Question: Calculating the variances is just a preliminary step. The important question is what do we do next? There are two possibilities - ignore the

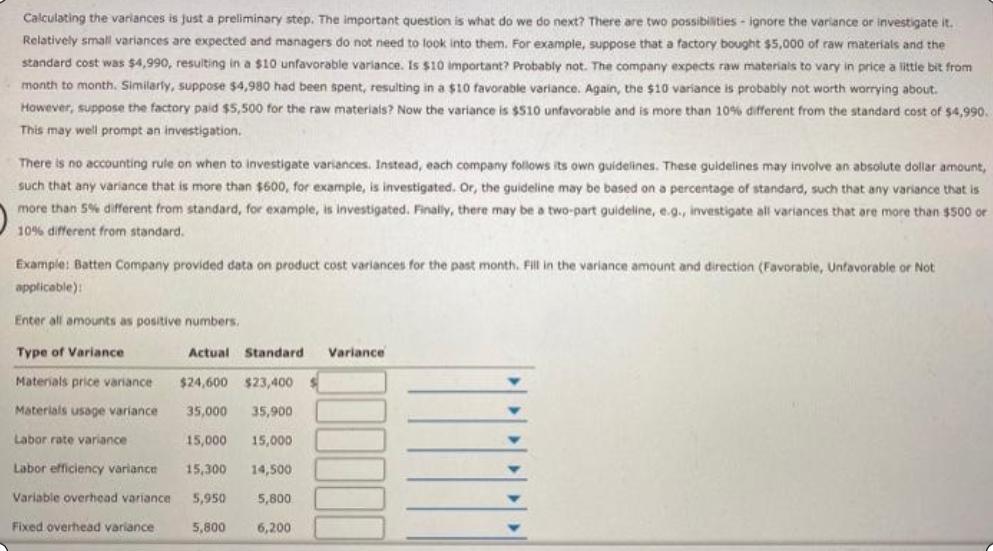

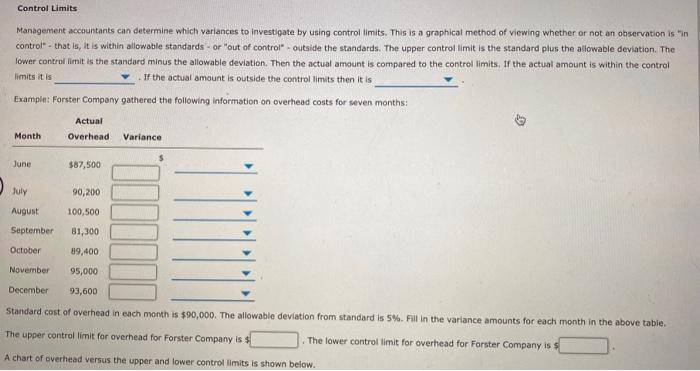

Calculating the variances is just a preliminary step. The important question is what do we do next? There are two possibilities - ignore the variance or investigate it. Relatively small variances are expected and managers do not need to look into them. For example, suppose that a factory bought $5,000 of raw materials and the standard cost was $4,990, resulting in a $10 unfavorable variance. Is $10 important? Probably not. The company expects raw materials to vary in price a little bit from month to month. Similarly, suppose $4,980 had been spent, resulting in a $10 favorable variance. Again, the $10 variance is probably not worth worrying about. However, suppose the factory paid $5,500 for the raw materials? Now the variance is $510 unfavorable and is more than 10% different from the standard cost of $4,990. This may well prompt an investigation. There is no accounting rule on when to investigate variances. Instead, each company follows its own guidelines. These guidelines may involve an absolute dollar amount, such that any variance that is more than $600, for example, is investigated. Or, the guideline may be based on a percentage of standard, such that any variance that is more than 5% different from standard, for example, is investigated. Finally, there may be a two-part guideline, e.g., investigate all variances that are more than $500 or 10% different from standard. Example: Batten Company provided data on product cost variances for the past month. Fill in the variance amount and direction (Favorable, Unfavorable or Not applicable): Enter all amounts as positive numbers. Type of Variance Actual Materials price variance $24,600 $23,400 $ Materials usage variance 35,000 35,900 Labor rate variance 15,000 15,000 Labor efficiency variance 15,300 14,500 Variable overhead variance 5,950 5,800 Fixed overhead variance 5,800 6,200 Standard Variance Batten's policy is to investigate all variances that are either more than $1,000 or 5% more than standard. Which variances should be investigated and why? Select "Yes" if the variance is more than $1,000" or "5% more than standard" else select "No" to explains why Batten would investigate. more than $1,000 Type of Variance Materials price variance Materials usage variance Labor rate variance Labor efficiency variance Variable overhead variance Fixed overhead variance Which of the following statements is true?. more than 5% of standard Control Limits Management accountants can determine which variances to investigate by using control limits. This is a graphical method of viewing whether or not an observation is "in control that is, it is within allowable standards or "out of control" - outside the standards. The upper control limit is the standard plus the allowable deviation. The lower control limit is the standard minus the allowable deviation. Then the actual amount is compared to the control limits. If the actual amount is within the control limits it is If the actual amount is outside the control limits then it is Example: Forster Company gathered the following information on overhead costs for seven months: Month June Actual Overhead. Variance. $87,500 July August September 81,300 October 89,400 November 95,000 December 93,600 Standard cost of overhead in each month is $90,000. The allowable deviation from standard is 5%. Fill in the variance amounts for each month in the above table. The upper control lmit for overhead for Forster Company is $ . The lower control limit for overhead for Forster Company is A chart of overhead versus the upper and lower control limits is shown below. 