use some combination of multiples and comparable companies and are thus relative valuations. Simran: "You mean to say DCF for business valuation and multiples for equity valuation." D'suza: "Yes, but don't consider it as a thumb rule. I think DCF is the more fundamentally sound way to value equities. But in order to avoid the assumptions on fundamental drivers of business value, multiple is an alternative." Simran: "Ok ok... got it." D'suza: "I have sent the details of Andrew Motors, go through into that \& start working on it. Very little time is left." D'suza left. Sid after a long gap to Simran, "convinced?" Simran: Hummm... Sid: "So.let's start." Sid starts downloading the details of Andrew Motors shared by D'suza. The excerpts are given below. Andrew Motors Limited is an automobile manufacturer. The Company is engaged in the business of automobile products consisting of all types of commercial and passenger vehicles, including financing of the vehicles sold by the Company. The Company's operating segments consists of automotive operations and other operations. Automotive operations business segment includes the design, manufacture, assembly, sale and service of commercial and passenger vehicles spare parts, components and accessories, as well as financing its vehicles. Its other operations business segment includes information technology (IT) services, construction equipment manufacturing, machine tools and factory automation solutions, high-precision tooling and plastic and electronic components for certain applications and investment business. Products: The company's key products and services include the following: Passenger cars, Utility vehicles, Medium and heavy commercial vehicles, Intermediate commercial vehicles, Light commercial vehicles, Small commercial vehicles, Buses, Defense vehicles, Engines, spare parts and other products, Construction equipment, Auto components. Table 1 Table 2 Table 3 Profitability EBITDA for the year has declined by 5.72% over last year, while EBITDA Margin stood at 14.88%, as against 22.08% during FY2015. For the quarter, Net Profit has increased by 4.75% QoQ \& 26.67\% YoY to Rs. 2633.1 crore. EBITDA for the quarter has grown by 12.35% QoQ \& 12.10% YoY to Rs.4330.9 crore. EBITDA margin stood at 14.05% for the quarter, flattish as compared to last quarter. The Profit growth for the year was lower than the revenue growth indicating a decline in the operating margins. The profitability for the current year has been affected due to salary hikes and the intent to make certain investments for future growth. Sid \& Simran in consultation with their boss D'suza identified the peers. These are Orchid Motor, Tulip Motor, Zora Motor and IMT Motor. The following table indicates the comparative analysis of Andrew Motor with its peers in terms of projected sales, EBITDA margin and EPS. Table 4 Sid: "Now it is another important step of Relative valuation". Simran: "You mean to say selection of multiples". Sid: "Yesss.. I think Enterprise Value/Revenue, Price to Sales, Enterprise Value/ EBITDA and P /E would be proper." Simran: "Ok.. Get the multiples of peers." The following tables show the multiples of peers. Table 5 Table 6 Table 7 Table 8 Sid \& Simran start working on multiples. They have to finish the assignment by the next day. CASE STUDY ON SELECTION OF RIGHT VALUATION TECHNIQUE FOR ANDREW MOTORS D'suza, the head of equity analyst team of Bullrock Equity forwarded the details of Andrew Motors to his team members in automobile domain and asking them to value the stock of the said company. The team is comprised by two equity analysts- Sid \& Simran. Sid \& Simran are good friends and working for two years in the company but both of them is from different school of thoughts as far as method of valuation is concerned. Sid believes in simplicity and thinks that multiples are the greatest virtue of the valuation technique as it is easy to apply and require very basic math skills. In addition, distant revenues, EPS or EBITDA do not have to be forecasted because multiples are typically applied to projections of current year or the at most next two year's revenues, EPS or EBITDA. On the other hand his colleague Simran firmly believes that DCF is the more fundamentally sound way to value equities. Following is the excerpts between Sid \& Simran on the methods of valuation they should look forward. Sid: "Hey, Simran very short time is left for valuing Andrew Motors. Boss wants to finish the assignment by tomorrow. Simran: So! Sid: "Let's decide the peer of Andrew Motors and the multiples to consider". Simran: "You know my point on valuation. My heart and brain don't permit me go for relative valuation. Multiples are not valuation; they represent shorthand for the valuation process." Sid: "While the focus in classrooms and academic discussions remains on discounted cash flow valuation, the reality is that most assets are valued on a relative basis. Simran: "So, what is your problem in applying DCF?" Sid: "A common criticism of DCF models is that they are more complex than multiples. The difficulty lies in estimating the fundamental drivers of business value in terms of cost of equity capital (discount rate), competitive advantages of the company \& barriers to entry, estimating