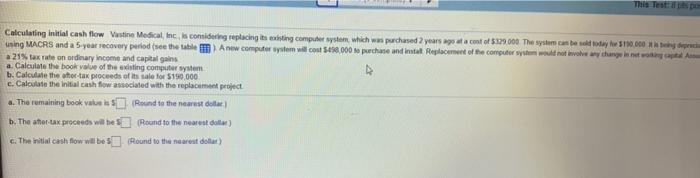

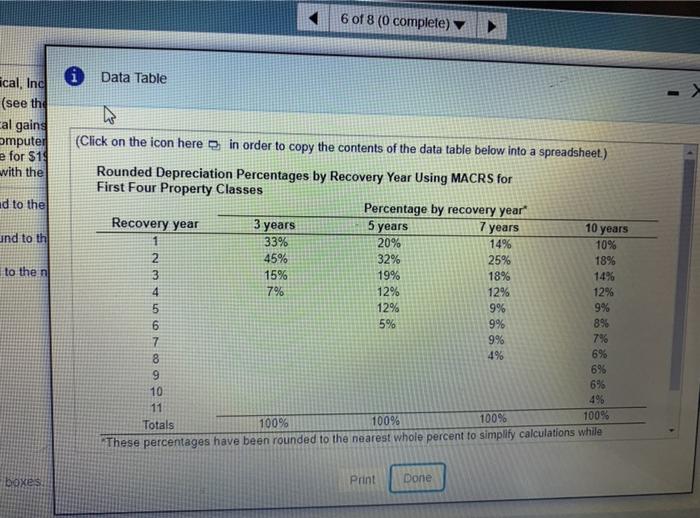

Calculating initial cash flow Vastine Medical, Inc. is considering replacing its sting computer system which was purchased 2 years ago at a cost of 5329.000 The system today the 130.000 de uning MACRS and a 5-year recovery period (nee the abilem Anw.computer system will cost 5490,000 to purchase and instalt Replacement of the computer system would not have way change 21% tax rate on ordinary income and capital gains a. Calculate the book value of the existing computer system b. Calculate the after-tax proceeds of its sale for $190.000 c. Calculate the initial cash flow associated with the replacement project a. The remaining book value is (Round to the nearest dollar) b. The after-tax proceeds whes Round to the nearest data) c. The initial cash flow will be found to the nearest dout) uuestion. 1 pt 6 of 8 (0 complete) This Test: culating initial cash flow Vastine Medical Inc. is considering replacing its existing computer system which was purchased 2 years ago at a cost of $120.000 The system medelwedd g MACRS and a 5-year recovery period (see the table Anw.computer system will cost $498 000 puchaw and install Replacement of the computer system would not be any change in toplam 1% tax rate on ordinary income and capital gains Calculate the book value of the existing computer system Calculate the after tax proceeds of its sale for $190.000 Calculate the initial cash flow associated with the replacement project The remaining book value is (Round to the nearest dodar) The after-tax proceeds will be Round to the nearest dollar) The initial cash flow will be SE (Round to the nearest dollar) 6 of 8 (0 complete) Data Table ical, Inc (see the Cal gains omputeil e for $1$ with the ad to the ind to th to the n (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes Percentage by recovery year Recovery year 3 years 5 years 7 years 10 years 1 33% 20% 14% 10% 2 45% 32% 25% 18% 3 15% 19% 18% 14% 4 7% 12% 12% 12% 5 12% 9% 9% 6 5% 9% 896 7 9% 7% 8 6% 9 6% 69 10 11 Totals 100% 100% 100% 100% These percentages have been founded to the nearest Whole percent to simplify calculations while boxes Print Done