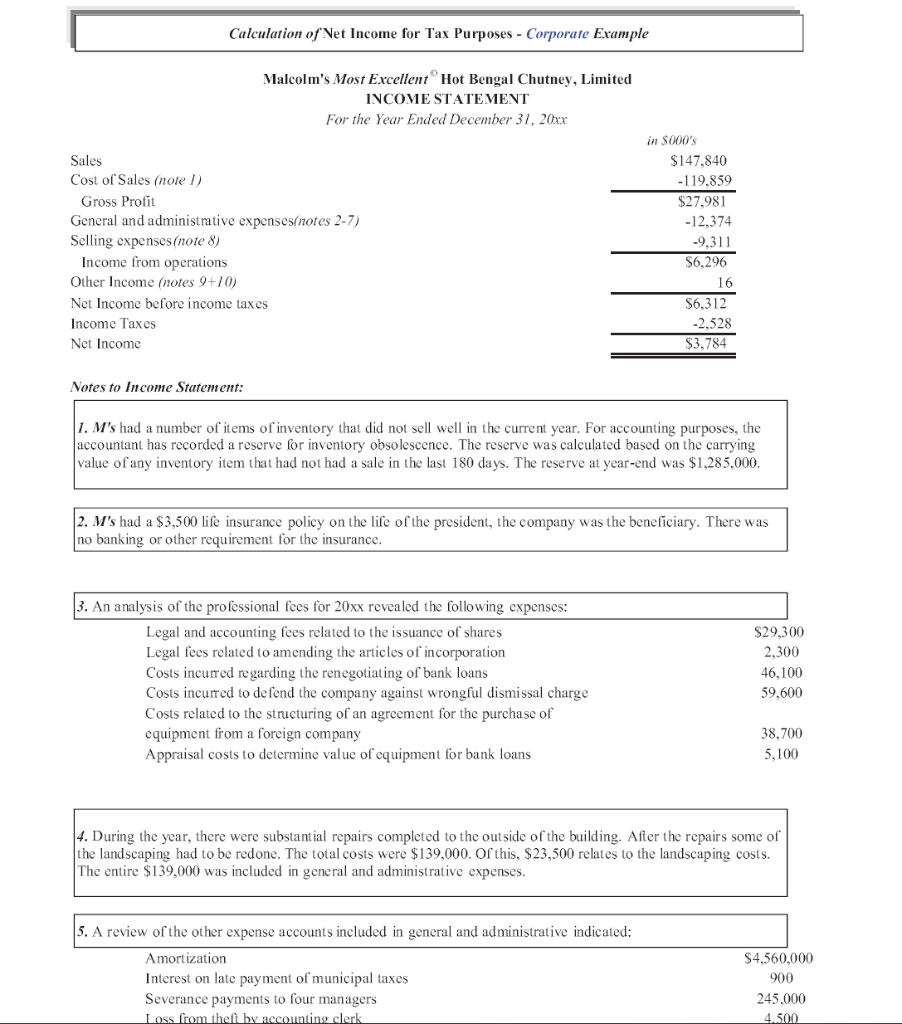

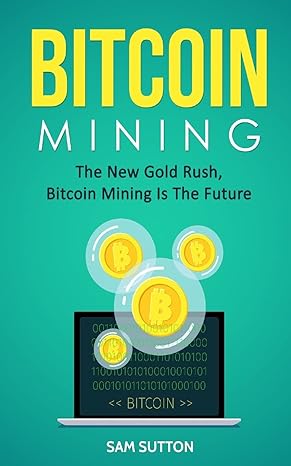

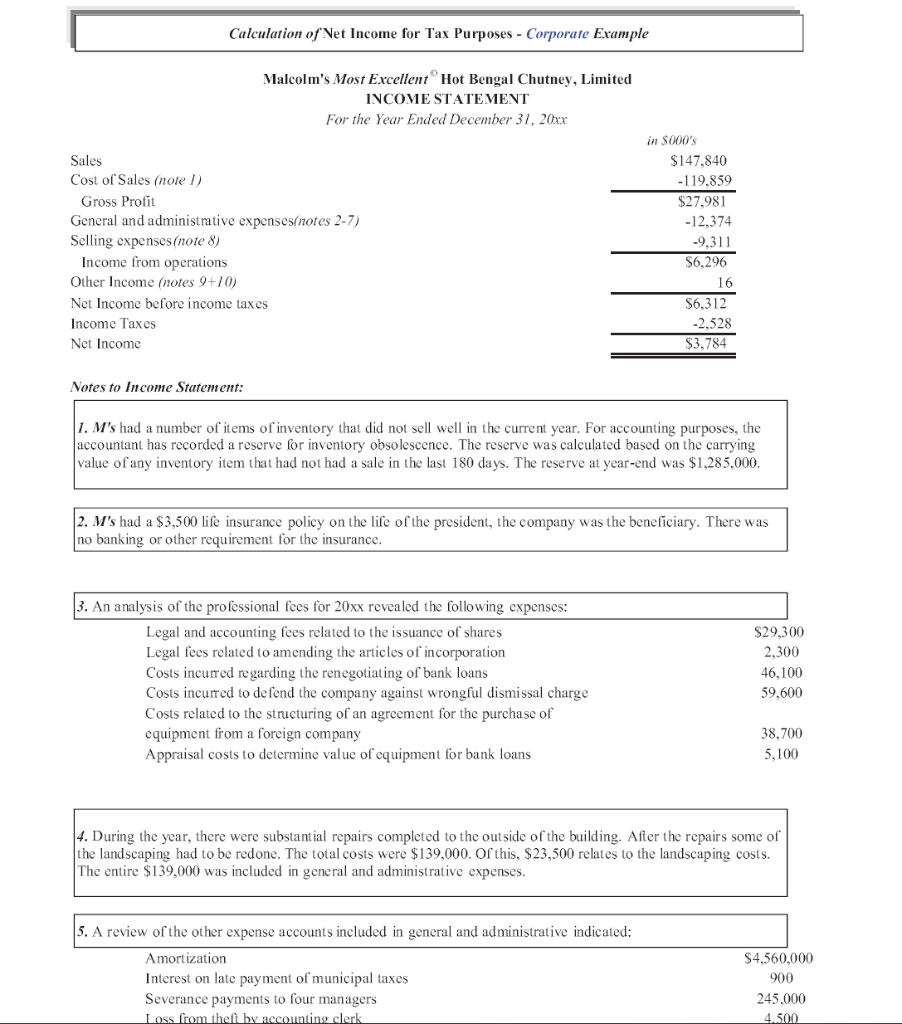

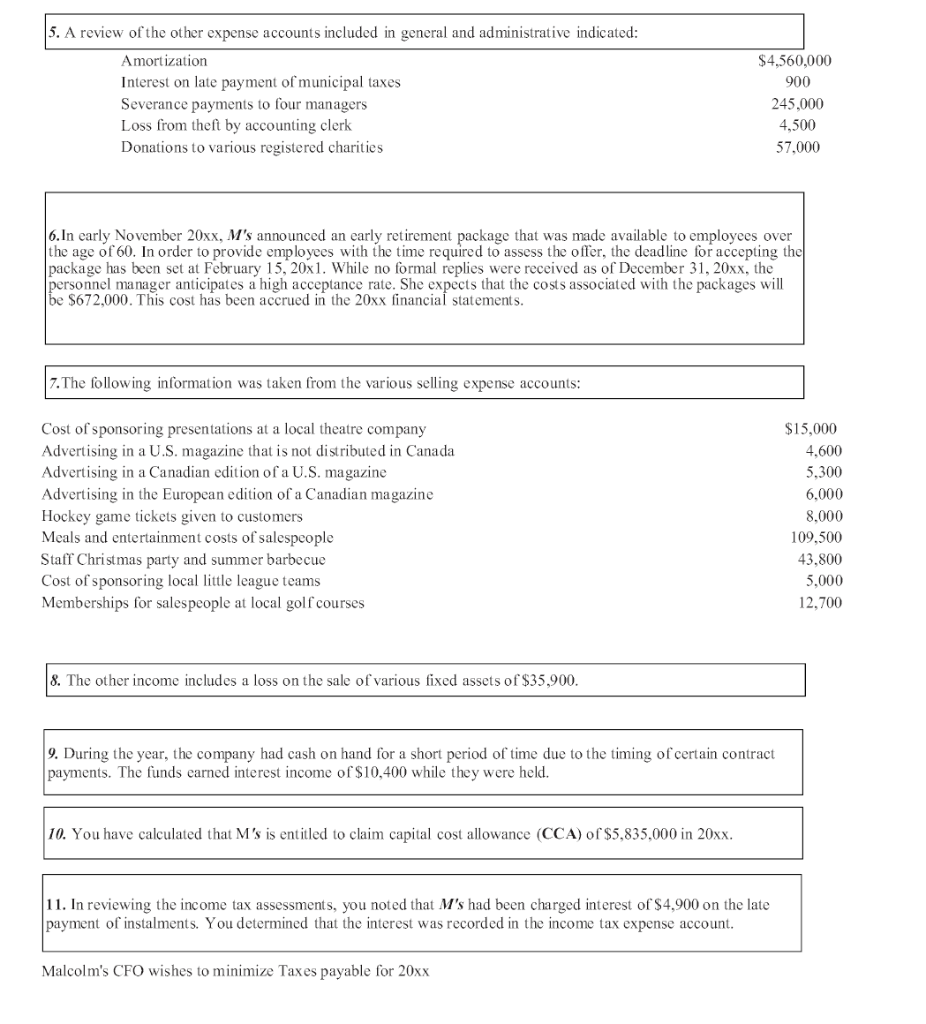

Calculation of Net Income for Tax Purposes - Corporate Example Malcolm's Most Excellent Hot Bengal Chutney, Limited INCOME STATEMENT For the Year Ended December 31, 20xx Sales Cost of Sales (note 1) Gross Profit General and administrative expensesotes 2-7) Selling expenses (note 8) Income from operations Other Income (notes 9+10) Net Income before income taxes Income Taxes Net Income in S000's $147,840 -119.859 $27.981 -12.374 -9,311 $6,296 16 $6,312 -2.528 $3,784 Notes to Income Statement: 1. M's had a number of items of inventory that did not sell well in the current year. For accounting purposes, the accountant has recorded a reserve for inventory obsolescence. The reserve was calculated based on the carrying value of any inventory item that had not had a sale in the last 180 days. reserve at year-end was $1,285,000. 2. M's had a $3,500 life insurance policy on the life of the president, the company was the beneficiary. There was no banking or other requirement for the insurance. 3. An analysis of the professional fees for 20xx revealed the following expenses: Legal and accounting fees related to the issuance of shares Legal fees related to amending the articles of incorporation Costs incurred regarding the renegotiating of bank loans Costs incurred to defend the company against wrongful dismissal charge Costs related to the structuring of an agreement for the purchase of equipment from a foreign company Appraisal costs to determine value of equipment for bank loans $29,300 2,300 46,100 59,600 38,700 5,100 4. During the year, there were substantial repairs completed to the outside of the building. After the repairs some of the landscaping had to be redone. The total costs were $139,000. Of this, $23,500 relates to the landscaping costs. The entire $139,000 was included in general and administrative expenses. 