Answered step by step

Verified Expert Solution

Question

1 Approved Answer

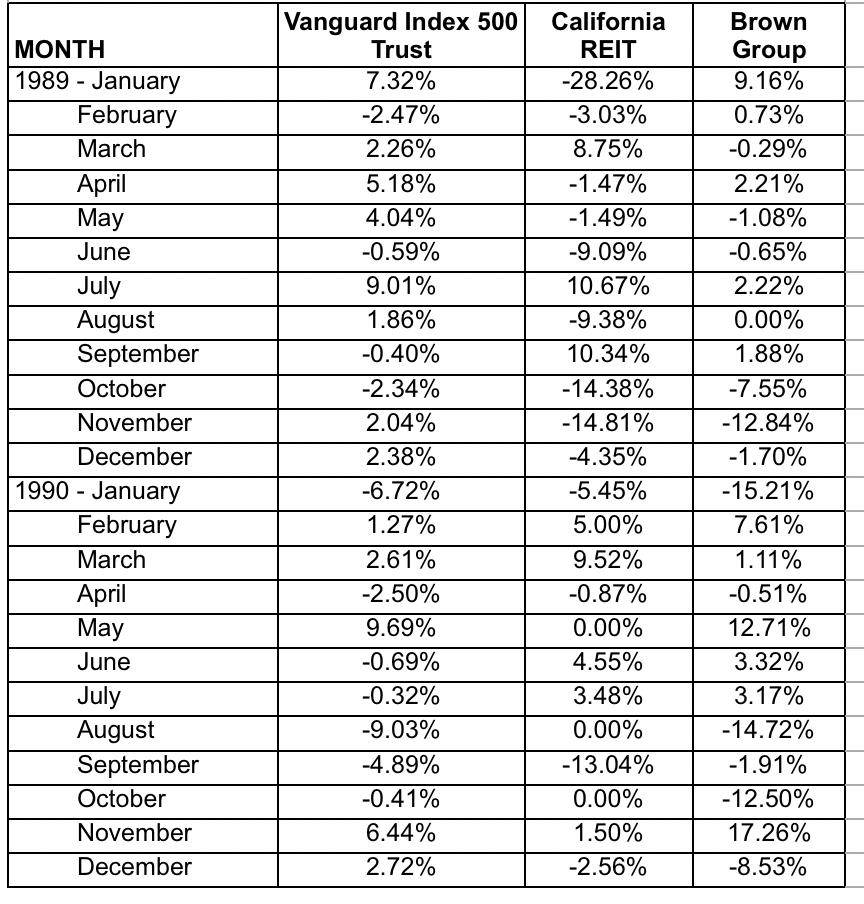

Calculate the volatility of the stock returns of California REIT and Brown Group with the spreadsheet data . How do the volatilities of the individual

- Calculate the volatility of the stock returns of California REIT and Brown Group with the spreadsheet data . How do the volatilities of the individual stock returns compare to that of the Vanguard fund? In theory, why should they be higher/lower than those of the Vanguard fund?

MONTH 1989 January February March April May June July August September October November December 1990 - January February March April May June - July August September October November December Vanguard Index 500 Trust 7.32% -2.47% 2.26% 5.18% 4.04% -0.59% 9.01% 1.86% -0.40% -2.34% 2.04% 2.38% -6.72% 1.27% 2.61% -2.50% 9.69% -0.69% -0.32% -9.03% -4.89% -0.41% 6.44% 2.72% California REIT -28.26% -3.03% 8.75% -1.47% -1.49% -9.09% 10.67% -9.38% 10.34% -14.38% -14.81% -4.35% -5.45% 5.00% 9.52% -0.87% 0.00% 4.55% 3.48% 0.00% -13.04% 0.00% 1.50% -2.56% Brown Group 9.16% 0.73% -0.29% 2.21% -1.08% -0.65% 2.22% 0.00% 1.88% -7.55% -12.84% -1.70% -15.21% 7.61% 1.11% -0.51% 12.71% 3.32% 3.17% -14.72% -1.91% -12.50% 17.26% -8.53%

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the volatility of the stock returns of California REIT and Brown Group compared to the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started