Answered step by step

Verified Expert Solution

Question

1 Approved Answer

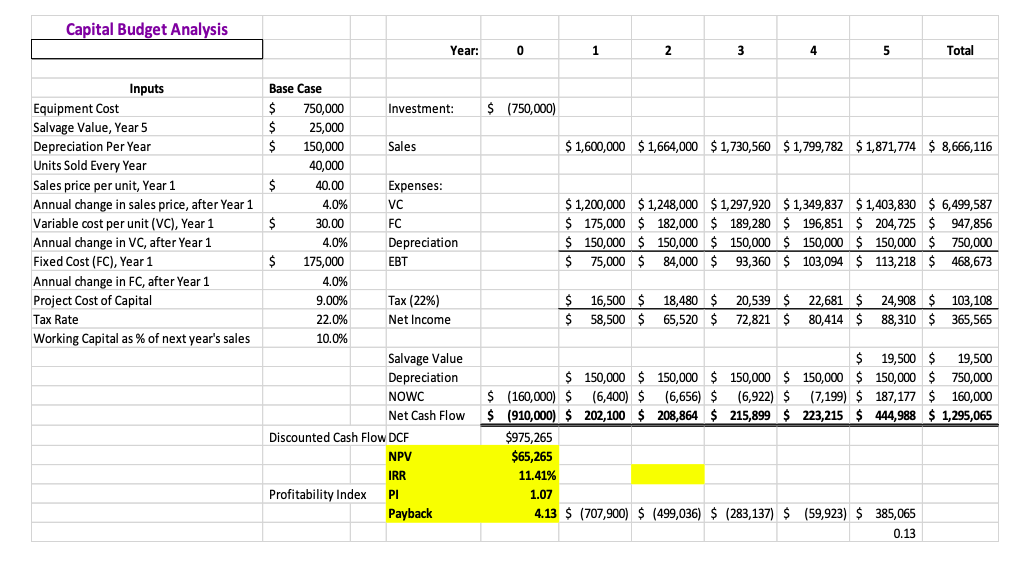

calculate the viable investment Capital Budget Analysis Year: 0 1 2 3 4 5 Total Inputs Base Case Equipment Cost $ 750,000 Investment: $ (750,000)

calculate the viable investment

Capital Budget Analysis Year: 0 1 2 3 4 5 Total Inputs Base Case Equipment Cost $ 750,000 Investment: $ (750,000) Salvage Value, Year 5 $ 25,000 Depreciation Per Year $ 150,000 Sales Units Sold Every Year 40,000 Sales price per unit, Year 1 $ 40.00 Expenses: Annual change in sales price, after Year 1 4.0% VC Variable cost per unit (VC), Year 1 $ 30.00 FC Annual change in VC, after Year 1 4.0% Depreciation Fixed Cost (FC), Year 1 $ 175,000 EBT Annual change in FC, after Year 1 4.0% Project Cost of Capital 9.00% Tax (22%) Tax Rate 22.0% Net Income Working Capital as % of next year's sales 10.0% Salvage Value Depreciation NOWC $1,600,000 $1,664,000 $1,730,560 $1,799,782 $1,871,774 $8,666,116 $1,200,000 $1,248,000 $1,297,920 $1,349,837 $1,403,830 $6,499,587 $ 175,000 $ 182,000 $ 189,280 $ 196,851 $204,725 $ 947,856 $ 150,000 $150,000 $150,000 $ 150,000 $ 150,000 $ 750,000 $ 75,000 $ 84,000 $ 93,360 $ 103,094 $ 113,218 $ 468,673 $ 16,500 $ 18,480 $ 20,539 $ 22,681 $ 24,908 $103,108 $ 58,500 $ 65,520 $ 72,821 $ 80,414 $ 88,310 $ 365,565 $ 19,500 $ 19,500 $ 150,000 $150,000 $150,000 $150,000 $ 150,000 $750,000 $ (160,000) $ (6,400) $ (6,656) $ (6,922) $ (7,199) $ 187,177 $ 160,000 Net Cash Flow $ (910,000) $ 202,100 $ 208,864 $ 215,899 $ 223,215 $ 444,988 $1,295,065 Discounted Cash Flow DCF NPV $975,265 $65,265 IRR 11.41% Profitability Index 1.07 Payback 4.13 $ (707,900) $ (499,036) $ (283,137) $ (59,923) $ 385,065 0.13

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To calculate the viability of the investment we can use different financial metrics such as N...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started