Answered step by step

Verified Expert Solution

Question

1 Approved Answer

*calculate what losses will be available after acquiring the shares and explain future deductibility of thise losses after the purchase that's all information provided to

*calculate what losses will be available after acquiring the shares and explain future deductibility of thise losses after the purchase

that's all information provided to us tho.

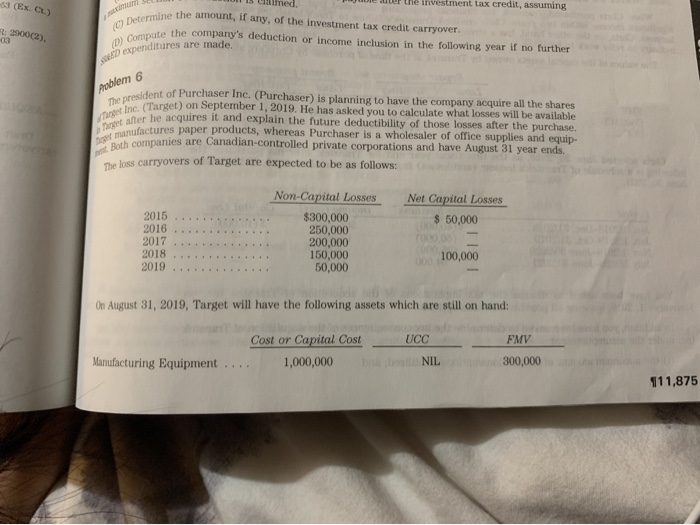

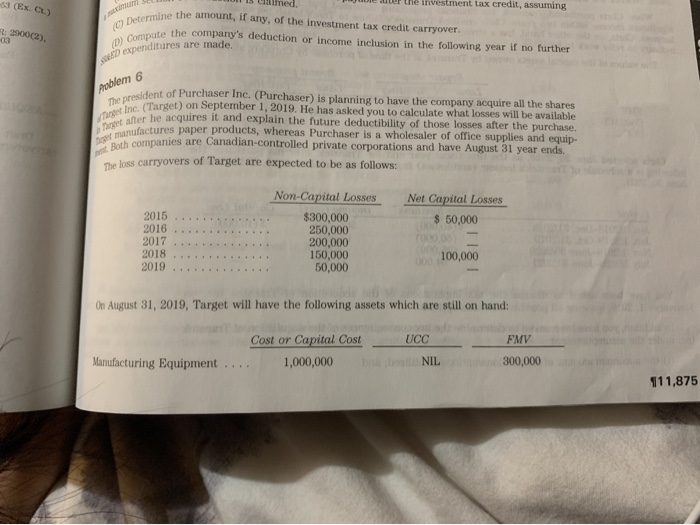

Both companies are Canadian-controlled private corporations and have August 31 year ends. O Determine the amount, if any, of the investment tax credit carryover. (0) Compute the company's deduction or income inclusion in the following year if no further expenditures are made. The president of Purchaser Inc. (Purchaser) is planning to have the company acquire all the shares Diger Inc. (Target) on September 1, 2019. He has asked you to calculate what losses will be available Page after he acquires it and explain the future deductibility of those losses after the purchase. De manufactures paper products, whereas Purchaser is a wholesaler of office supplies and equip- the investment tax credit, assuming : 2900(2), roblem 6 The loss carryovers of Target are expected to be as follows: Net Capital Losses $ 50,000 2015 2016 2017 2018 2019 Non-Capital Losses $300,000 250,000 200,000 150,000 50,000 100,000 On August 31, 2019, Target will have the following assets which are still on hand: UCC FMV Cost or Capital Cost 1,000,000 Manufacturing Equipment NIL 300,000 111,875 Both companies are Canadian-controlled private corporations and have August 31 year ends. O Determine the amount, if any, of the investment tax credit carryover. (0) Compute the company's deduction or income inclusion in the following year if no further expenditures are made. The president of Purchaser Inc. (Purchaser) is planning to have the company acquire all the shares Diger Inc. (Target) on September 1, 2019. He has asked you to calculate what losses will be available Page after he acquires it and explain the future deductibility of those losses after the purchase. De manufactures paper products, whereas Purchaser is a wholesaler of office supplies and equip- the investment tax credit, assuming : 2900(2), roblem 6 The loss carryovers of Target are expected to be as follows: Net Capital Losses $ 50,000 2015 2016 2017 2018 2019 Non-Capital Losses $300,000 250,000 200,000 150,000 50,000 100,000 On August 31, 2019, Target will have the following assets which are still on hand: UCC FMV Cost or Capital Cost 1,000,000 Manufacturing Equipment NIL 300,000 111,875 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started