Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculate the WACC for this firm: 30% is financed with debt and the remaining financed with equity Cost of debt is 5% Risk free rate

- Calculate the WACC for this firm:

- 30% is financed with debt and the remaining financed with equity

- Cost of debt is 5%

- Risk free rate is 2%

- Expected market return is 8%

- Beta of "AAA" stock is 1.10

- Tax rate is 30%

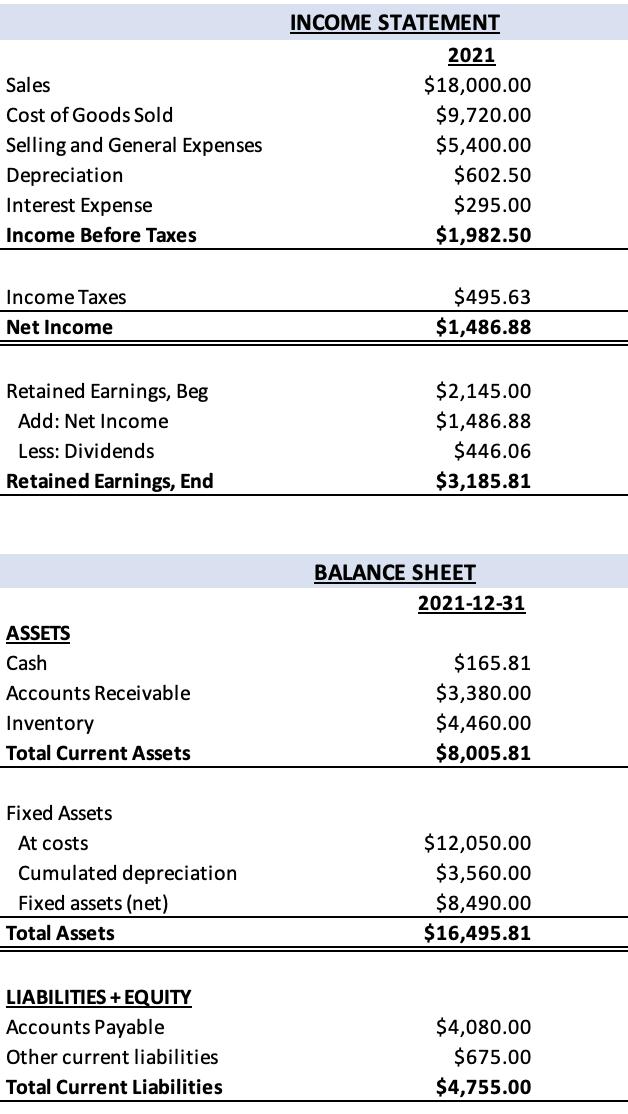

Sales Cost of Goods Sold INCOME STATEMENT 2021 $18,000.00 $9,720.00 Selling and General Expenses Depreciation Interest Expense Income Before Taxes $5,400.00 $602.50 $295.00 $1,982.50 Income Taxes Net Income $495.63 $1,486.88 Retained Earnings, Beg $2,145.00 Add: Net Income $1,486.88 Less: Dividends $446.06 Retained Earnings, End $3,185.81 BALANCE SHEET 2021-12-31 ASSETS Cash $165.81 Accounts Receivable $3,380.00 Inventory $4,460.00 Total Current Assets $8,005.81 Fixed Assets At costs $12,050.00 Cumulated depreciation $3,560.00 Fixed assets (net) $8,490.00 Total Assets $16,495.81 LIABILITIES + EQUITY Accounts Payable $4,080.00 Other current liabilities $675.00 Total Current Liabilities $4,755.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The weighted average cost of capital is calculated by following formul...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started