Answered step by step

Verified Expert Solution

Question

1 Approved Answer

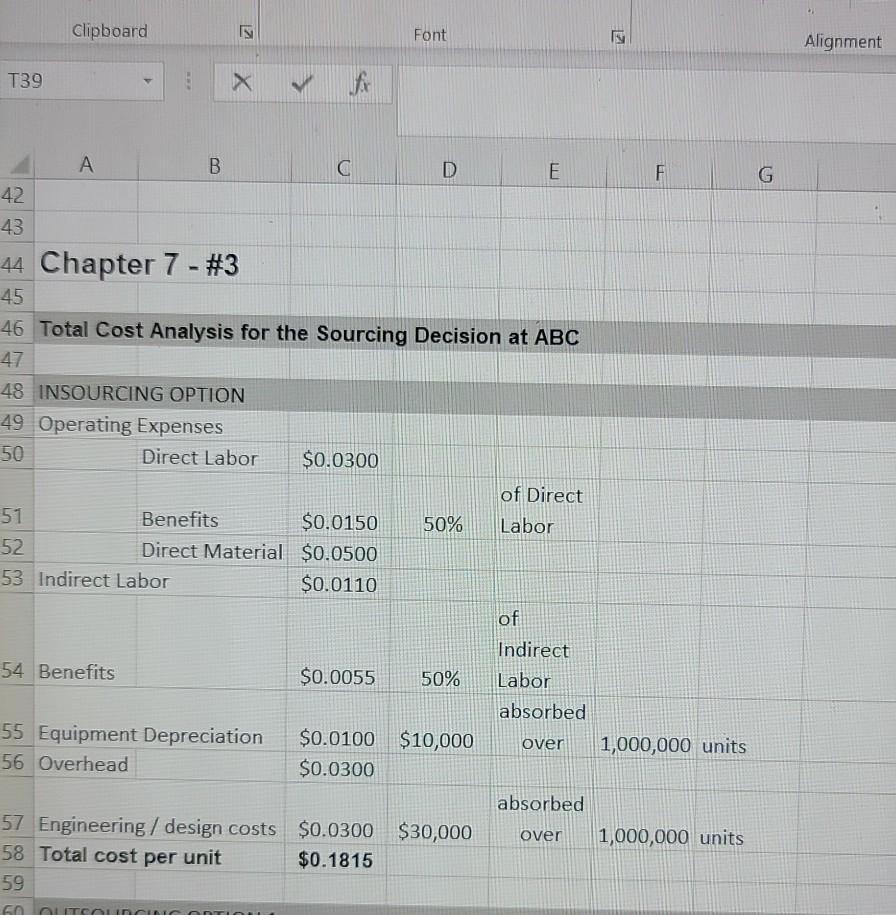

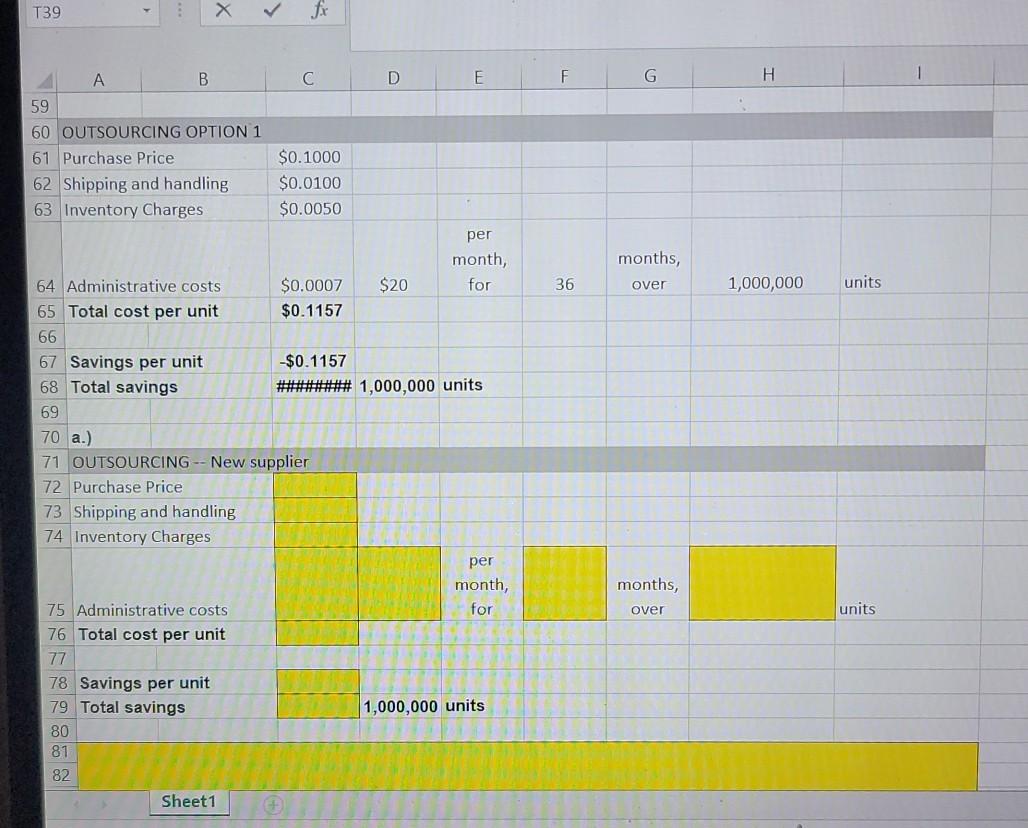

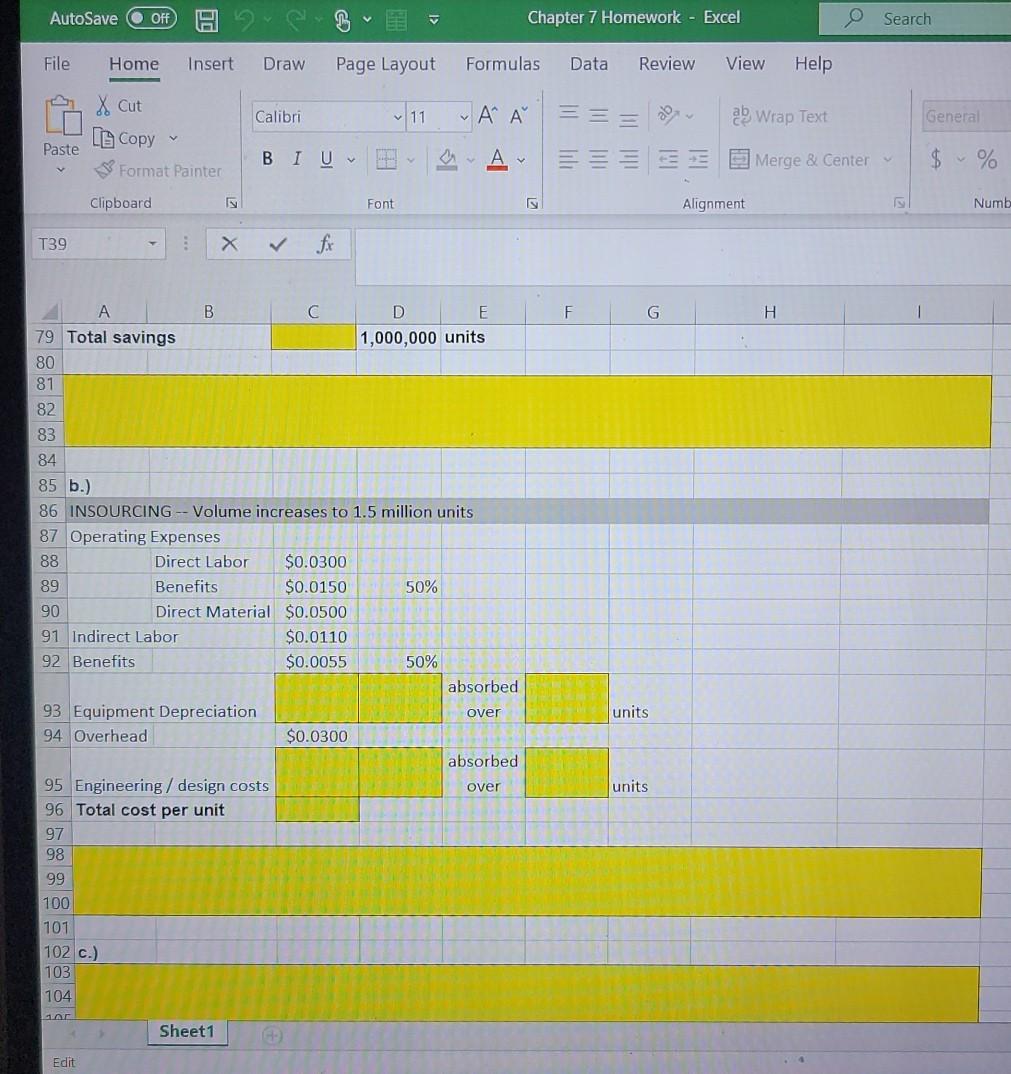

calculate the yellow boxes. thanks for your help. Clipboard Z Font Alignment T39 g X F G B. C D E 42 43 44 Chapter

calculate the yellow boxes. thanks for your help.

