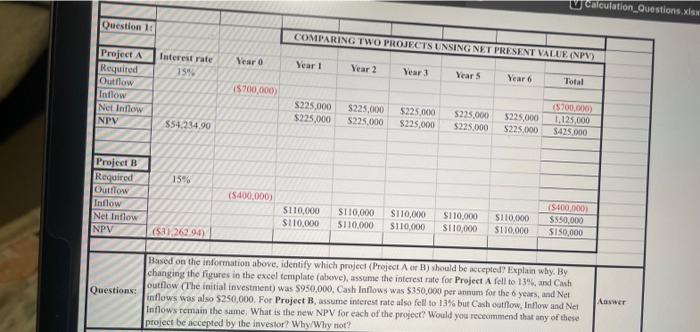

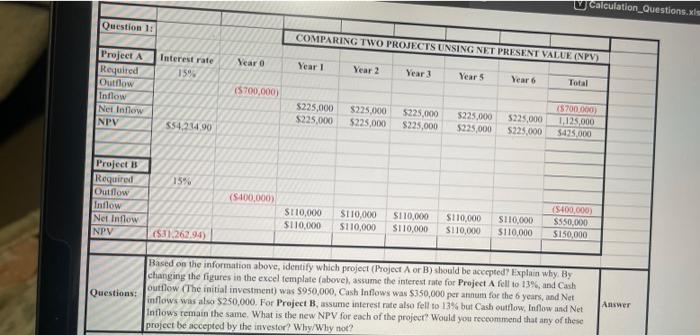

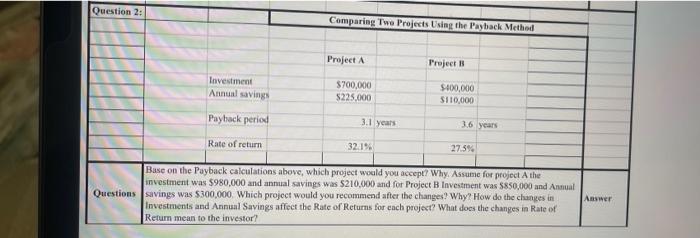

calculation_Questions.xlsx Question 1: COMPARING TWO PROJECTS UNSING NET PRESENT VALUE (NPV) Interest rate 159 Year o Year 1 Year 2 Vear 3 Year 5 Year Total Project A Required Outflow Inflow Net Inflow NPV $700,000) $225,000 $225,000 $225,000 $225,000 $225.000 $225,000 $54.234.90 $225,000 $225.000 $225,000 5225.000 (5700.000 1.125,000 $425.000 15% Project B Required Outflow Inflow Net Intlow NPV (5400,000) S110,000 S110,000 S110,000 S110.000 $110,000 S110,000 S110,000 $110,000 $110.000 S110,000 15400.000 S550.000 $150,000 (531.262.94) Questions: Based on the information above, identify which project (Project A or B) should be accepted? Explain why. By changing the figures in the excel template (above), assume the interest rate for Project A fell to 13%, and Cash outflow (The initial investment) was $950,000, Cash Inflows was $350,000 per annum for the years, and Net inflows was also $250,000 For Project Bassume interest rate also fell to 13% but Cash outflow. Inflow and Net Inflows remain the same. What is the new NPV for each of the project? Would you recommend that any of these project be accepted by the investor? Why/Why not? Anwar U Calculation_Questions.is Question 1: COMPARING TWO PROJECTS UNSING NET PRESENT VALUE (NPV) Interest rate 159 Year o Year! Year 2 Year 3 Year 5 Year 6 Total Project A Required Outflow Inflow Net Inflow NPV $700.000) $225,000 $225,000 $225.000 $225.000 $225,000 $225,000 554.244.90 $225,000 $225,000 $225.000 $225,000 $700.000) 1.125.000 5435.000 15% Project Required Outflow Inilow Net Inflow NPV ($100,000) S110,000 $110.000 ST10,000 S110,000 S110,00 S110,000 $110,000 S110,000 $110,000 S110,000 (5400.000) S550.000 $150,000 ($11.262.94) Questions: Based on the information above, identify which project (Project A or B) should be accepted? Explain why By changing the figures in the excel template (above), assume the interest rate for Project A fell to 13%, and Cash outflow (The initial investment) was $950,000, Cash Inflows was $350,000 per annum for the 6 years, and Net inflows was also $250,000, For Project Bassume interest rate also fell to 13% but Cash outflow, Inflow and Net Intlows remain the same. What is the new NPV for each of the project? Would you recommend that any of these project be accepted by the investor? Why/Why not? Answer Question 2: Comparing Two Projects Using the Payback Method Project A Project Investment Annual savings $700,000 $225,000 $100,000 $110,000 Payback period 3.1 years 16 years Rate of return 32.196 27.5% Base on the Payback calculations above, which project would you accept? Why Assume for project Athe investment was $980,000 and annual savings was $210,000 and for Project B Investment was $850,000 and Annual Questions savings was $300,000 Which project would you recommend after the changes? Why? How do the changes in Investments and Annual Savings affect the Rate of Returns for each project? What does the changes in Rate of Return mean to the investor