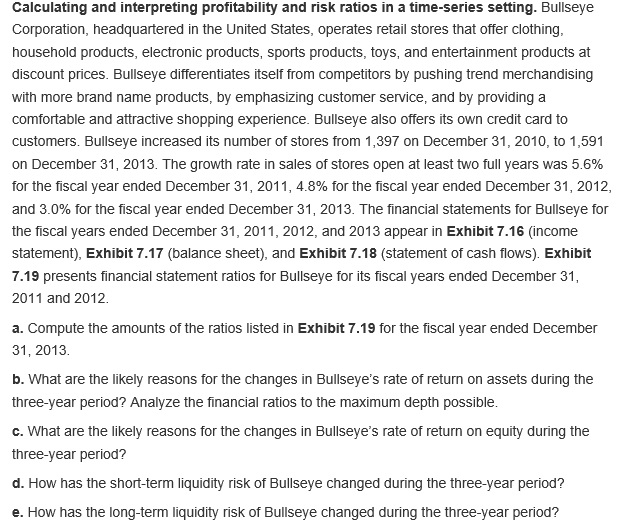

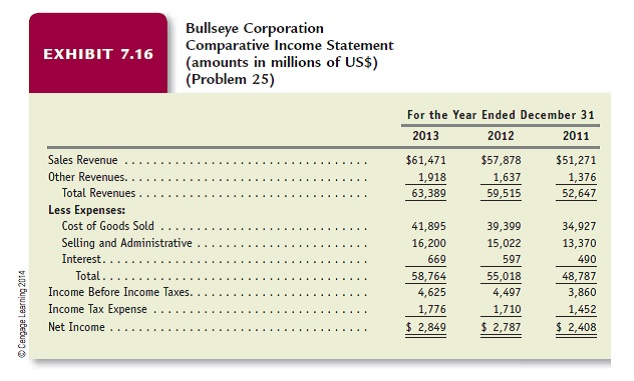

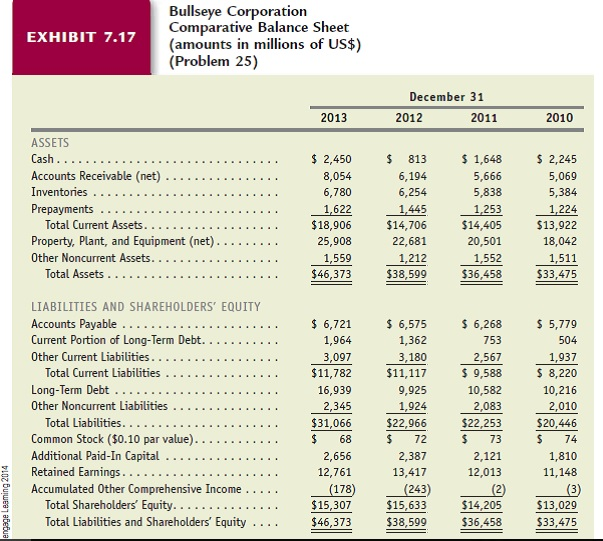

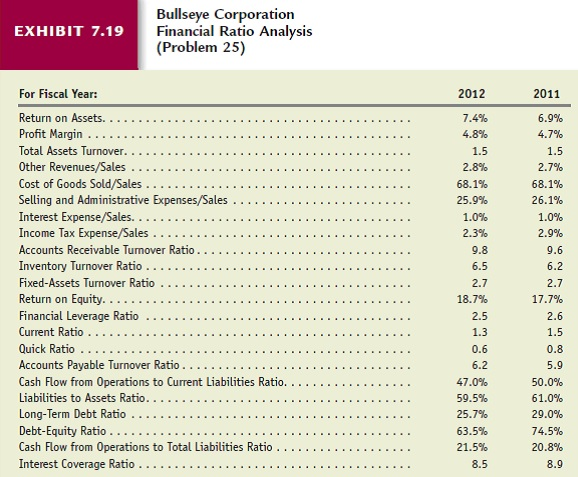

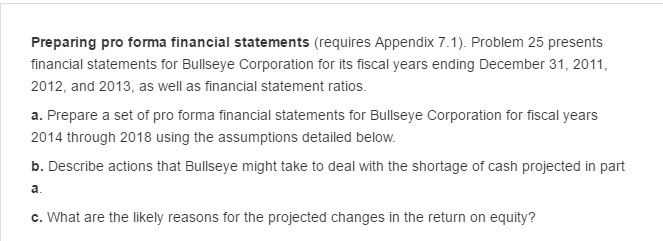

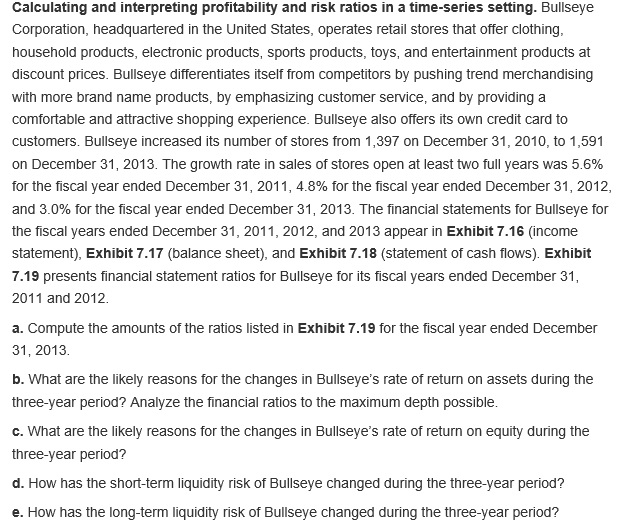

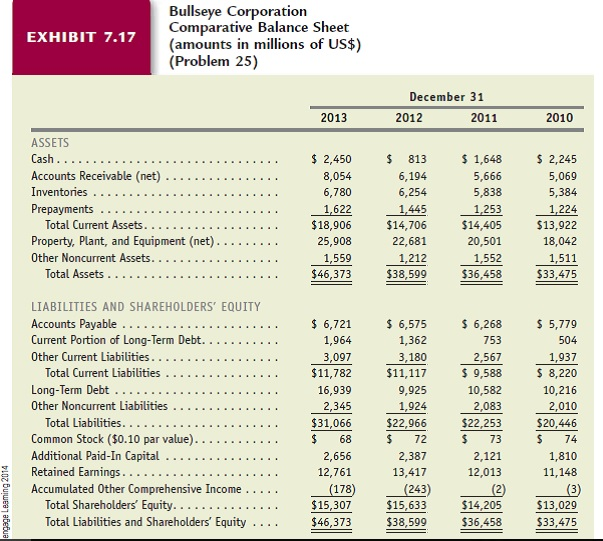

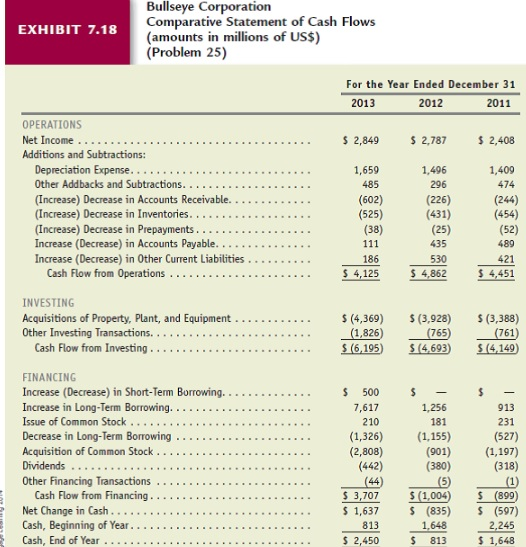

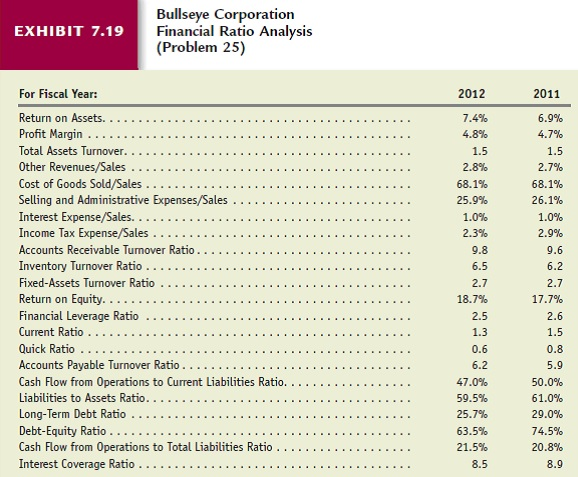

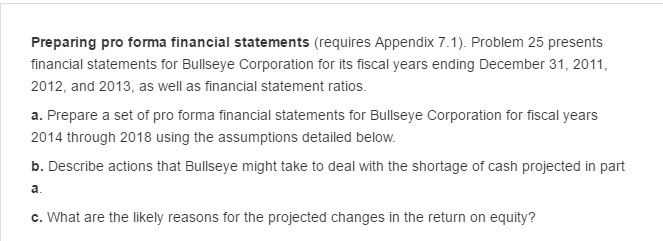

Calculating and interpreting profitability and risk ratios in a time-series setting. Bullseye Corporation, headquartered in the United States, operates retail stores that offer clothing, household products, electronic products, sports products, toys, and entertainment products at discount prices. Bullseye differentiates itself from competitors by pushing trend merchandising with more brand name products, by emphasizing customer service, and by providing a comfortable and attractive shopping experience. Bullseye also offers its own credit card to customers. Bullseye increased its number of stores from 1, 397 on December 31, 2010, to 1, 591 on December 31, 2013. The growth rate in sales of stores open at least two full years was 5.6% for the fiscal year ended December 31, 2011, 4.8% for the fiscal year ended December 31, 2012, and 3.0% for the fiscal year ended December 31, 2013. The financial statements for Bullseye for the fiscal years ended December 31, 2011, 2012, and 2013 appear in Exhibit 7.16 (income statement). Exhibit 7.17 (balance sheet), and Exhibit 7.18 (statement of cash flows). Exhibit 7.19 presents financial statement ratios for Bullseye for its fiscal years ended December 31, 2011 and 2012. Compute the amounts of the ratios listed in Exhibit 7.19 for the fiscal year ended December 31, 2013. What are the likely reasons for the changes in Bullseye's rate of return on assets during the three-year period? Analyze the financial ratios to the maximum depth possible. What are the likely reasons for the changes in Bullseye's rate of return on equity during the three-year period? How has the short-term liquidity risk of Bullseye changed during the three-year period? How has the long-term liquidity risk of Bullseye changed during the three-year period? Preparing pro forma financial statements (requires Appendix 7.1). Problem 25 presents financial statements for Bullseye Corporation for its fiscal years ending December 31, 2011, 2012, and 2013, as well as financial statement ratios. Prepare a set of pro forma financial statements for Bullseye Corporation for fiscal years 2014 through 2018 using the assumptions detailed below. Describe actions that Bullseye might take to deal with the shortage of cash projected in part a. What are the likely reasons for the projected changes in the return on equity