Question

Calculating the payments on an interest rate swap Bank A enters into a $1,000,000 quarterly-pay plain vanilla interest rate swap as the fixed-rate payer

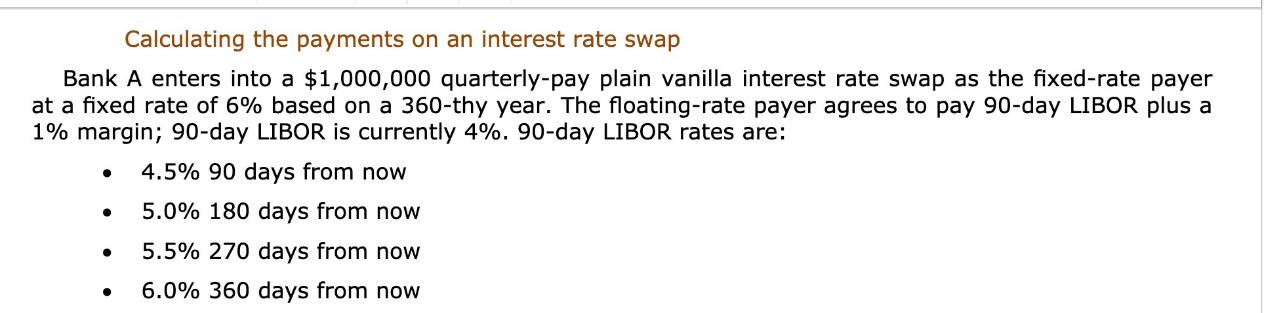

Calculating the payments on an interest rate swap Bank A enters into a $1,000,000 quarterly-pay plain vanilla interest rate swap as the fixed-rate payer at a fixed rate of 6% based on a 360-thy year. The floating-rate payer agrees to pay 90-day LIBOR plus a 1% margin; 90-day LIBOR is currently 4%. 90-day LIBOR rates are: 4.5% 90 days from now 5.0% 180 days from now 5.5% 270 days from now 6.0% 360 days from now

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the payments on the interest rate swap we need to determine the fixed and floating paym...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Reporting and Analysis

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer

7th edition

1259722651, 978-1259722653

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App