calculate the WACC of netflix and explain how it affect the business?

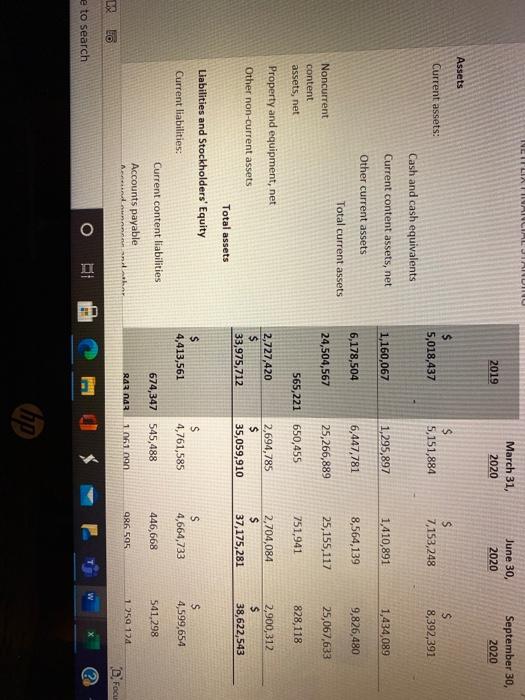

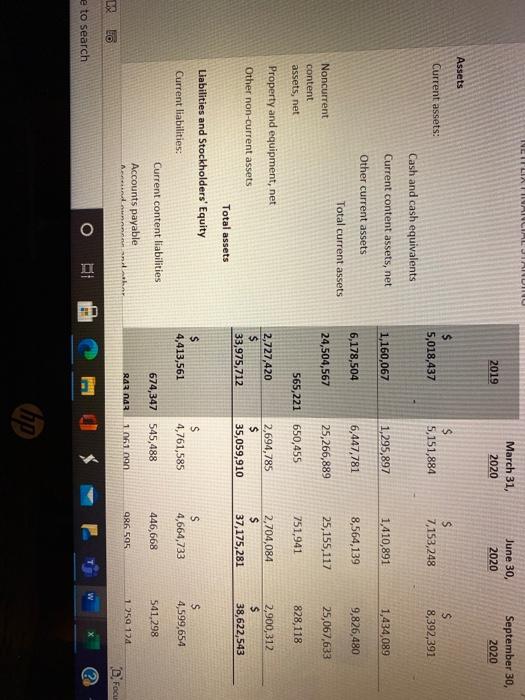

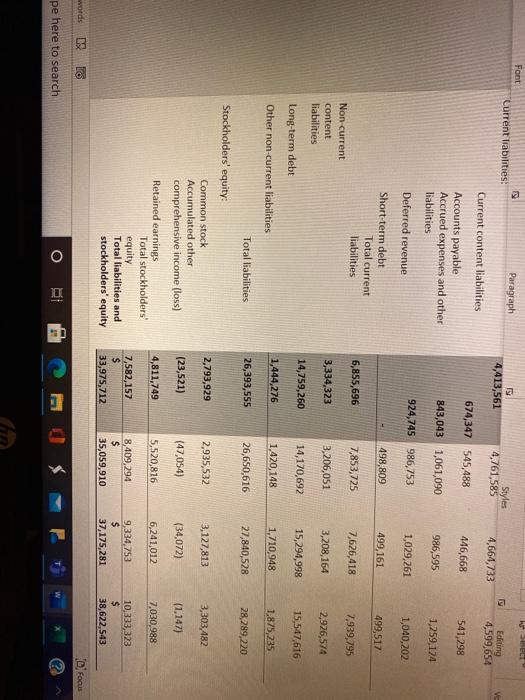

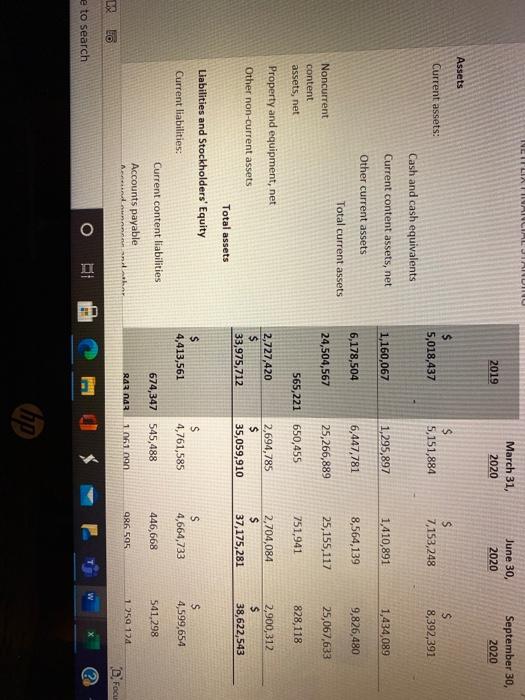

balance sheet

March 31, 2020 June 30, 2020 September 30, 2020 2019 Assets Current assets: $ 5,018,437 $ 5,151,884 $ 7,153,248 8,392,391 Cash and cash equivalents Current content assets, net 1,160,067 1,295,897 1,410,891 1,434,089 Other current assets 6,178,504 6,447,781 8,564,139 9,826,480 Total current assets 24,504,567 25,266,889 25,155,117 25,067,633 Noncurrent content assets, net 565,221 650,455 751,941 828,118 Property and equipment, net Other non-current assets 2,727,420 $ 33,975,712 2,694,785 $ 35,059,910 2.704,084 $ 37,175,281 2,900,312 $ 38,622,543 Total assets Liabilities and Stockholders' Equity Current liabilities: $ 4,413,561 S 4,761,585 S 4,664,733 S 4,599,654 Current content liabilities 674,347 545,488 446,668 541,298 Accounts payable RAR NA 11 061 an 986 595 1.259 174 BX BO Focu e to search O Foot Stec Paragraph Current liabilities: 4,413,561 Styles 4,761,585 Editing 4,599,654 ve 4,664,733 674,347 545,488 446,668 Current content liabilities Accounts payable Accrued expenses and other liabilities 541,298 843,043 1,061,090 986,595 1,259,124 Deferred revenue 924,745 986,753 1,029,261 1,040,202 498,809 499,161 499,517 Short-term debt Total current liabilities 6,855,696 7,853,725 7,626,418 7.939,795 Non-current content liabilities 3,334,323 3,206,051 3,208,164 2,926,574 14,759,260 14,170,692 Long-term debt 15,294,998 15,547,616 Other non-current liabilities 1,444,276 1.420,148 1,710,948 1.875,235 Total liabilities 26,393,555 26,650,616 27,840,528 28,289,220 Stockholders' equity 2,793,929 2,935,532 3,127,813 3,303,482 (23,521) (47,054) (34,072) (1.147) Common stock Accumulated other comprehensive income (loss) Retained earnings Total stockholders equity Total liabilities and stockholders' equity 4,811,749 5,520,816 6,241,012 7,030.988 