calculate weight average cost of capital (WACC)

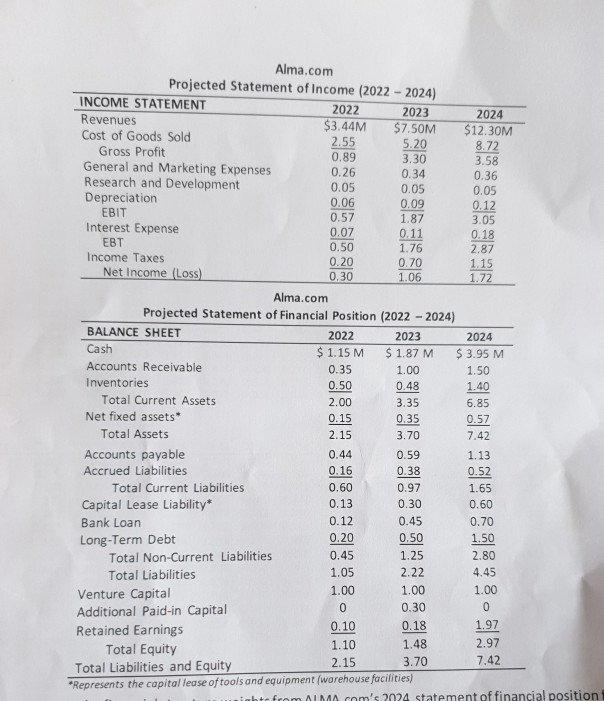

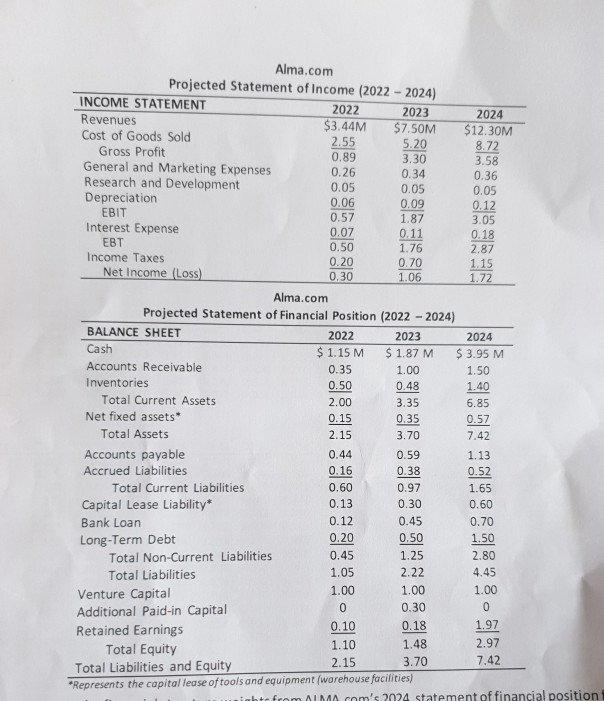

Alma.com Projected Statement of Income (2022 - 2024) INCOME STATEMENT 2022 2023 2024 Revenues $3.44M Cost of Goods Sold $7.50M $12.30M 2.55 5.20 8.72 Gross Profit 0.89 3.30 General and Marketing Expenses 3.58 0.26 0.34 0.36 Research and Development 0.05 0.05 0.05 Depreciation 0.06 0.09 0.12 EBIT 0.57 1.87 3.05 Interest Expense 0.07 0.11 0.18 EBT 0.50 1.76 2.87 Income Taxes 0.20 0.70 1.15 Net Income (Loss) 0.30 1.06 1.72 Alma.com Projected Statement of Financial Position (2022 - 2024) BALANCE SHEET 2022 2023 2024 Cash $ 1.15 M $ 1.87 M $ 3.95 M Accounts Receivable 0.35 1.00 1.50 Inventories 0.50 0.48 1.40 Total Current Assets 2.00 3.35 6.85 Net fixed assets 0.15 0.35 0.57 Total Assets 2.15 3.70 7.42 Accounts payable 0.44 0.59 1.13 Accrued Liabilities 0.16 0.38 0.52 Total Current Liabilities 0.60 0.97 1.65 Capital Lease Liability* 0.13 0.30 0.60 Bank Loan 0.12 0.45 0.70 Long-Term Debt 0.20 0.50 1.50 Total Non-Current Liabilities 0.45 1.25 2.80 Total Liabilities 1.05 2.22 4.45 Venture Capital 1.00 1.00 1.00 0 Additional Paid-in Capital 0.30 0 0.10 0.18 1.97 Retained Earnings 1.10 1.48 Total Equity 2.97 2.15 3.70 Total Liabilities and Equity 7.42 *Represents the capital lease of tools and equipment (warehouse facilities) from ALMA com's 2024 statement of financial position 1 Alma.com Projected Statement of Income (2022 - 2024) INCOME STATEMENT 2022 2023 2024 Revenues $3.44M Cost of Goods Sold $7.50M $12.30M 2.55 5.20 8.72 Gross Profit 0.89 3.30 General and Marketing Expenses 3.58 0.26 0.34 0.36 Research and Development 0.05 0.05 0.05 Depreciation 0.06 0.09 0.12 EBIT 0.57 1.87 3.05 Interest Expense 0.07 0.11 0.18 EBT 0.50 1.76 2.87 Income Taxes 0.20 0.70 1.15 Net Income (Loss) 0.30 1.06 1.72 Alma.com Projected Statement of Financial Position (2022 - 2024) BALANCE SHEET 2022 2023 2024 Cash $ 1.15 M $ 1.87 M $ 3.95 M Accounts Receivable 0.35 1.00 1.50 Inventories 0.50 0.48 1.40 Total Current Assets 2.00 3.35 6.85 Net fixed assets 0.15 0.35 0.57 Total Assets 2.15 3.70 7.42 Accounts payable 0.44 0.59 1.13 Accrued Liabilities 0.16 0.38 0.52 Total Current Liabilities 0.60 0.97 1.65 Capital Lease Liability* 0.13 0.30 0.60 Bank Loan 0.12 0.45 0.70 Long-Term Debt 0.20 0.50 1.50 Total Non-Current Liabilities 0.45 1.25 2.80 Total Liabilities 1.05 2.22 4.45 Venture Capital 1.00 1.00 1.00 0 Additional Paid-in Capital 0.30 0 0.10 0.18 1.97 Retained Earnings 1.10 1.48 Total Equity 2.97 2.15 3.70 Total Liabilities and Equity 7.42 *Represents the capital lease of tools and equipment (warehouse facilities) from ALMA com's 2024 statement of financial position 1