90,200 100,500 Calculating the variances is just a preliminary step. The important question is what do we do next? There are two possibilities - ignore the variance or investigate it. Relatively small variances are expected and managers do not need to look into them. For example, suppose that a factory bought $5,000 of raw materials and the standard cost was $4,990, resulting in a $10 unfavorable variance. Is $10 important? Probably not. The company expects raw materials to vary in price a little bit from month to month. Similarly, suppose $4,980 had been spent, resulting in a $10 favorable variance. Again, the $10 variance is probably not worth worrying about. However, suppose the factory paid $5,500 for the raw materials? Now the variance is $510 unfavorable and is more than 10% different from the standard cost of $4,990. This may well prompt an investigation. There is no accounting rule on when to investigate variances. Instead, each company follows its own guidelines. These guidelines may involve an absolute dollar amount, such that any variance that is more than $600, for example, is investigated. Or, the guideline may be based on a percentage of standard, such that any variance that is more than 5% different from standard, for example, is investigated. Finally, there may be a two-part guideline, e.g., investigate all variances that are more than $500 or 10% different from standard. Example: Batten Company provided data on product cost variances for the past month. Fill in the variance amount and direction (Favorable, Unfavorable or Not applicable): Enter all amounts as positive numbers. Type of Variance Actual Materials price variance $24,600 $23,400 $ Materials usage variance 35,000 35,900 Labor rate variance 15,000 15,000 Labor efficiency variance 15,300 14,500 Variable overhead variance 5,950 5,800 Fixed overhead variance 5,800 6,200 Standard Variance Batten's policy is to investigate all variances that are either more than $1,000 or 5% more than standard. Which variances should be investigated and why? Select "Yes" if the variance is more than $1,000" or "5% more than standard" else select "No" to explains why Batten would investigate. more than $1,000 Type of Variance Materials price variance Materials usage variance Labor rate variance Labor efficiency variance Variable overhead variance Fixed overhead variance Which of the following statements is true?. more than 5% of standard Control Limits Management accountants can determine which variances to investigate by using control limits. This is a graphical method of viewing whether or not an observation is "in control that is, it is within allowable standards or "out of control" - outside the standards. The upper control limit is the standard plus the allowable deviation. The lower control limit is the standard minus the allowable deviation. Then the actual amount is compared to the control limits. If the actual amount is within the control limits it is If the actual amount is outside the control limits then it is Example: Forster Company gathered the following information on overhead costs for seven months: Month June Actual Overhead. Variance. $87,500 July August September 81,300 October 89,400 November 95,000 December 93,600 Standard cost of overhead in each month is $90,000. The allowable deviation from standard is 5%. Fill in the variance amounts for each month in the above table. The upper control lmit for overhead for Forster Company is $ . The lower control limit for overhead for Forster Company is A chart of overhead versus the upper and lower control limits is shown below. 90,200 100,500

Step by Step Solution

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Section 1 varianceFavourable or amount adverse variance StandardActual Material price 234... View full answer

Get step-by-step solutions from verified subject matter experts