Answered step by step

Verified Expert Solution

Question

1 Approved Answer

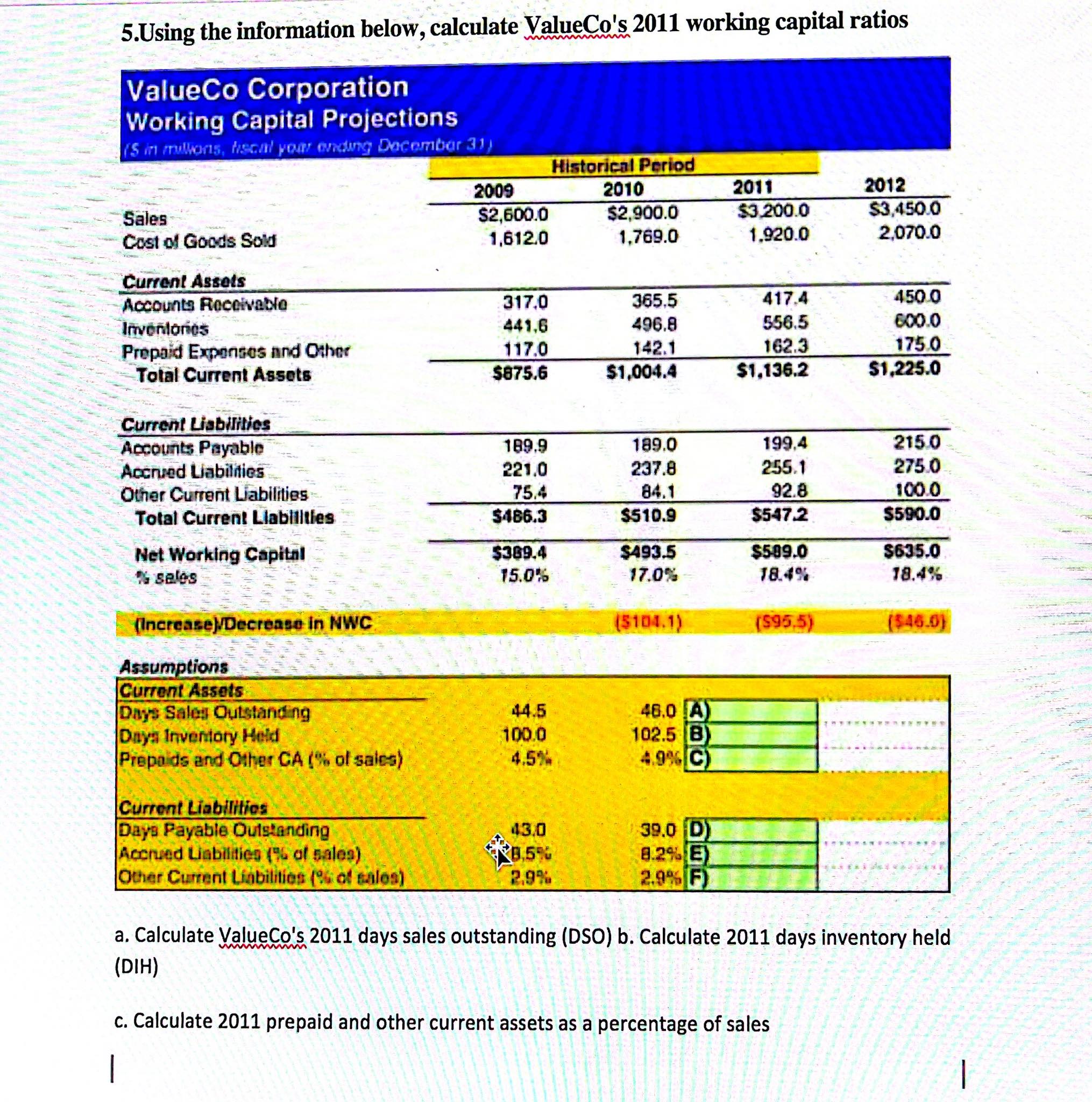

Calculate Value Co's 2013 sales Calculate 2014 COGS Calculate 2015 gross profit Calculate 2016 SG&A 5. Calculate 2017 EBITDA 5.Using the information below,

