Answered step by step

Verified Expert Solution

Question

1 Approved Answer

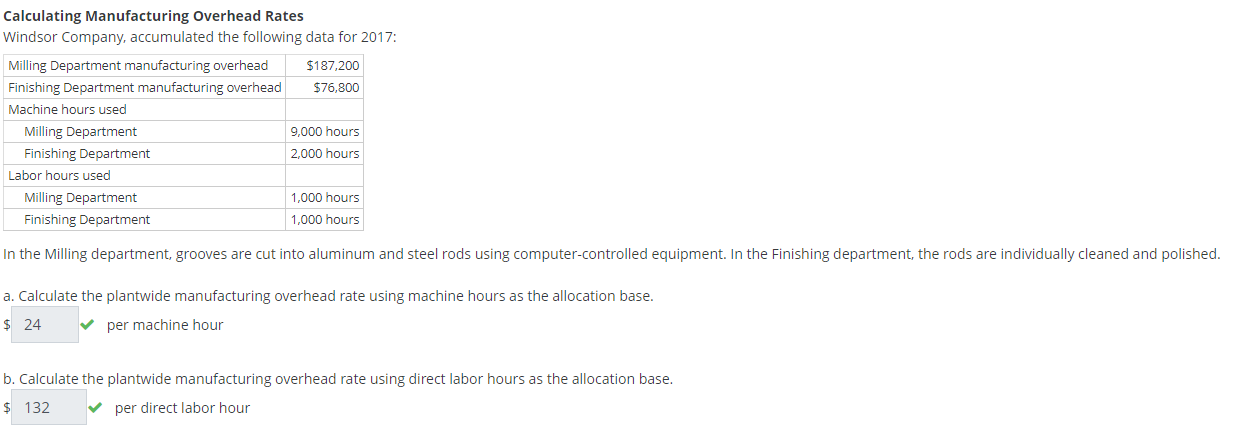

Calculating Manufacturing Overhead Rates Windsor Company, accumulated the following data for 2017: Milling Department manufacturing overhead $187,200 Finishing Department manufacturing overhead $76,800 Machine hours

