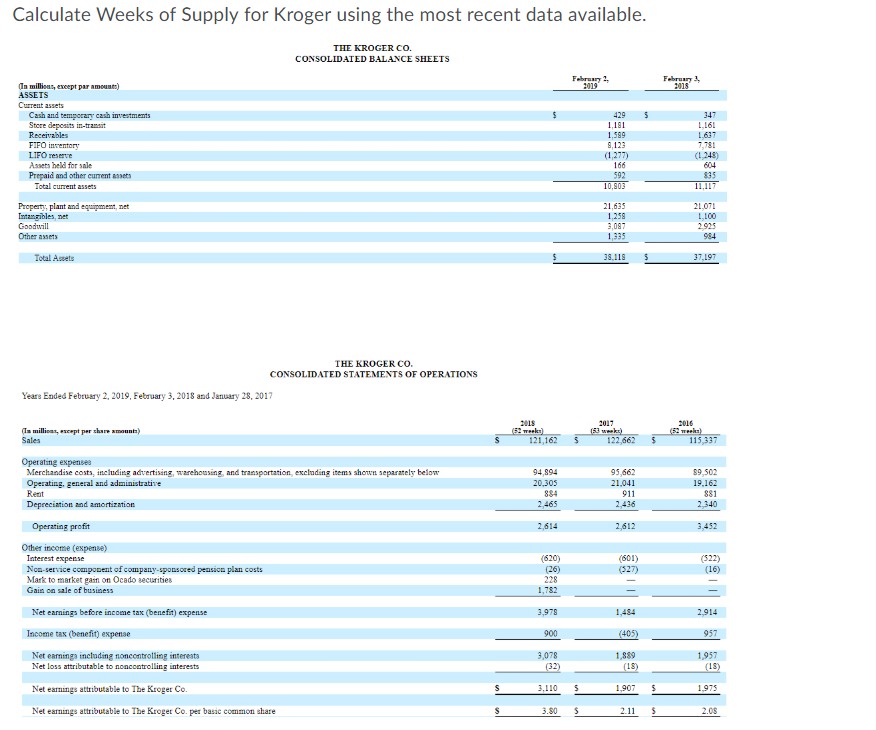

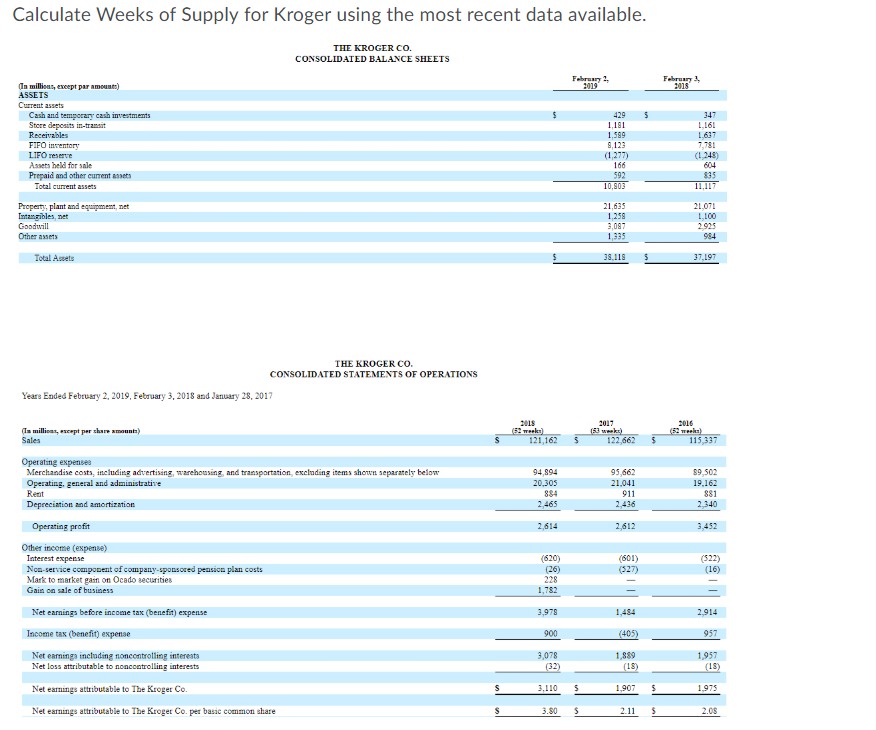

Calculate Weeks of Supply for Kroger using the most recent data available. THE KROGER CO. CONSOLIDATED BALANCE SHEETS Feb February In millions, exempt par amounts) ASSETS Current assets Cash and temporary cash investments Store deposits in-transit Receivables FIFO inventory LIFO reserve Assets held for sale Prepaid and other current sets Total current assets 1161 1637 429 1.191 1.599 9.123 (1277) 166 7.781 (1 248) 592 10,503 1.117 21 635 1.259 Property, plant and equipment, net Titanribles, net C35dall Other Assets 21.071 1.100 2995 984 1.335 Total Assets 38.118 5 37.197 THE KROGER CO. CONSOLIDATED STATEMENTS OF OPERATIONS Years Ended February 2, 2019, February 3, 2018 and January 28, 2017 2013 (la millions, except per share amounta) Sales (52 roku) 121,1625 (53 week) 122.6625 115337 Operating expenses Merchandise costs, including advertising, warehousing and transportation excluding items show separately below Operating, general and administrative 89,502 19.162 94 894 20.305 884 2,465 95,662 21.041 911 2,436 Depreciation and amortization 2,340 Operating profit 2,614 2,612 3,452 Other income (expense) Interest expense Non-service component of company sponsored pension plan costs Mark to market gain on Ocado securities Gain on sale of business (620) (26) (601) (327) (16) 228 1.782 - Net earnings before income tax (benefit) expense 3,975 2.914 Income tax (benefit) expense 900 (405) 957 Net earnings including noncontrolling interests Net loss attributable to noncontrolling interests 3,078 (32) 1,889 (18) 1957 (18) Net earnings attributable to The Kroger Co. S 3 ,110 S 1 ,907 $ 1.975 Net earnings attributable to The Kroger Co. per