Answered step by step

Verified Expert Solution

Question

1 Approved Answer

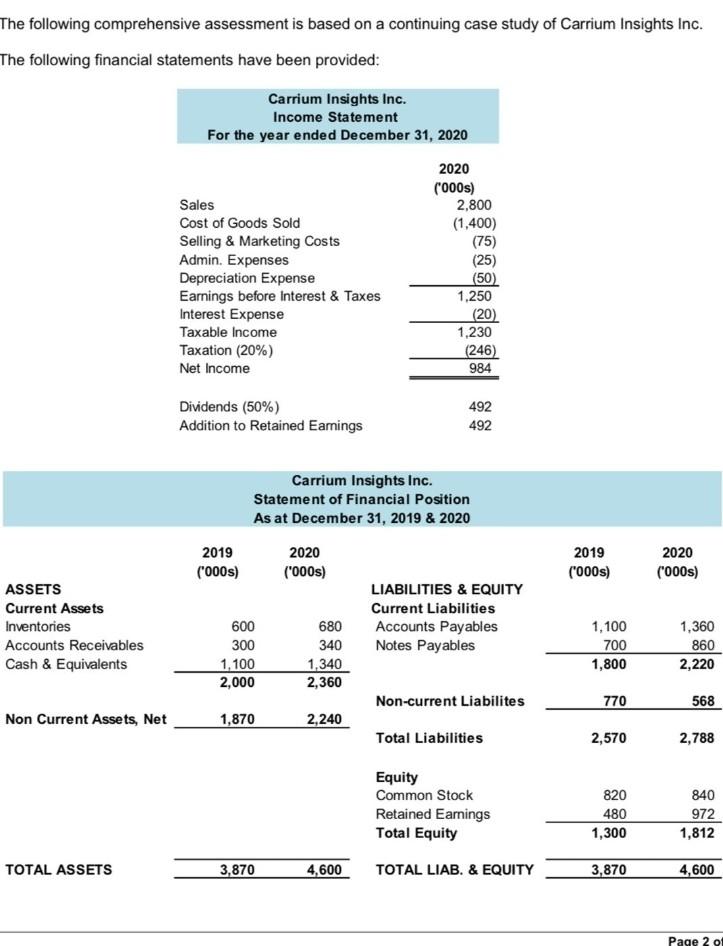

calculate the weighted average cost of capital The following comprehensive assessment is based on a continuing case study of Carrium Insights Inc. The following financial