5. A review of the other expense accounts included in general and administrative indicated: Amortization Interest on late payment of municipal taxes Severance payments to four managers Loss from the il by accounting clerk $4,560,000 900 245,000 4.500 5. A review of the other expense accounts included in general and administrative indicated: Amortization Interest on late payment of municipal taxes Severance payments to four managers Loss from theft by accounting clerk Donations to various registered charities $4,560,000 900 245,000 4,500 57,000 6. In early November 20xx, M's announced an early retirement package that was made available to employees over the age of 60. In order to provide employees with the time required to assess the offer, the deadline for accepting the package has been set at February 15, 20x1. While no formal replies were received as of December 31, 20xx, the personnel manager anticipates a high acceptance rate. She expects that the costs associated with the packages will be $672,000. This cost has been accrued in the 20xx financial statements. 7. The following information was taken from the various selling expense accounts: Cost of sponsoring presentations at a local theatre company Advertising in a U.S. magazine that is not distributed in Canada Advertising in a Canadian edition of a U.S. magazine Advertising in the European edition of a Canadian magazine Hockey game tickets given to customers Meals and entertainment costs of salespeople Staff Christmas party and summer barbecue Cost of sponsoring local little league teams Memberships for salespeople at local golf courses $15,000 4.600 5,300 6,000 8,000 109.500 43.800 5,000 12.700 8. The other income includes a loss on the sale of various fixed assets of $35,900. 9. During the year, the company had cash on hand for a short period of time due to the timing of certain contract payments. The funds earned interest income of $10,400 while they were held. 10. You have calculated that M's is entitled to claim capital cost allowance (CCA) of $5,835,000 in 20xx. 11. In reviewing the income tax assessments, you noted that M's had been charged interest of $4,900 on the late payment of instalments. You determined that the interest was recorded in the