Clipboard Z Font Alignment T39 g X F G B. C D E 42 43 44 Chapter 7 - #3 45 46 Total Cost Analysis for the Sourcing Decision at ABC 47 48 INSOURCING OPTION 49 Operating Expenses 50 Direct Labor $0.0300 of Direct 51 Benefits $0.0150 50% Labor 52 Direct Material $0.0500 53 Indirect Labor $0.0110 of 54 Benefits $0.0055 50% Indirect Labor absorbed 55 Equipment Depreciation 56 Overhead over $0.0100 $10,000 $0.0300 1,000,000 units absorbed over 1,000,000 units 57 Engineering / design costs $0.0300 $30,000 58 Total cost per unit $0.1815 59 60 LITSOURCINCONTI T39 X C D E G H B 59 60 OUTSOURCING OPTION 1 61 Purchase Price 62 Shipping and handling 63 Inventory Charges $0.1000 $0.0100 $0.0050 per month, for months, $20 36 over 1,000,000 units $0.0007 $0.1157 $0.1157 #****#****# 1,000,000 units 64 Administrative costs 65 Total cost per unit 66 67 Savings per unit 68 Total savings 69 70 a.) 71 OU ew 72 Purchase Price 73 Shipping and handling 74 Inventory Charges pplier per month, for months, over units 75 Administrative costs 76 Total cost per unit 77 78 Savings per unit 79 Total savings 80 81 1,000,000 units 82 Sheet1 AutoSave Off V Chapter 7 Homework - Excel Search File Home Insert Draw Page Layout Formulas Data Review View Help & Cut LE Copy Calibri 11 ' a Wrap Text General Paste BIU A Merge & Center Format Painter Clipboard Font Alignment Numb T39 X fx F G H A B D 79 Total savings 1,000,000 units 80 81 82 83 84 85 b.) 86 INSOURCING Volume increases to 1.5 million units 87 Operating Expenses 88 Direct Labor $0.0300 89 Benefits $0.0150 50% 90 Direct Material $0.0500 91 Indirect Labor $0.0110 92 Benefits $0.0055 50% absorbed 93 Equipment Depreciation over 94 Overhead $0.0300 absorbed 95 Engineering / design costs over 96 Total cost per unit 97 98 99 100 101 102 c.) 103 units units 104 car Sheet1 Edit Clipboard Z Font Alignment T39 g X F G B. C D E 42 43 44 Chapter 7 - #3 45 46 Total Cost Analysis for the Sourcing Decision at ABC 47 48 INSOURCING OPTION 49 Operating Expenses 50 Direct Labor $0.0300 of Direct 51 Benefits $0.0150 50% Labor 52 Direct Material $0.0500 53 Indirect Labor $0.0110 of 54 Benefits $0.0055 50% Indirect Labor absorbed 55 Equipment Depreciation 56 Overhead over $0.0100 $10,000 $0.0300 1,000,000 units absorbed over 1,000,000 units 57 Engineering / design costs $0.0300 $30,000 58 Total cost per unit $0.1815 59 60 LITSOURCINCONTI T39 X C D E G H B 59 60 OUTSOURCING OPTION 1 61 Purchase Price 62 Shipping and handling 63 Inventory Charges $0.1000 $0.0100 $0.0050 per month, for months, $20 36 over 1,000,000 units $0.0007 $0.1157 $0.1157 #****#****# 1,000,000 units 64 Administrative costs 65 Total cost per unit 66 67 Savings per unit 68 Total savings 69 70 a.) 71 OU ew 72 Purchase Price 73 Shipping and handling 74 Inventory Charges pplier per month, for months, over units 75 Administrative costs 76 Total cost per unit 77 78 Savings per unit 79 Total savings 80 81 1,000,000 units 82 Sheet1 AutoSave Off V Chapter 7 Homework - Excel Search File Home Insert Draw Page Layout Formulas Data Review View Help & Cut LE Copy Calibri 11 ' a Wrap Text General Paste BIU A Merge & Center Format Painter Clipboard Font Alignment Numb T39 X fx F G H A B D 79 Total savings 1,000,000 units 80 81 82 83 84 85 b.) 86 INSOURCING Volume increases to 1.5 million units 87 Operating Expenses 88 Direct Labor $0.0300 89 Benefits $0.0150 50% 90 Direct Material $0.0500 91 Indirect Labor $0.0110 92 Benefits $0.0055 50% absorbed 93 Equipment Depreciation over 94 Overhead $0.0300 absorbed 95 Engineering / design costs over 96 Total cost per unit 97 98 99 100 101 102 c.) 103 units units 104 car Sheet1 EditStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started