Calculate the year ending financial statements with the information below.

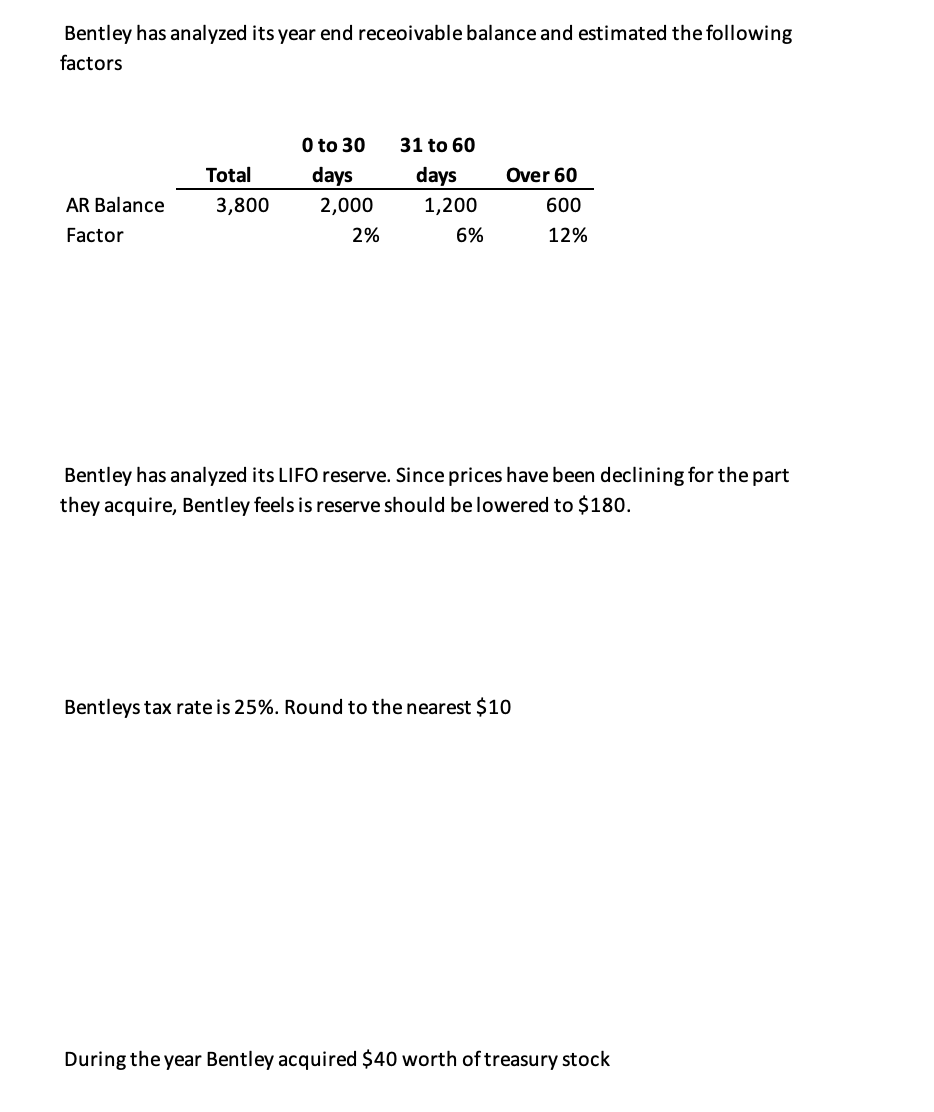

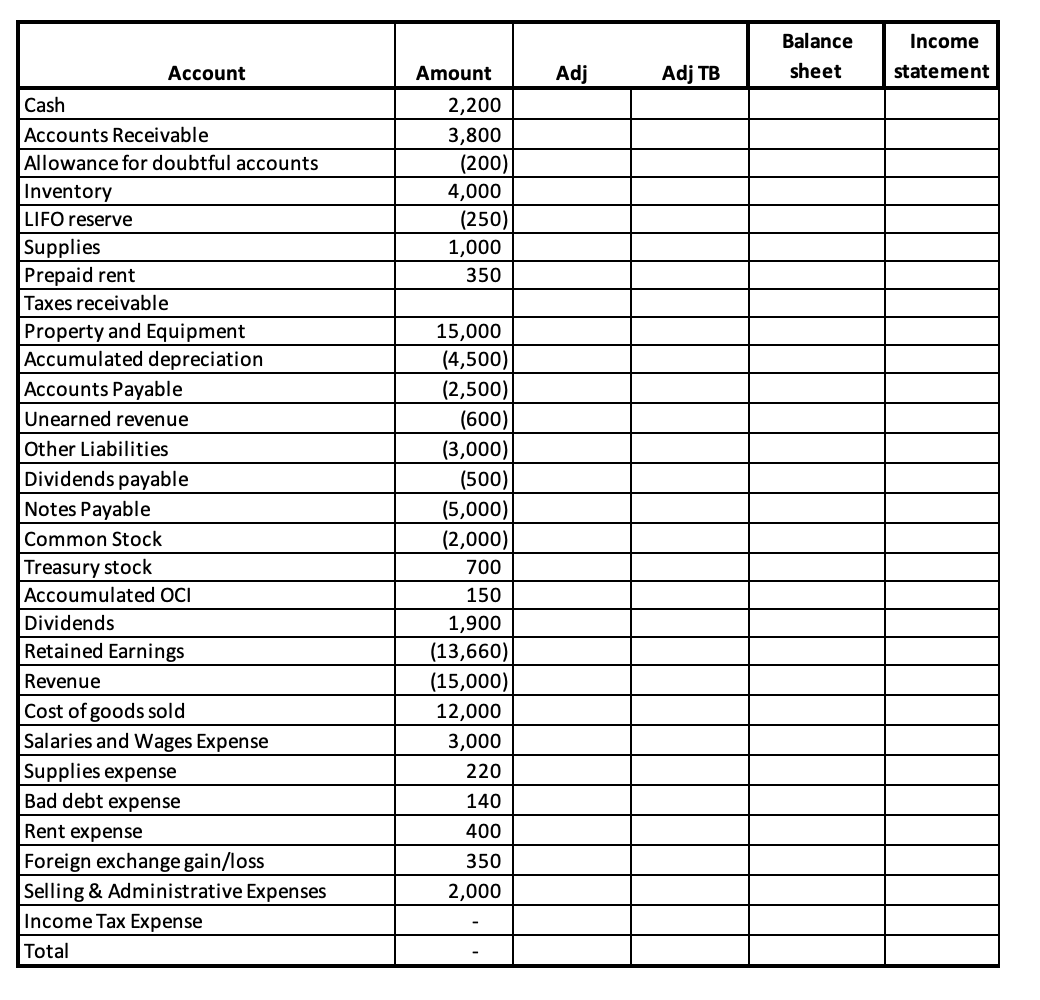

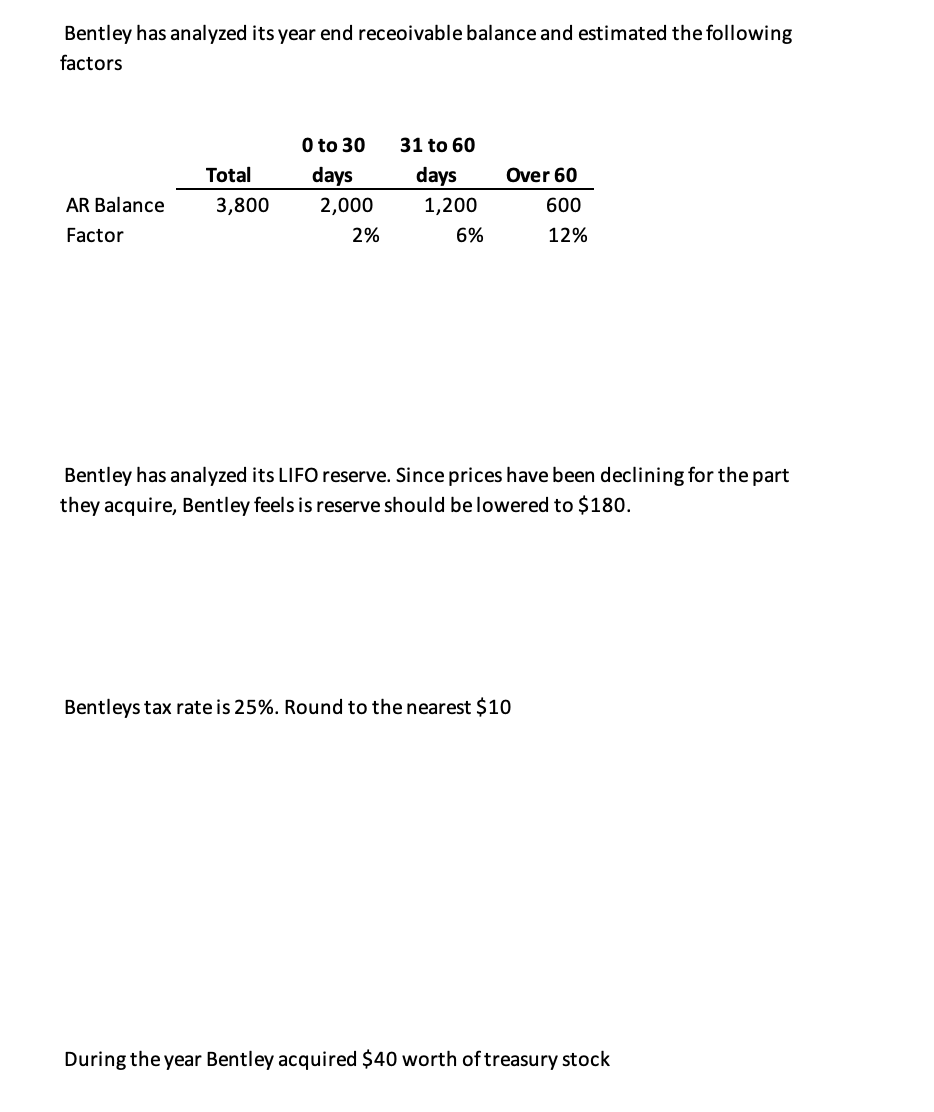

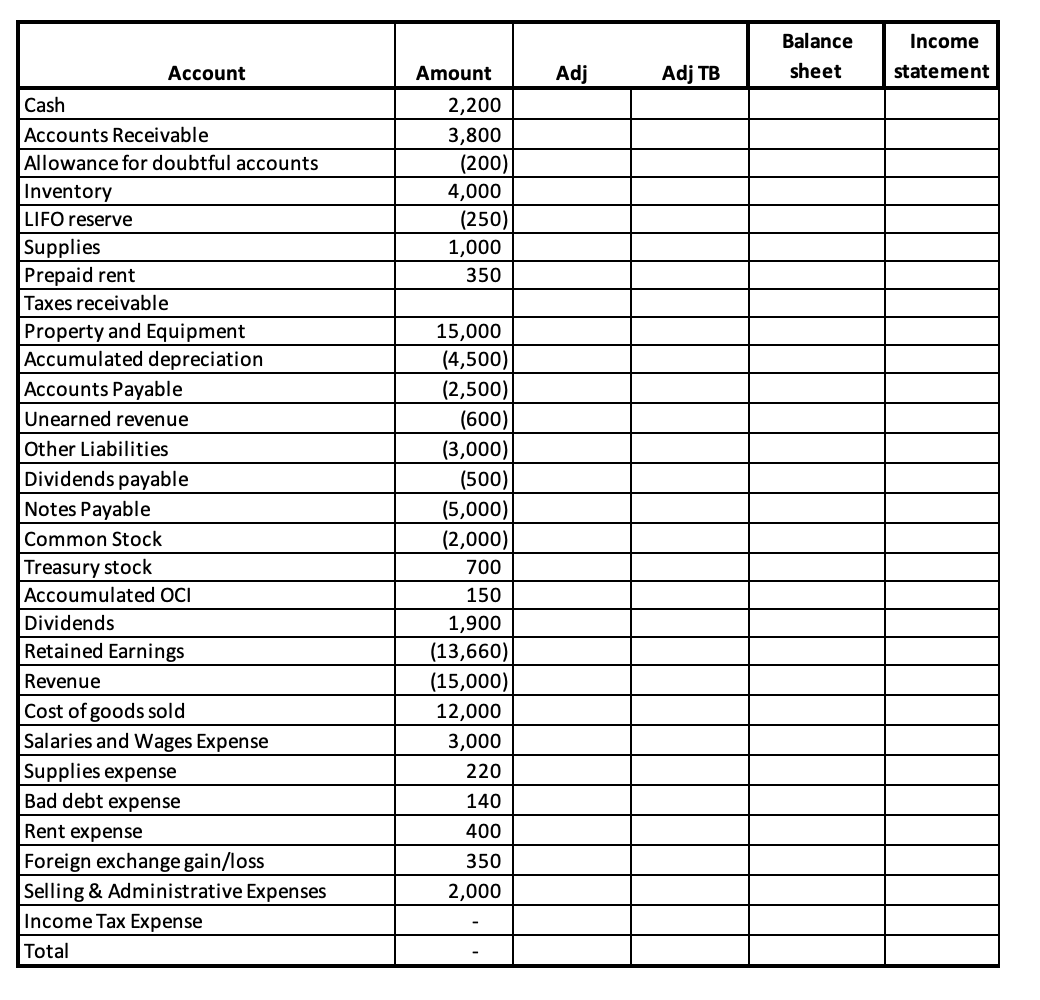

Bentley has analyzed its year end receoivable balance and estimated the following factors Total 3,800 O to 30 days 2,000 2% 31 to 60 days 1,200 6% AR Balance Over 60 600 12% Factor Bentley has analyzed its LIFO reserve. Since prices have been declining for the part they acquire, Bentley feels is reserve should be lowered to $180. Bentleys tax rate is 25%. Round to the nearest $10 During the year Bentley