Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculating taxable income The 2 0 1 9 standard deduction is $ 1 2 , 2 0 0 for unmarried taxpayers or married taxpayers filing

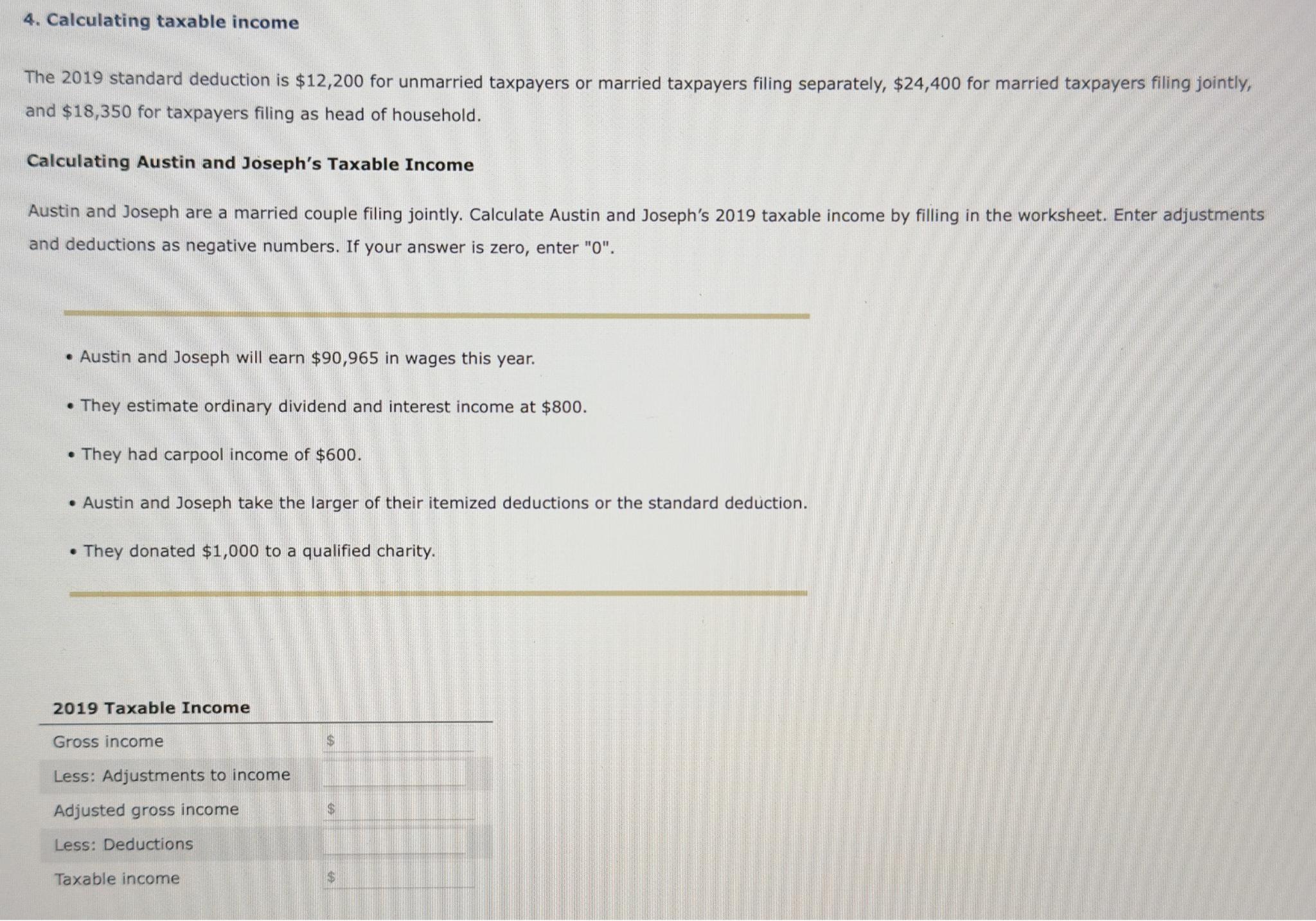

Calculating taxable income

The standard deduction is $ for unmarried taxpayers or married taxpayers filing separately, $ for married taxpayers filing jointly, and $ for taxpayers filing as head of household.

Calculating Austin and Joseph's Taxable Income

Austin and Joseph are a married couple filing jointly. Calculate Austin and Joseph's taxable income by filling in the worksheet. Enter adjustments and deductions as negative numbers. If your answer is zero, enter

Austin and Joseph will earn $ in wages this year.

They estimate ordinary dividend and interest income at $

They had carpool income of $

Austin and Joseph take the larger of their itemized deductions or the standard deduction.

They donated $ to a qualified charity.

Taxable Income

Gross income

Less: Adjustments to income

Adjusted gross income

Less: Deductions

Taxable income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started