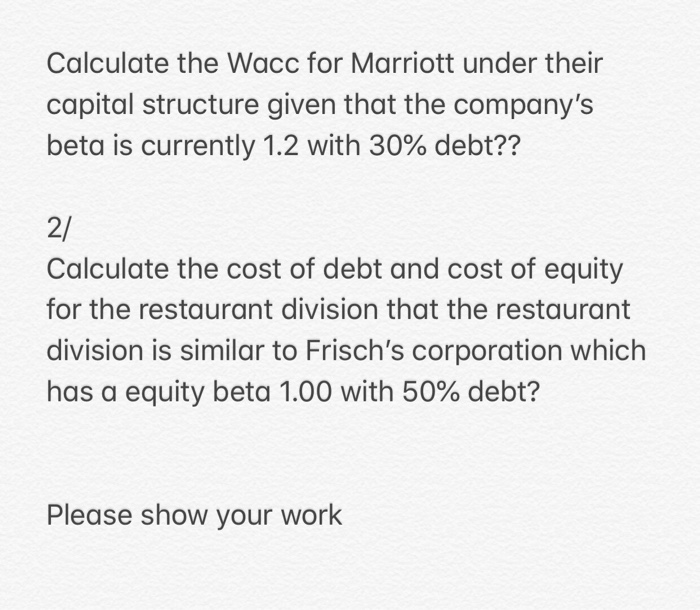

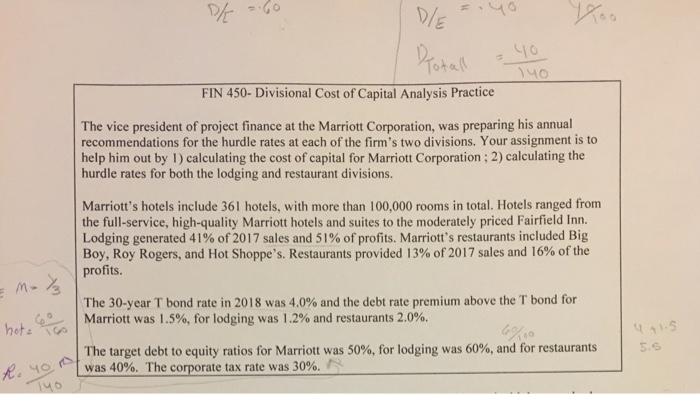

Calculate the Wacc for Marriott under their capital structure given that the company's beta is currently 1.2 with 30% debt?? Calculate the cost of debt and cost of equity for the restaurant division that the restaurant division is similar to Frisch's corporation which has a equity beta 1.00 with 50% debt? Please show your work Totall - Yo otall you FIN 450- Divisional Cost of Capital Analysis Practice The vice president of project finance at the Marriott Corporation, was preparing his annual recommendations for the hurdle rates at each of the firm's two divisions. Your assignment is to help him out by 1) calculating the cost of capital for Marriott Corporation : 2) calculating the hurdle rates for both the lodging and restaurant divisions. Marriott's hotels include 361 hotels, with more than 100,000 rooms in total. Hotels ranged from the full-service, high-quality Marriott hotels and suites to the moderately priced Fairfield Inn. Lodging generated 41% of 2017 sales and 51% of profits. Marriott's restaurants included Big Boy, Roy Rogers, and Hot Shoppe's. Restaurants provided 13% of 2017 sales and 16% of the profits. The 30-year T bond rate in 2018 was 4.0% and the debt rate premium above the T bond for Marriott was 1.5%, for lodging was 1.2% and restaurants 2.0%. hot The target debt to equity ratios for Marriott was 50%, for lodging was 60%, and for restaurants was 40%. The corporate tax rate was 30%. F Calculate the Wacc for Marriott under their capital structure given that the company's beta is currently 1.2 with 30% debt?? Calculate the cost of debt and cost of equity for the restaurant division that the restaurant division is similar to Frisch's corporation which has a equity beta 1.00 with 50% debt? Please show your work Totall - Yo otall you FIN 450- Divisional Cost of Capital Analysis Practice The vice president of project finance at the Marriott Corporation, was preparing his annual recommendations for the hurdle rates at each of the firm's two divisions. Your assignment is to help him out by 1) calculating the cost of capital for Marriott Corporation : 2) calculating the hurdle rates for both the lodging and restaurant divisions. Marriott's hotels include 361 hotels, with more than 100,000 rooms in total. Hotels ranged from the full-service, high-quality Marriott hotels and suites to the moderately priced Fairfield Inn. Lodging generated 41% of 2017 sales and 51% of profits. Marriott's restaurants included Big Boy, Roy Rogers, and Hot Shoppe's. Restaurants provided 13% of 2017 sales and 16% of the profits. The 30-year T bond rate in 2018 was 4.0% and the debt rate premium above the T bond for Marriott was 1.5%, for lodging was 1.2% and restaurants 2.0%. hot The target debt to equity ratios for Marriott was 50%, for lodging was 60%, and for restaurants was 40%. The corporate tax rate was 30%. F