basic common share S 3 .80 2.11 $ 2.08 Calculate Weeks of Supply for Kroger using the most recent data available. THE KROGER CO. CONSOLIDATED BALANCE SHEETS Feb February In millions, exempt par amounts) ASSETS Current assets Cash and temporary cash investments Store deposits in-transit Receivables FIFO inventory LIFO reserve Assets held for sale Prepaid and other current sets Total current assets 1161 1637 429 1.191 1.599 9.123 (1277) 166 7.781 (1 248) 592 10,503 1.117 21 635 1.259 Property, plant and equipment, net Titanribles, net C35dall Other Assets 21.071 1.100 2995 984 1.335 Total Assets 38.118 5 37.197 THE KROGER CO. CONSOLIDATED STATEMENTS OF OPERATIONS Years Ended February 2, 2019, February 3, 2018 and January 28, 2017 2013 (la millions, except per share amounta) Sales (52 roku) 121,1625 (53 week) 122.6625 115337 Operating expenses Merchandise costs, including advertising, warehousing and transportation excluding items show separately below Operating, general and administrative 89,502 19.162 94 894 20.305 884 2,465 95,662 21.041 911 2,436 Depreciation and amortization 2,340 Operating profit 2,614 2,612 3,452 Other income (expense) Interest expense Non-service component of company sponsored pension plan costs Mark to market gain on Ocado securities Gain on sale of business (620) (26) (601) (327) (16) 228 1.782 - Net earnings before income tax (benefit) expense 3,975 2.914 Income tax (benefit) expense 900 (405) 957 Net earnings including noncontrolling interests Net loss attributable to noncontrolling interests 3,078 (32) 1,889 (18) 1957 (18) Net earnings attributable to The Kroger Co. S 3 ,110 S 1 ,907 $ 1.975 Net earnings attributable to The Kroger Co. per basic common share S 3 .80 2.11 $ 2.08