Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculations of component of weighted average cost of capital from above statements The profile of selected company and different types of long term funds used?

- Calculations of component of weighted average cost of capital from above statements

- The profile of selected company and different types of long term funds used?

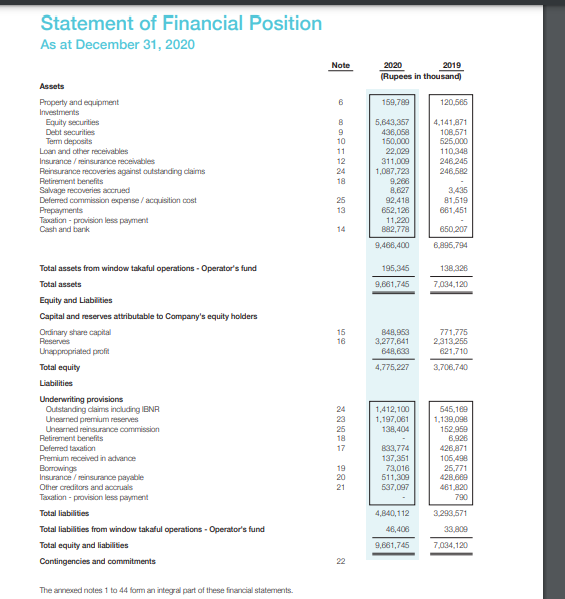

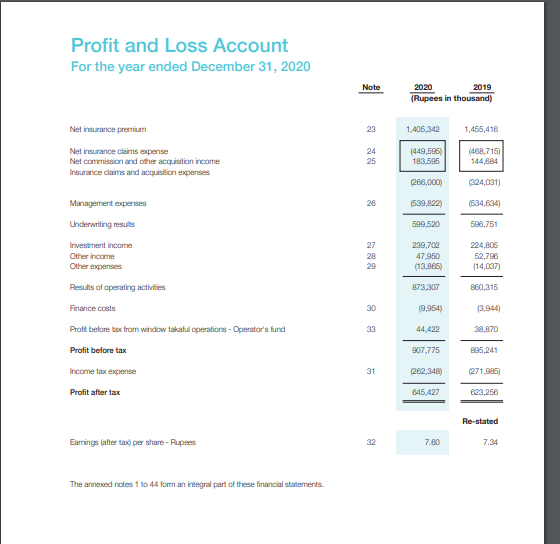

The Company Name is ''Atlas Insurance Limited'' Annual report statements

Statement of Financial Position As at December 31, 2020 Note 2020 2019 (Rupees in thousand) 159,719 120.585 4.141.871 108,571 525.000 Assets Property and equipment Investments Equity Securities Debt securities Term deposits Loan and other receivables Insurance / insurance receivables Reinsurance recoveries against outstanding claims Retirement benefits Salvage recoveries accrued Deferred commission expense / acquisition cost Prepayments Tacation provision less payment Cash and bank B 9 10 11 12 24 18 110,348 246.245 248,582 5,643,357 436,058 150.000 22.029 311,009 1,087,722 9,288 8,627 92,418 662,128 11,220 B92.77a 9,468.400 25 13 3,435 81.519 661,451 14 650.207 8.996.794 195,345 138.328 7,034,120 9,661,745 15 16 B48,950 3,277,841 B48,633 771.775 2,313.255 821,710 3,706,740 4,775,227 Total assets from window takaful operations - Operator's fund Total assets Equity and Liabilities Capital and reserves attributable to Company's equity holders Ordinary share capital Reserves Unappropriated profit Total equity Liabilities Underwriting provisions Outstanding claims including BNR Unearned premium reserves Unearned reinsurance commission Retirement benefits Deferred tascation Premium received in advance Borrowings Insurance/reinsurance payable Other creditors and accruals Tacation provision less payment Total liabilities Total liabilities from window takaful operations - Operator's fund Total equity and liabilities Contingencies and commitments 24 22 1,412,100 1,197,061 138,404 19 17 545,169 1.139,098 152.959 6.926 426.871 106,498 25,771 428.689 481.820 790 833,774 137,351 73,016 511,309 537,097 19 20 21 4,840,112 48,406 9,881,745 3.293,571 33.800 7,034,120 22 The need notes 1 to 44 for an integral part of these financial statements. Profit and Loss Account For the year ended December 31, 2020 Note 2020 2019 (Rupees in thousand) Net insurance premium 23 1,406,342 1,455,416 Net insurance claims expense Net commission and other acquisition income Insurance claims and acquisition expenses 24 25 (449,596) 183.595 (468,715 144,684 (286,000) (324,031) 26 1539,822 1534,634) 599.520 586,751 27 28 29 239,702 47 950 (13,865) 224,806 52,796 (14,037) Management expenses Underwriting results Investment income Other income Other expenses Results of operating activities Finance costs Praft before tax fram window takaful operations - Operator's fund Profit before tax 873.307 B80,315 30 19,964) (3.944 33 44.422 