earning growth rate. Errors in estimating these drivers lead to incorrect intrinsic values. Finally, the terminal value comprises far too much of a company's value. It is not uncommon to see DCF models where the terminal value represents 6070% of a company's total intrinsic value." Simran: "The difficulties portrayed by you can be overcome by properly analysing the business model of the company, analyzing the industry outlook and examining financials. At Bullrock, the DCF models developed by us reflect the long term robustness of companies' competitive advantages. In the model developed by us the terminal values represent a relatively small portion of our intrinsic value estimates." D'suza was silently observing the discussion from behind suddenly intervenes. "Hey guys, have you started work on new assignment?" Sid \& Simran became speechless and looked at each other helplessly. D'suza: "Don't worry, I have listened the debate. No doubt, it is healthy." Smiles came back to the face of Sid \& Simran, feeling relaxed. Simran: "So what's your view? Whose logic is more acceptable to you? Which method should we apply? D'suza: "The discussion was really commendable. Both of your logic is sound \& I must appreciate the kind of knowledge you possess. As a team leader I am proud of having such wonderful team member." Sid \& Simran replied with a big smile, "Thank you sir." D'suza: At this juncture to conclude the debate I must quote Aswath Damodaran, the valuation expert and finance professor at New York University, "multiples are the most common method used by investors to value stocks; if good investors buy businesses, rather than stocks (the Warren Buffet adage), discounted cash flow valuation is the right way to think about what you are getting when you buy an asset." In a 2002 study, Damodaran found that almost 90% of equity research valuations and 50% of acquisition valuations use some combination of multiples and comparable companies and are thus relative valuations. Simran: "You mean to say DCF for business valuation and multiples for equity valuation." D'suza: "Yes, but don't consider it as a thumb rule. I think DCF is the more fundamentally sound way to value equities. But in order to avoid the assumptions on fundamental drivers of business value, multiple is an alternative." Simran: "Ok ok... got it." D'suza: "I have sent the details of Andrew Motors, go through into that \& start working on it. Very little time is left." D'suza left. Sid after a long gap to Simran, "convinced?" Simran: Hummm... Sid: "So.let's start." Sid starts downloading the details of Andrew Motors shared by D'suza. The excerpts are given below. Andrew Motors Limited is an automobile manufacturer. The Company is engaged in the business of automobile products consisting of all types of commercial and passenger vehicles, including financing of the vehicles sold by the Company. The Company's operating segments consists of automotive operations and other operations. Automotive operations business segment includes the design, manufacture, assembly, sale and service of commercial and passenger vehicles spare parts, components and accessories, as well as financing its vehicles. Its other operations business segment includes information technology (IT) services, construction equipment manufacturing, machine tools and factory automation solutions, high-precision tooling and plastic and electronic components for certain applications and investment business. Products: The company's key products and services include the following: Passenger cars, Utility vehicles, Medium and heavy commercial vehicles, Intermediate commercial vehicles, Light commercial vehicles, Small commercial vehicles, Buses, Defense vehicles, Engines, spare parts and other products, Construction equipment, Auto components. Table 1 Table 2 Table 3 Profitability EBITDA for the year has declined by 5.72% over last year, while EBITDA Margin stood at 14.88%, as against 22.08% during FY2015. For the quarter, Net Profit has increased by 4.75% QoQ \& 26.67\% YoY to Rs. 2633.1 crore. EBITDA for the quarter has grown by 12.35% QoQ \& 12.10% YoY to Rs.4330.9 crore. EBITDA margin stood at 14.05% for the quarter, flattish as compared to last quarter. The Profit growth for the year was lower than the revenue growth indicating a decline in the operating margins. The profitability for the current year has been affected due to salary hikes and the intent to make certain investments for future growth. Sid \& Simran in consultation with their boss D'suza identified the peers. These are Orchid Motor, Tulip Motor, Zora Motor and IMT Motor. The following table indicates the comparative analysis of Andrew Motor with its peers in terms of projected sales, EBITDA margin and EPS. Table 4 Sid: "Now it is another important step of Relative valuation". Simran: "You mean to say selection of multiples". Sid: "Yesss.. I think Enterprise Value/Revenue, Price to Sales, Enterprise Value/ EBITDA and P /E would be proper." Simran: "Ok.. Get the multiples of peers." The following tables show the multiples of peers. Table 5 Table 6 Table 7 Table 8 Sid \& Simran start working on multiples. They have to finish the assignment by the next dayStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started