Question

Calculating initial investment: DuPree Coffee Roasters, Inc., wishes to expand and modernize its facilities. The installed cost of a proposed computer-controlled automatic-feed roaster will be

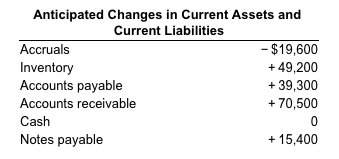

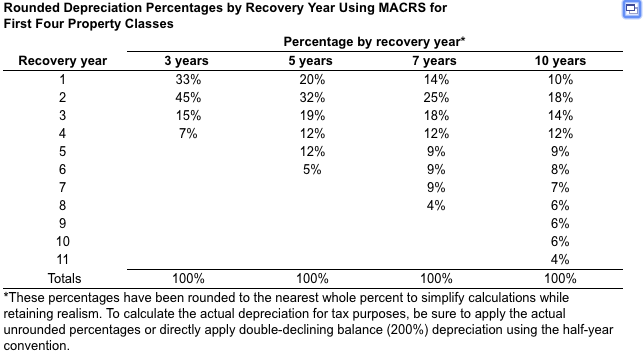

Calculating initial investment: DuPree Coffee Roasters, Inc., wishes to expand and modernize its facilities. The installed cost of a proposed computer-controlled automatic-feed roaster will be $131000. The firm has a chance to sell its 4-year-old roaster for $35800. The existing roaster originally cost $59600 and was being depreciated using MACRS and a 7-year recovery period (see the table) DuPree is subject to a 40% tax rate.

a. What is the book value of the existing roaster?

b. Calculate the after-tax proceeds of the sale of the existing roaster.

c. Calculate the change in net working capital using the following figures

d. Calculate the initial investment associated with the proposed new roaster

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started