Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculate using appropriate formulas for the bonds that Sanofi is planning to invest : i) Yield to maturity ii) Durations iii) Volatilities Sanofi Limited has

Calculate using appropriate formulas for the bonds that Sanofi is planning to invest :

i) Yield to maturity

ii) Durations

iii) Volatilities

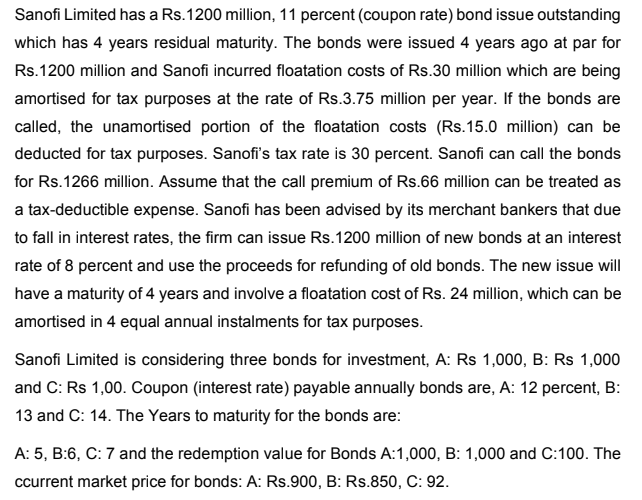

Sanofi Limited has a Rs. 1200 million, 11 percent (coupon rate) bond issue outstanding which has 4 years residual maturity. The bonds were issued 4 years ago at par for Rs. 1200 million and Sanofi incurred floatation costs of Rs.30 million which are being amortised for tax purposes at the rate of Rs.3.75 million per year. If the bonds are called, the unamortised portion of the floatation costs (Rs.15.0 million) can be deducted for tax purposes. Sanofi's tax rate is 30 percent. Sanofi can call the bonds for Rs. 1266 million. Assume that the call premium of Rs.66 million can be treated as a tax-deductible expense. Sanofi has been advised by its merchant bankers that due to fall in interest rates, the firm can issue Rs. 1200 million of new bonds at an interest rate of 8 percent and use the proceeds for refunding of old bonds. The new issue will have a maturity of 4 years and involve a floatation cost of Rs. 24 million, which can be amortised in 4 equal annual instalments for tax purposes. Sanofi Limited is considering three bonds for investment, A: Rs 1,000, B: Rs 1,000 and C: Rs 1,00. Coupon (interest rate) payable annually bonds are, A: 12 percent, B: 13 and C: 14. The Years to maturity for the bonds are: A: 5, B:6, C: 7 and the redemption value for Bonds A: 1,000, B: 1,000 and C:100. The ccurrent market price for bonds: A: Rs.900, B: Rs.850, C: 92Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started