income tax expense account. Malcolm's CFO wishes to minimize Taxes payable for 20xx Calculation of Net Income for Tax Purposes - Corporate Example Malcolm's Most Excellent Hot Bengal Chutney, Limited INCOME STATEMENT For the Year Ended December 31, 20xx Sales Cost of Sales (note 1) Gross Profit General and administrative expensesotes 2-7) Selling expenses (note 8) Income from operations Other Income (notes 9+10) Net Income before income taxes Income Taxes Net Income in S000's $147,840 -119.859 $27.981 -12.374 -9,311 $6,296 16 $6,312 -2.528 $3,784 Notes to Income Statement: 1. M's had a number of items of inventory that did not sell well in the current year. For accounting purposes, the accountant has recorded a reserve for inventory obsolescence. The reserve was calculated based on the carrying value of any inventory item that had not had a sale in the last 180 days. reserve at year-end was $1,285,000. 2. M's had a $3,500 life insurance policy on the life of the president, the company was the beneficiary. There was no banking or other requirement for the insurance. 3. An analysis of the professional fees for 20xx revealed the following expenses: Legal and accounting fees related to the issuance of shares Legal fees related to amending the articles of incorporation Costs incurred regarding the renegotiating of bank loans Costs incurred to defend the company against wrongful dismissal charge Costs related to the structuring of an agreement for the purchase of equipment from a foreign company Appraisal costs to determine value of equipment for bank loans $29,300 2,300 46,100 59,600 38,700 5,100 4. During the year, there were substantial repairs completed to the outside of the building. After the repairs some of the landscaping had to be redone. The total costs were $139,000. Of this, $23,500 relates to the landscaping costs. The entire $139,000 was included in general and administrative expenses. 