7,582,157 S 33,975,712 8,409,294 $ 35,059,910 9,334,753 $ 37,175,281 10.333,323 $ 38,622,543 words DS LO Focus pe here to search March 31, 2020 June 30, 2020 September 30, 2020 2019 Assets Current assets: $ 5,018,437 $ 5,151,884 $ 7,153,248 8,392,391 Cash and cash equivalents Current content assets, net 1,160,067 1,295,897 1,410,891 1,434,089 Other current assets 6,178,504 6,447,781 8,564,139 9,826,480 Total current assets 24,504,567 25,266,889 25,155,117 25,067,633 Noncurrent content assets, net 565,221 650,455 751,941 828,118 Property and equipment, net Other non-current assets 2,727,420 $ 33,975,712 2,694,785 $ 35,059,910 2.704,084 $ 37,175,281 2,900,312 $ 38,622,543 Total assets Liabilities and Stockholders' Equity Current liabilities: $ 4,413,561 S 4,761,585 S 4,664,733 S 4,599,654 Current content liabilities 674,347 545,488 446,668 541,298 Accounts payable RAR NA 11 061 an 986 595 1.259 174 BX BO Focu e to search O Foot Stec Paragraph Current liabilities: 4,413,561 Styles 4,761,585 Editing 4,599,654 ve 4,664,733 674,347 545,488 446,668 Current content liabilities Accounts payable Accrued expenses and other liabilities 541,298 843,043 1,061,090 986,595 1,259,124 Deferred revenue 924,745 986,753 1,029,261 1,040,202 498,809 499,161 499,517 Short-term debt Total current liabilities 6,855,696 7,853,725 7,626,418 7.939,795 Non-current content liabilities 3,334,323 3,206,051 3,208,164 2,926,574 14,759,260 14,170,692 Long-term debt 15,294,998 15,547,616 Other non-current liabilities 1,444,276 1.420,148 1,710,948 1.875,235 Total liabilities 26,393,555 26,650,616 27,840,528 28,289,220 Stockholders' equity 2,793,929 2,935,532 3,127,813 3,303,482 (23,521) (47,054) (34,072) (1.147) Common stock Accumulated other comprehensive income (loss) Retained earnings Total stockholders equity Total liabilities and stockholders' equity 4,811,749 5,520,816 6,241,012 7,030.988 7,582,157 S 33,975,712 8,409,294 $ 35,059,910 9,334,753 $ 37,175,281 10.333,323 $ 38,622,543 words DS LO Focus pe here to search