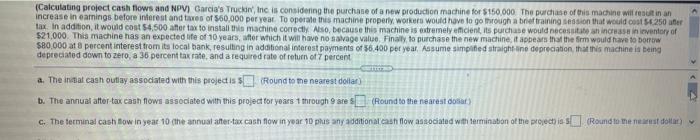

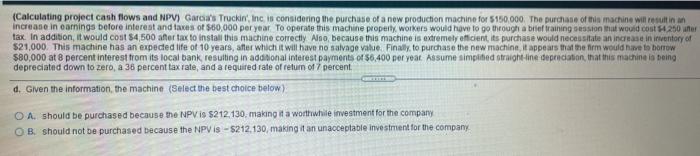

(Calculating project cash flows and NPV) Garcia's Truco, Inc is considering the purchase of a new production machine for $150.000 The purchase of this machine will result in an increase in earnings before interest and res of 560,000 per year. To operate this machine properly workers would have to go through a brief training session that would cost 250 er tax. In addition, it would cost 54,500 after tax to install this machine correctly. Also, because this machine is extremely eficient its purchase would necesitate increase inventory of $21,000. This machine has an expected life of 10 years, after which it will have no savage value. Finally to purchase the new machine, it appears that the firm would have to do $80.000 at 8 percent interest from its local bank, resulting in additional interest payments of 56.400 per year. Assume simplified straight line depreciation that this machine is being depreciated down to zero, a 36 percent tax rate and a required rate of return of 7 percent a. The inita cash outlay associated with this projects Round to the nearest dollar) b. The annual atter-tax cash flows associated with this project for years 1 through are $ (Round to the nearestos) c. The terminal cash how in year 10 the annual aster-tax cash flow in year 10 pras any additional cash flow associated with termination of the project is Round to meet dou) (Calculating project cash flows and NPV) Garcia's Truckin', Inc is considering the purchase of a new production machine for $150,000. The purchase of this machine will resultin Increase in earnings before interest and taxes of $60,000 per year to operate this machine properly workers would have to go through a brief training session that would cost 250 after tax. In addition, it would cost $4,500 afer tax to install this machine correctly Alno because this machine is extremely eficient, its purchase would necessitate an increase in inventory of $21,000. This machine has an expected life of 10 years, after which it will have no salvage value. Finally, to purchase the new machine it appears that the firm would have to borrow $80,000 at 8 percent interest from its local bank resulting in additional interest payments of 56,400 per year. Assume Simplified straight line depreciation that this machine is being depreciated down to zero, a 36 percent tax rate, and a required rate of return of 7 percent d. Given the information, the machine (Select the best choice below) O A. should be purchased because the NPV is $212.130, making it a worthwhile investment for the company OB should not be purchased because the NPV is-S212.130, making it an unacceptable investment for the company