39,870 907,775 895,241 Income tax expense 31 (262,346) (271.995 Profit after tax 845,427 623,256 Re-stated Earrings (after tax) per share - Rupees 32 7.60 7.34 The annexed notes 1 to 44 for an integral part of these financial statements Statement of Financial Position As at December 31, 2020 Note 2020 2019 (Rupees in thousand) 159,719 120.585 4.141.871 108,571 525.000 Assets Property and equipment Investments Equity Securities Debt securities Term deposits Loan and other receivables Insurance / insurance receivables Reinsurance recoveries against outstanding claims Retirement benefits Salvage recoveries accrued Deferred commission expense / acquisition cost Prepayments Tacation provision less payment Cash and bank B 9 10 11 12 24 18 110,348 246.245 248,582 5,643,357 436,058 150.000 22.029 311,009 1,087,722 9,288 8,627 92,418 662,128 11,220 B92.77a 9,468.400 25 13 3,435 81.519 661,451 14 650.207 8.996.794 195,345 138.328 7,034,120 9,661,745 15 16 B48,950 3,277,841 B48,633 771.775 2,313.255 821,710 3,706,740 4,775,227 Total assets from window takaful operations - Operator's fund Total assets Equity and Liabilities Capital and reserves attributable to Company's equity holders Ordinary share capital Reserves Unappropriated profit Total equity Liabilities Underwriting provisions Outstanding claims including BNR Unearned premium reserves Unearned reinsurance commission Retirement benefits Deferred tascation Premium received in advance Borrowings Insurance/reinsurance payable Other creditors and accruals Tacation provision less payment Total liabilities Total liabilities from window takaful operations - Operator's fund Total equity and liabilities Contingencies and commitments 24 22 1,412,100 1,197,061 138,404 19 17 545,169 1.139,098 152.959 6.926 426.871 106,498 25,771 428.689 481.820 790 833,774 137,351 73,016 511,309 537,097 19 20 21 4,840,112 48,406 9,881,745 3.293,571 33.800 7,034,120 22 The need notes 1 to 44 for an integral part of these financial statements. Profit and Loss Account For the year ended December 31, 2020 Note 2020 2019 (Rupees in thousand) Net insurance premium 23 1,406,342 1,455,416 Net insurance claims expense Net commission and other acquisition income Insurance claims and acquisition expenses 24 25 (449,596) 183.595 (468,715 144,684 (286,000) (324,031) 26 1539,822 1534,634) 599.520 586,751 27 28 29 239,702 47 950 (13,865) 224,806 52,796 (14,037) Management expenses Underwriting results Investment income Other income Other expenses Results of operating activities Finance costs Praft before tax fram window takaful operations - Operator's fund Profit before tax 873.307 B80,315 30 19,964) (3.944 33 44.422 39,870 907,775 895,241 Income tax expense 31 (262,346) (271.995 Profit after tax 845,427 623,256 Re-stated Earrings (after tax) per share - Rupees 32 7.60 7.34 The annexed notes 1 to 44 for an integral part of these financial statementsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started