Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculating Remittance, we pay the Government GST (5%) on commission NOT HST (13%) ie. if we make a commission of $239 on a product, we

Calculating Remittance, we pay the Government GST (5%) on commission NOT HST (13%)

ie. if we make a commission of $239 on a product, we also have to calculate the GST on the commission: $239 x 5% = $11.95

Remember these "golden rules":

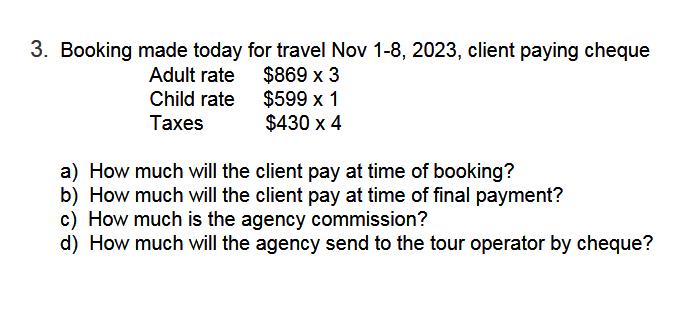

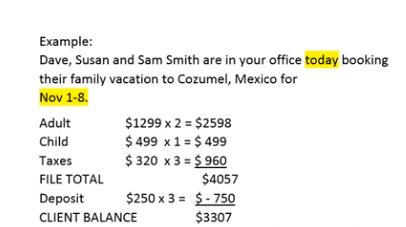

* Bookings made outside 45 days only require deposit payment at time of booking

* Bookings made inside 45 days must be paid in full at time of booking

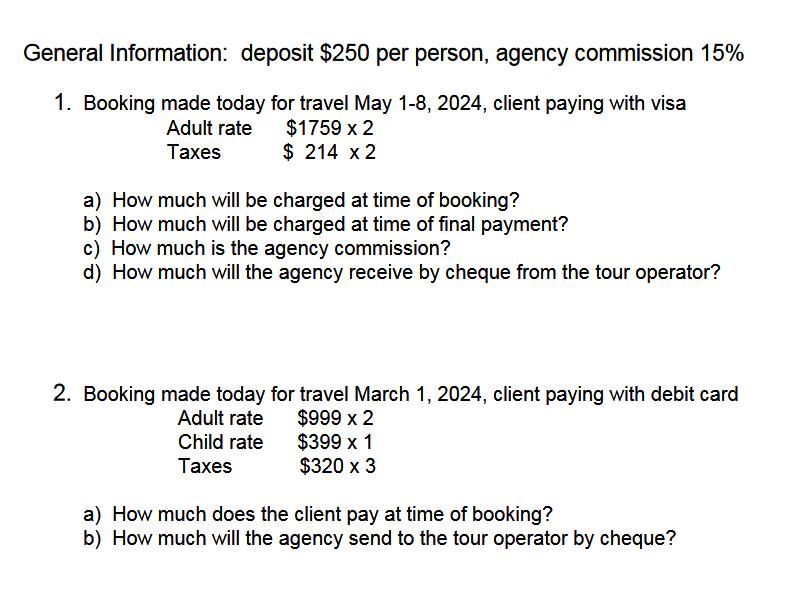

* Commission is calculated on everything EXCEPT taxes

General Information: deposit $250 per person, agency commission 15% 1. Booking made today for travel May 1-8, 2024, client paying with visa Adult rate Taxes $1759 x 2 $ 214 x 2 a) How much will be charged at time of booking? b) How much will be charged at time of final payment? c) How much is the agency commission? d) How much will the agency receive by cheque from the tour operator? 2. Booking made today for travel March 1, 2024, client paying with debit card Adult rate $999 x 2 Child rate $399 x 1 Taxes $320 x 3 a) How much does the client pay at time of booking? b) How much will the agency send to the tour operator by cheque?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started