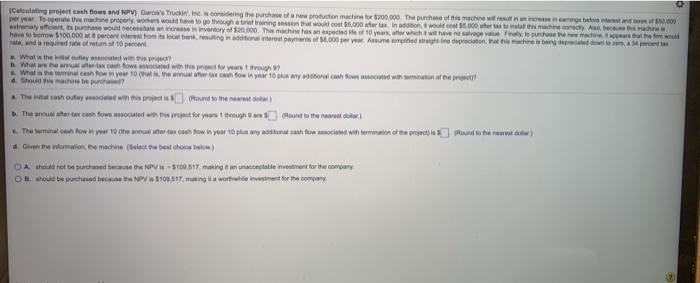

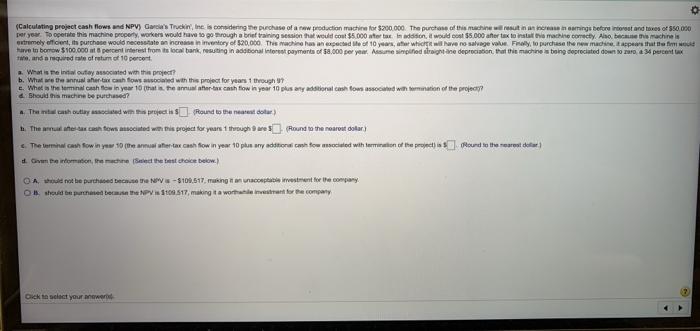

Calculating project th flows and NPV Truck Ine coming the purchase of the machine for $300,000. The purchase of the machen wird in new win.000 or you to operate the machinery, wars would have to go through a brief training at woulu 56.000 Menton S.000 where to this mattery array cant he would record invertory of $20,000. This machine as an expected to a 10 years after which will be sure that would have to bemow $100.000 percent or from the bank, resulting for interest payments 8.000 per you. Anune getirereciation. The report rate, and are now of return of t percent What is the win Whether shows with for years to Whole mal confine too. The water te how in 10 An any for chwed with nation of art! there? The anno fa foscuted with a project for your thought to the nearesto Turminat can own pour 10 w wynical tortus cun tow n year to pan wynether than w nocient with turneration of te promet e xhand to the reare deter) the nomion, the machine is best choice below) OA should not be purchased the NPV-5100.517, making it an unacceptationes rent for the company on would be pushed to the NV300.517. making it worth it for the company Calculating project cash flows und NPV) Gard TruckInes codering the purchase of a new production machine for $200.000. The purchase of this machine will result in andere in curange before interest and teves oss.000 per year operate the machine propory workers would have to rough a brief training session that would cost $5.000 utoradio i would cont 5.000 afer tax to install the machine comedy Aho became the machines have to bomow $100.000 at percent interest from a local bank, resulting in additional interest payments of $3,000 per year. Assame simplified straight-ane depreciation that this machine tong depreciated down so muro 45 percent tax and are tale of return of 10 percent What is the intalutay associated with this project b. What we the annual her.cach tows used with the project for years through 5. When the dominat cash or in year 10 hat in the annual terba canh flow in year 10 plus any additional cash Rom associated wormination of the property machine be purchased The cash outlayed with projects Round to the nearestoa) The mette ar con tow accedit project for years 1 through wes (Pound to the nearet olar) The ormai cash tow in yow 10 me armuaf stor tax cash Row in year 10 phun any addera con cremaciated with termination of the project sound to the nearest de normation, the machine (Sed the croice below) Old not be purchased because the NW-5109.517.making a content to the company O should be purchased the NPV 109.517, making a worth street for the company Oick tocact your own Calculating project th flows and NPV Truck Ine coming the purchase of the machine for $300,000. The purchase of the machen wird in new win.000 or you to operate the machinery, wars would have to go through a brief training at woulu 56.000 Menton S.000 where to this mattery array cant he would record invertory of $20,000. This machine as an expected to a 10 years after which will be sure that would have to bemow $100.000 percent or from the bank, resulting for interest payments 8.000 per you. Anune getirereciation. The report rate, and are now of return of t percent What is the win Whether shows with for years to Whole mal confine too. The water te how in 10 An any for chwed with nation of art! there? The anno fa foscuted with a project for your thought to the nearesto Turminat can own pour 10 w wynical tortus cun tow n year to pan wynether than w nocient with turneration of te promet e xhand to the reare deter) the nomion, the machine is best choice below) OA should not be purchased the NPV-5100.517, making it an unacceptationes rent for the company on would be pushed to the NV300.517. making it worth it for the company Calculating project cash flows und NPV) Gard TruckInes codering the purchase of a new production machine for $200.000. The purchase of this machine will result in andere in curange before interest and teves oss.000 per year operate the machine propory workers would have to rough a brief training session that would cost $5.000 utoradio i would cont 5.000 afer tax to install the machine comedy Aho became the machines have to bomow $100.000 at percent interest from a local bank, resulting in additional interest payments of $3,000 per year. Assame simplified straight-ane depreciation that this machine tong depreciated down so muro 45 percent tax and are tale of return of 10 percent What is the intalutay associated with this project b. What we the annual her.cach tows used with the project for years through 5. When the dominat cash or in year 10 hat in the annual terba canh flow in year 10 plus any additional cash Rom associated wormination of the property machine be purchased The cash outlayed with projects Round to the nearestoa) The mette ar con tow accedit project for years 1 through wes (Pound to the nearet olar) The ormai cash tow in yow 10 me armuaf stor tax cash Row in year 10 phun any addera con cremaciated with termination of the project sound to the nearest de normation, the machine (Sed the croice below) Old not be purchased because the NW-5109.517.making a content to the company O should be purchased the NPV 109.517, making a worth street for the company Oick tocact your own