Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculating financial statement ratios P3 Selected current year-end financial statements of Cabot Corporation follow. All sales were on credit; selected balance sheet amounts at

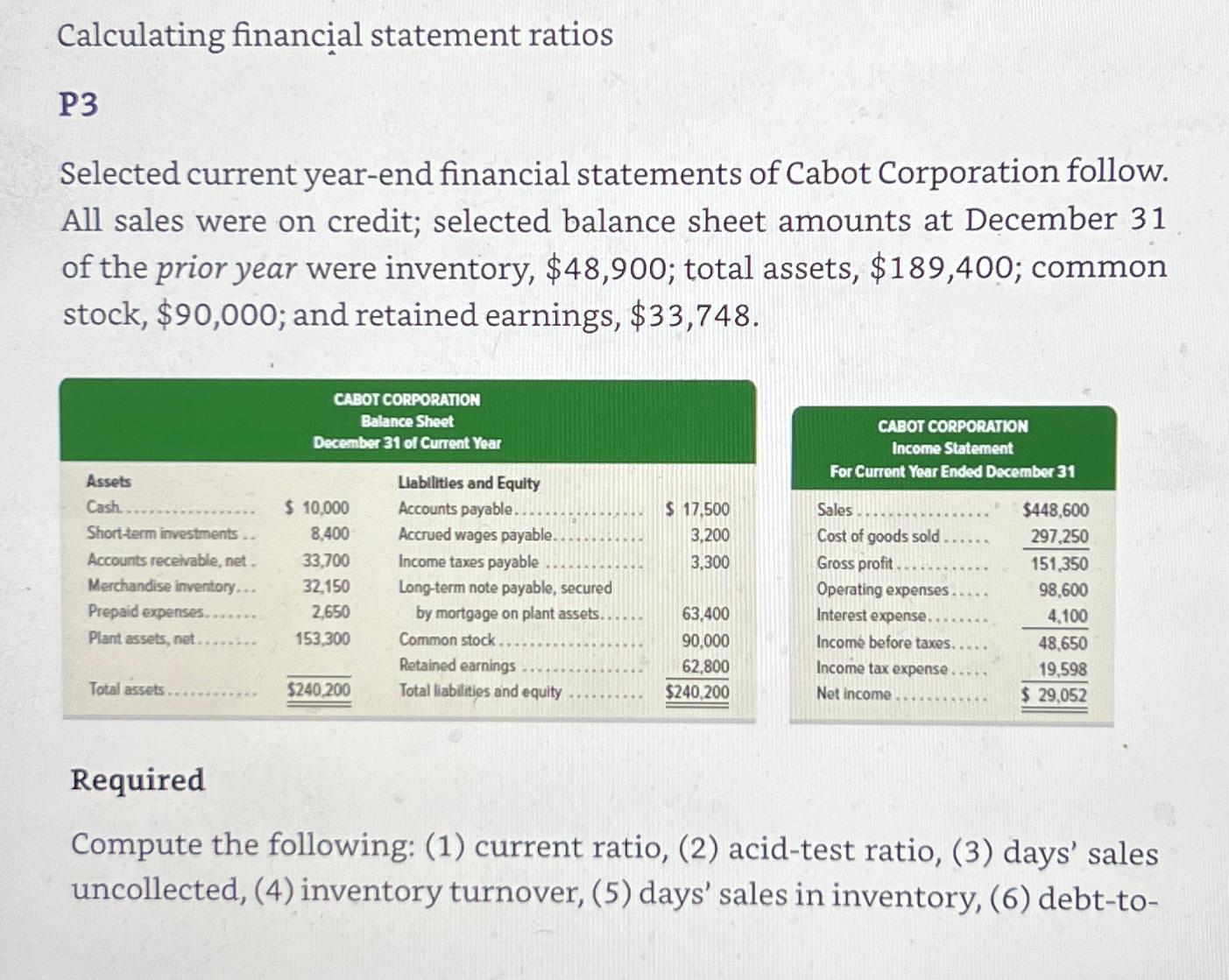

Calculating financial statement ratios P3 Selected current year-end financial statements of Cabot Corporation follow. All sales were on credit; selected balance sheet amounts at December 31 of the prior year were inventory, $48,900; total assets, $189,400; common stock, $90,000; and retained earnings, $33,748. CABOT CORPORATION Balance Sheet December 31 of Current Year CABOT CORPORATION Income Statement For Current Year Ended December 31 Assets Cash. Liabilities and Equity $ 10,000 Accounts payable. $ 17,500 Sales $448,600 Short-term investments.. 8,400 Accrued wages payable.. 3,200 Cost of goods sold. 297,250 Accounts receivable, net. 33,700 Income taxes payable 3,300 Gross profit 151,350 Merchandise inventory... 32,150 Long-term note payable, secured Operating expenses. 98,600 Prepaid expenses.. 2,650 by mortgage on plant assets. 63,400 Interest expense.. 4,100 Plant assets, net.. 153,300 Common stock. 90,000 Income before taxes. 48,650 Retained earnings 62,800 Total assets $240,200 Total liabilities and equity $240,200 Income tax expense Net income 19,598 $ 29,052 Required Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' sales uncollected, (4) inventory turnover, (5) days' sales in inventory, (6) debt-to-

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started