acquired $40 worth of treasury stock Balance sheet Income statement Adj Adj TB Amount 2,200 3,800 (200) 4,000 (250) 1,000 350 Account Cash Accounts Receivable Allowance for doubtful accounts Inventory LIFO reserve Supplies Prepaid rent Taxes receivable Property and Equipment Accumulated depreciation Accounts Payable Unearned revenue Other Liabilities Dividends payable Notes Payable Common Stock Treasury stock Accoumulated OCI Dividends Retained Earnings Revenue Cost of goods sold Salaries and Wages Expense Supplies expense Bad debt expense Rent expense Foreign exchange gain/loss Selling & Administrative Expenses Income Tax Expense Total 15,000 (4,500) (2,500) (600) (3,000) (500) (5,000) (2,000) 700 150 1,900 (13,660) (15,000) 12,000 3,000 220 140 400 350 2,000 Bentley has analyzed its year end receoivable balance and estimated the following factors Total 3,800 O to 30 days 2,000 2% 31 to 60 days 1,200 6% AR Balance Over 60 600 12% Factor Bentley has analyzed its LIFO reserve. Since prices have been declining for the part they acquire, Bentley feels is reserve should be lowered to $180. Bentleys tax rate is 25%. Round to the nearest $10 During the year Bentley acquired $40 worth of treasury stock Balance sheet Income statement Adj Adj TB Amount 2,200 3,800 (200) 4,000 (250) 1,000 350 Account Cash Accounts Receivable Allowance for doubtful accounts Inventory LIFO reserve Supplies Prepaid rent Taxes receivable Property and Equipment Accumulated depreciation Accounts Payable Unearned revenue Other Liabilities Dividends payable Notes Payable Common Stock Treasury stock Accoumulated OCI Dividends Retained Earnings Revenue Cost of goods sold Salaries and Wages Expense Supplies expense Bad debt expense Rent expense Foreign exchange gain/loss Selling & Administrative Expenses Income Tax Expense Total 15,000 (4,500) (2,500) (600) (3,000) (500) (5,000) (2,000) 700 150 1,900 (13,660) (15,000) 12,000 3,000 220 140 400 350 2,000