calculate the weighted average cost of capital

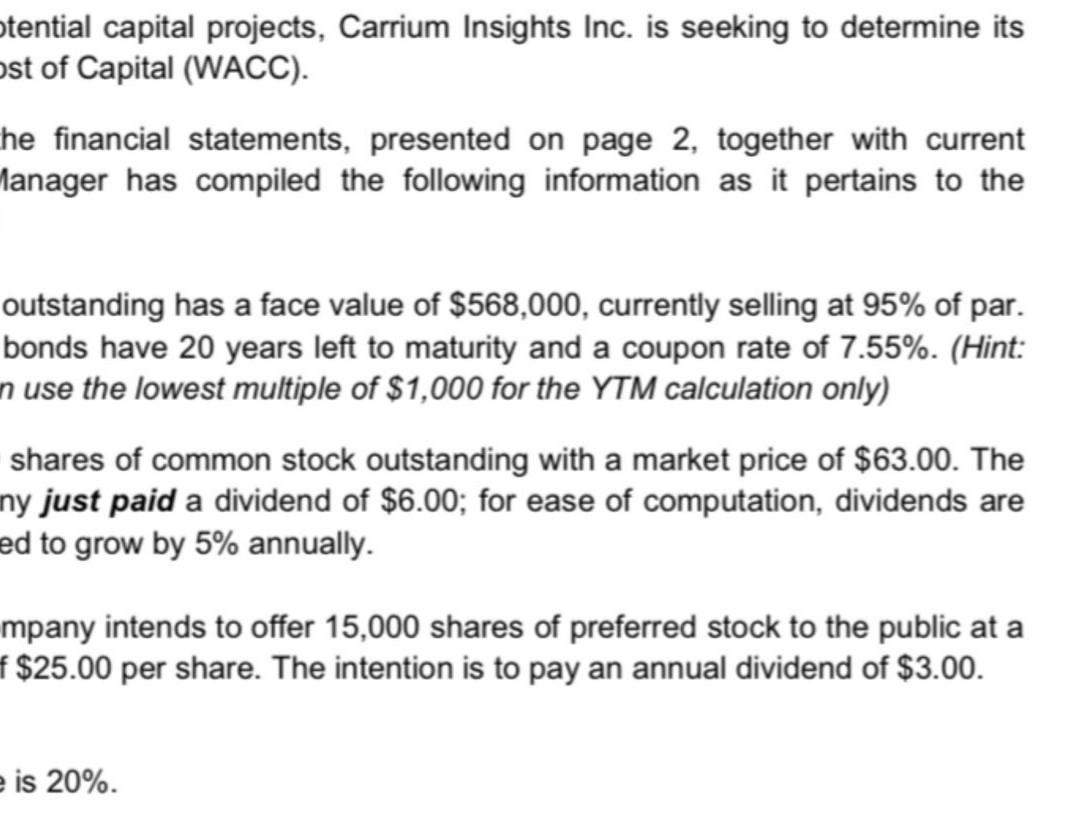

The following comprehensive assessment is based on a continuing case study of Carrium Insights Inc. The following financial statements have been provided: Carrium Insights Inc. Income Statement For the year ended December 31, 2020 Sales Cost of Goods Sold Selling & Marketing Costs Admin. Expenses Depreciation Expense Earnings before Interest & Taxes Interest Expense Taxable income Taxation (20%) Net Income 2020 ('000s) 2,800 (1,400) (75) (25) (50) 1,250 (20) 1,230 (246) 984 492 Dividends (50%) Addition to Retained Earings 492 Carrium Insights Inc. Statement of Financial Position As at December 31, 2019 & 2020 2019 (000s) 2020 ('000s) 2019 ('000) 2020 ('000) ASSETS Current Assets Inventories Accounts Receivables Cash & Equivalents LIABILITIES & EQUITY Current Liabilities Accounts Payables Notes Payables 600 300 1,100 2,000 680 340 1,340 2,360 1,100 700 1,800 1,360 860 2,220 Non-current Liabilites 770 568 Non Current Assets, Net 1,870 2,240 Total Liabilities 2,570 2,788 Equity Common Stock Retained Earnings Total Equity 820 480 1,300 840 972 1,812 TOTAL ASSETS 3,870 4,600 TOTAL LIAB. & EQUITY 3,870 4,600 Page 2 o otential capital projects, Carrium Insights Inc. is seeking to determine its ost of Capital (WACC). he financial statements, presented on page 2, together with current Manager has compiled the following information as it pertains to the outstanding has a face value of $568,000, currently selling at 95% of par. bonds have 20 years left to maturity and a coupon rate of 7.55%. (Hint: n use the lowest multiple of $1,000 for the YTM calculation only) shares of common stock outstanding with a market price of $63.00. The ny just paid a dividend of $6.00; for ease of computation, dividends are ed to grow by 5% annually. mpany intends to offer 15,000 shares of preferred stock to the public at a f $25.00 per share. The intention is to pay an annual dividend of $3.00. is 20%. Required: Calculate the Weighted Average Cost of Capital for Carrium The following comprehensive assessment is based on a continuing case study of Carrium Insights Inc. The following financial statements have been provided: Carrium Insights Inc. Income Statement For the year ended December 31, 2020 Sales Cost of Goods Sold Selling & Marketing Costs Admin. Expenses Depreciation Expense Earnings before Interest & Taxes Interest Expense Taxable income Taxation (20%) Net Income 2020 ('000s) 2,800 (1,400) (75) (25) (50) 1,250 (20) 1,230 (246) 984 492 Dividends (50%) Addition to Retained Earings 492 Carrium Insights Inc. Statement of Financial Position As at December 31, 2019 & 2020 2019 (000s) 2020 ('000s) 2019 ('000) 2020 ('000) ASSETS Current Assets Inventories Accounts Receivables Cash & Equivalents LIABILITIES & EQUITY Current Liabilities Accounts Payables Notes Payables 600 300 1,100 2,000 680 340 1,340 2,360 1,100 700 1,800 1,360 860 2,220 Non-current Liabilites 770 568 Non Current Assets, Net 1,870 2,240 Total Liabilities 2,570 2,788 Equity Common Stock Retained Earnings Total Equity 820 480 1,300 840 972 1,812 TOTAL ASSETS 3,870 4,600 TOTAL LIAB. & EQUITY 3,870 4,600 Page 2 o otential capital projects, Carrium Insights Inc. is seeking to determine its ost of Capital (WACC). he financial statements, presented on page 2, together with current Manager has compiled the following information as it pertains to the outstanding has a face value of $568,000, currently selling at 95% of par. bonds have 20 years left to maturity and a coupon rate of 7.55%. (Hint: n use the lowest multiple of $1,000 for the YTM calculation only) shares of common stock outstanding with a market price of $63.00. The ny just paid a dividend of $6.00; for ease of computation, dividends are ed to grow by 5% annually. mpany intends to offer 15,000 shares of preferred stock to the public at a f $25.00 per share. The intention is to pay an annual dividend of $3.00. is 20%. Required: Calculate the Weighted Average Cost of Capital for CarriumStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started