- Calculate Value Co's 2013 sales

- Calculate 2014 COGS

- Calculate 2015 gross profit

- Calculate 2016 SG&A

5. Calculate 2017 EBITDA

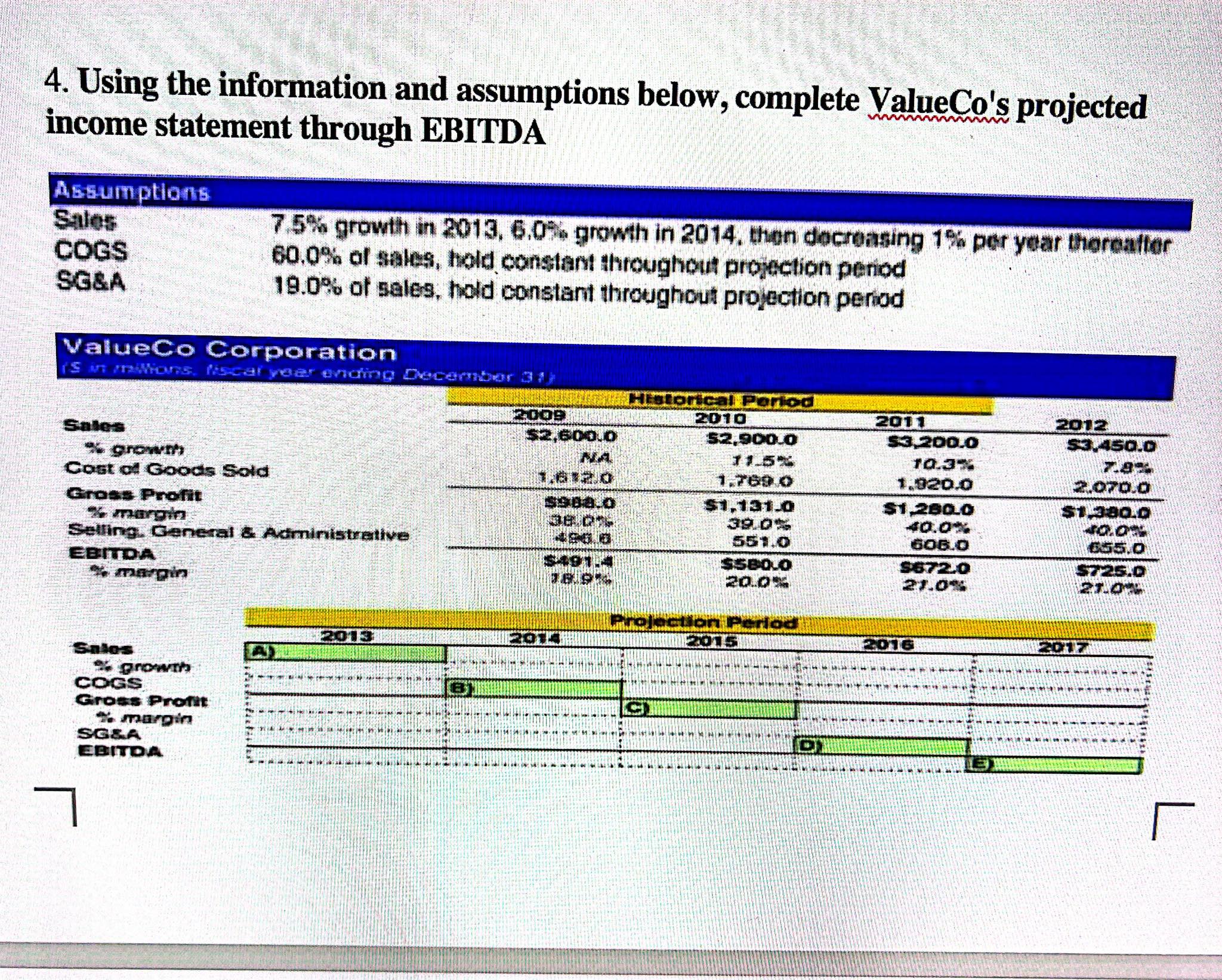

5.Using the information below, calculate ValueCo's 2011 working capital ratios ValueCo Corporation Working Capital Projections (5 in millions, fiscal your ending December 31) Sales Cost of Goods Sold Current Assets Accounts Receivable Inventories Prepaid Expenses and Other Total Current Assets Current Liabilities Accounts Payable Accrued Liabilities Other Current Liabilities Total Current Liabilities Net Working Capital % sales (Increase)/Decrease in NWC Assumptions Current Assets Days Sales Outstanding Days Inventory Held Prepaids and Other CA (% of sales) Current Liabilities Days Payable Outstanding Accrued Liabilities (% of sales) Other Current Liabilities (% of sales) 2009 $2,600.0 1,612.0 317.0 441,6 117.0 $875.6 189.9 221.0 75.4 $486.3 $389.4 15.0% 44.5 100.0 4.5% 43.0 8.5% 2.9% Historical Period 2010 $2,900.0 1,769.0 365.5 496.8 142.1 $1,004.4 189.0 237.8 84.1 $510.9 $493.5 17.0% ($104.1) 46.0 A) 102.5 (B) 4.9 % C) 39.0 (D) 8.2% E 2.9% F) 2011 $3,200.0 1,920.0 417.4 556.5 162.3 $1,136.2 199,4 255.1 92.8 $547.2 $589.0 18.4% ($95.5) 2012 $3,450.0 2,070.0 c. Calculate 2011 prepaid and other current assets as a percentage of sales | 450.0 600.0 175.0 $1,225.0 215.0 275.0 100.0 $590.0 $635.0 18.4% ($46.0) a. Calculate ValueCo's 2011 days sales outstanding (DSO) b. Calculate 2011 days inventory held (DIH) |

Step by Step Solution

★★★★★

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER To calculate the values requested well use the given information and assumptions Lets calcula...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started