Answered step by step

Verified Expert Solution

Question

1 Approved Answer

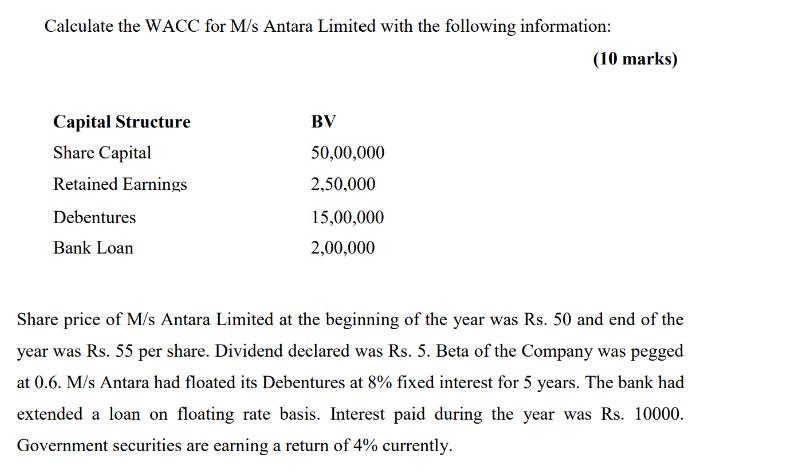

Calculate the WACC for M/s Antara Limited with the following information: Capital Structure Share Capital Retained Earnings Debentures Bank Loan BV 50,00,000 2,50,000 15,00,000

Calculate the WACC for M/s Antara Limited with the following information: Capital Structure Share Capital Retained Earnings Debentures Bank Loan BV 50,00,000 2,50,000 15,00,000 2,00,000 (10 marks) Share price of M/s Antara Limited at the beginning of the year was Rs. 50 and end of the year was Rs. 55 per share. Dividend declared was Rs. 5. Beta of the Company was pegged at 0.6. M/s Antara had floated its Debentures at 8% fixed interest for 5 years. The bank had extended a loan on floating rate basis. Interest paid during the year was Rs. 10000. Government securities are earning a return of 4% currently.

Step by Step Solution

★★★★★

3.53 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the Weighted Average Cost of Capital WACC for Ms Antara Limited we need to consider the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started