5. A review of the other expense accounts included in general and administrative indicated: Amortization Interest on late payment of municipal taxes Severance payments to four managers Loss from the il by accounting clerk $4,560,000 900 245,000 4.500 5. A review of the other expense accounts included in general and administrative indicated: Amortization Interest on late payment of municipal taxes Severance payments to four managers Loss from theft by accounting clerk Donations to various registered charities $4,560,000 900 245,000 4,500 57,000 6. In early November 20xx, M's announced an early retirement package that was made available to employees over the age of 60. In order to provide employees with the time required to assess the offer, the deadline for accepting the package has been set at February 15, 20x1. While no formal replies were received as of December 31, 20xx, the personnel manager anticipates a high acceptance rate. She expects that the costs associated with the packages will be $672,000. This cost has been accrued in the 20xx financial statements. 7. The following information was taken from the various selling expense accounts: Cost of sponsoring presentations at a local theatre company Advertising in a U.S. magazine that is not distributed in Canada Advertising in a Canadian edition of a U.S. magazine Advertising in the European edition of a Canadian magazine Hockey game tickets given to customers Meals and entertainment costs of salespeople Staff Christmas party and summer barbecue Cost of sponsoring local little league teams Memberships for salespeople at local golf courses $15,000 4.600 5,300 6,000 8,000 109.500 43.800 5,000 12.700 8. The other income includes a loss on the sale of various fixed assets of $35,900. 9. During the year, the company had cash on hand for a short period of time due to the timing of certain contract payments. The funds earned interest income of $10,400 while they were held. 10. You have calculated that M's is entitled to claim capital cost allowance (CCA) of $5,835,000 in 20xx. 11. In reviewing the income tax assessments, you noted that M's had been charged interest of $4,900 on the late payment of instalments. You determined that the interest was recorded in the income tax expense account. Malcolm's CFO wishes to minimize Taxes payable for 20xx