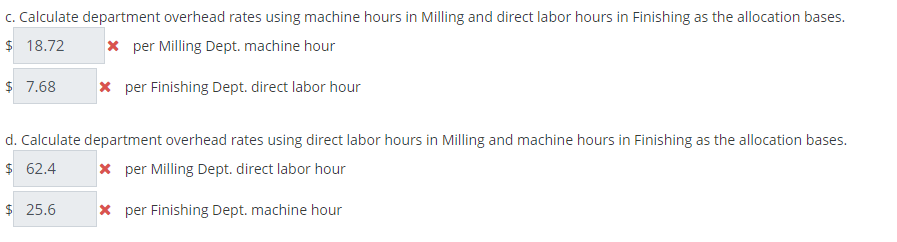

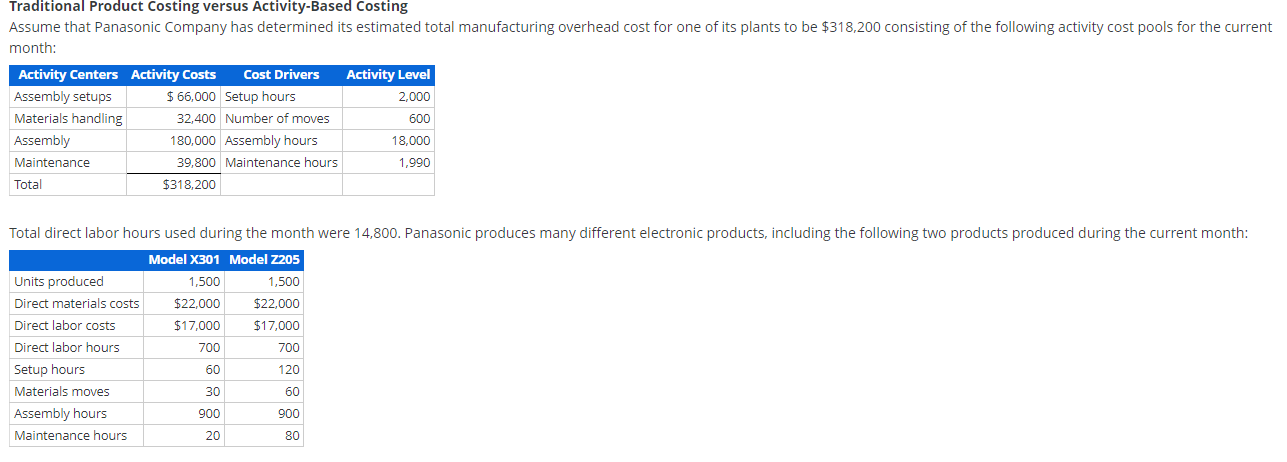

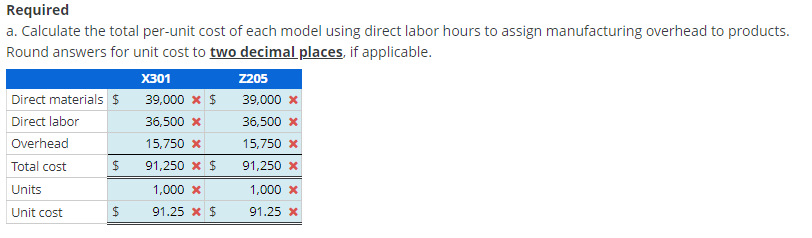

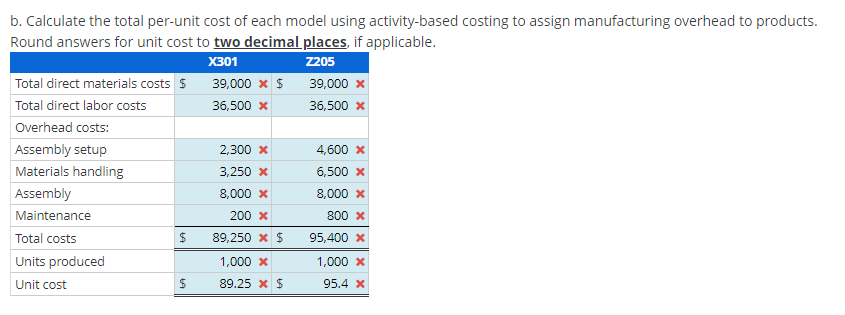

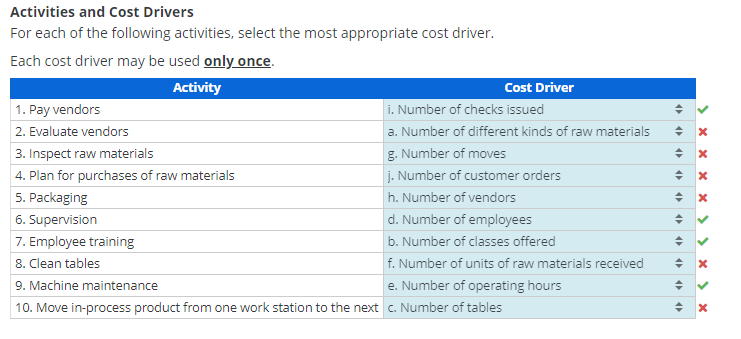

Calculating Manufacturing Overhead Rates Windsor Company, accumulated the following data for 2017: Milling Department manufacturing overhead $187,200 Finishing Department manufacturing overhead $76,800 Machine hours used Milling Department Finishing Department Labor hours used Milling Department Finishing Department 9,000 hours 2,000 hours 1,000 hours 1,000 hours In the Milling department, grooves are cut into aluminum and steel rods using computer-controlled equipment. In the Finishing department, the rods are individually cleaned and polished. a. Calculate the plantwide manufacturing overhead rate using machine hours as the allocation base. $ 24 per machine hour b. Calculate the plantwide manufacturing overhead rate using direct labor hours as the allocation base. $ 132 per direct labor hour c. Calculate department overhead rates using machine hours in Milling and direct labor hours in Finishing as the allocation bases. 18.72 Xper Milling Dept. machine hour $ $ 7.68 per Finishing Dept. direct labor hour d. Calculate department overhead rates using direct labor hours in Milling and machine hours in Finishing as the allocation bases. $ 62.4 per Milling Dept. direct labor hour $ 25.6 * per Finishing Dept. machine hour Traditional Product Costing versus Activity-Based Costing Assume that Panasonic Company has determined its estimated total manufacturing overhead cost for one of its plants to be $318,200 consisting of the following activity cost pools for the current month: Activity Centers Activity Costs Assembly setups Cost Drivers $66,000 Setup hours Activity Level 2,000 Materials handling Assembly Maintenance 32,400 Number of moves 180,000 Assembly hours 600 Total 39,800 Maintenance hours $318,200 18,000 1,990 Total direct labor hours used during the month were 14,800. Panasonic produces many different electronic products, including the following two products produced during the current month: Model X301 Model Z205 Units produced Direct materials costs 1,500 1,500 $22,000 $22,000 Direct labor costs $17,000 $17,000 Direct labor hours Setup hours 700 700 60 120 Materials moves 30 60 Assembly hours 900 900 Maintenance hours 20 80 Required a. Calculate the total per-unit cost of each model using direct labor hours to assign manufacturing overhead to products. Round answers for unit cost to two decimal places, if applicable. Direct materials $ X301 39,000 x $ Z205 39,000 x Direct labor 36,500 x 36,500 x Overhead 15,750 x 15,750 x Total cost $ 91,250 x $ 91,250 x Units 1,000 x 1,000 x Unit cost $ 91.25 x $ 91.25 x b. Calculate the total per-unit cost of each model using activity-based costing to assign manufacturing overhead to products. Round answers for unit cost to two decimal places, if applicable. Total direct materials costs $ Total direct labor costs X301 Z205 39,000 x $ 39,000 x 36,500 x 36,500 x Overhead costs: Assembly setup 2,300 x 4,600 x Materials handling 3,250 x 6,500 x Assembly Maintenance 8,000 x 8,000 * 200 x 800 x Total costs $ 89,250 x $ 95,400 x Units produced 1,000 x 1,000 * Unit cost $ 89.25 * $ 95.4 x Activities and Cost Drivers For each of the following activities, select the most appropriate cost driver. Each cost driver may be used only once. 1. Pay vendors 2. Evaluate vendors 3. Inspect raw materials Activity 4. Plan for purchases of raw materials 5. Packaging 6. Supervision Cost Driver i. Number of checks issued a. Number of different kinds of raw materials h. Number of vendors g. Number of moves j. Number of customer orders d. Number of employees x x x x x b. Number of classes offered f. Number of units of raw materials received e. Number of operating hours 10. Move in-process product from one work station to the next c. Number of tables 7. Employee training 8. Clean tables 9. Machine maintenance x x

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started