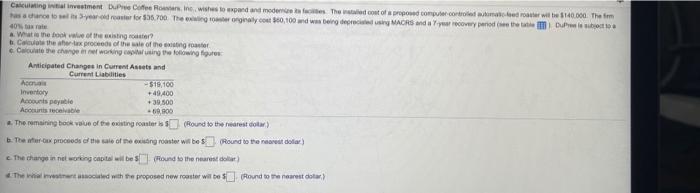

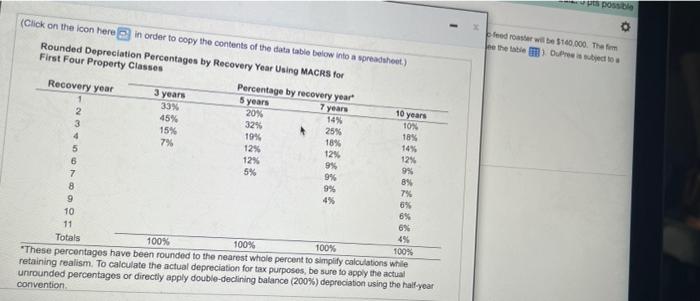

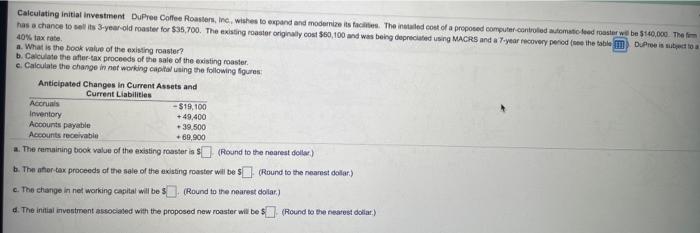

Calculating in testment Proteine wishes to expand and modernes. The cost of proposed computer cord made witte 140.000. The to as a verrater for 506.700 Theorginal con 560,100 and was being red MACRS and arcowy periode 40 What the book of the existing router? Co the store proceeds of the sale of the groter Cut the change working in the following for Anticipated Changes in Current Assets and Current Liabilities Ano -$18.900 Inventory +49.400 Accounts payable +39.500 Accounts receive .. The remaining hooke of the existing roasters (Round to the rest Teater.cox procedee the date of existing rooster will be Round to the rest dolar) c. The charge in networking capital wil bound to the nearest coat) The winted with the proposed new rooster will be Round to the nearest doar Dos 0 drowie 140.000. The the table) DuPresto (Click on the icon here in order to copy the contents of the data table below into a spreadshot) Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes Percentage by recovery year Recovery year 3 years 5 years 7 years 10 years 20% TON 2 32% 3 33% 45% 145 15% 25% 19% 18% 7% 18% 5 12% 14% 12% 6 12% 12% 9% 9% 7 5% 9% 8% 8 9% 7% 9 6% 10 6% 11 6% 4% Totals 100% 100% 100% 100% *These percentages have been rounded to the nearest whole percent to simplity calculations while retaining realism. To calculate the actual depreciation for tax purposes, be sure to apply the actual unrounded percentages or directly apply double-declining balance (200%) depreciation using the half year convention 4% Calculating initial investment Dupree Coffee Roasters, Inc. wishes to expand and modernizats tacities. The installed cost of a proposed compue.controlled tomato feed rooster we be $140,000. Thom has a chance to its 3-year-old rooster for $35.700. The rooster original cost $80,100 and was being deprecated using MACRS and a 7-year recovery periods The table ) Dressupostos 40% tax rate a. What is the book value of the existing roaster? b. Calculate the after-tax proceeds of the sale of the existing rooster e. Calculate the change in networking capital using the following figures Anticipated Changes in Current Assets and Current Liabilities Accruals -$19.100 Inventory +49.400 Accounts payable +39.500 Accounts receivable +60,000 1. The remaining book value of the existing roaster is $(Round to the nearest dotor) b. The other tax proceeds of the sale of the existing roaster wil be $(Round to the nearest dotor) c. The change in networking capital will be (Round to the nearest dollar) d. The initial investment associated with the proposed new roaster will be $(Round to the nearest doilar.)