Calculations please

Calculations please

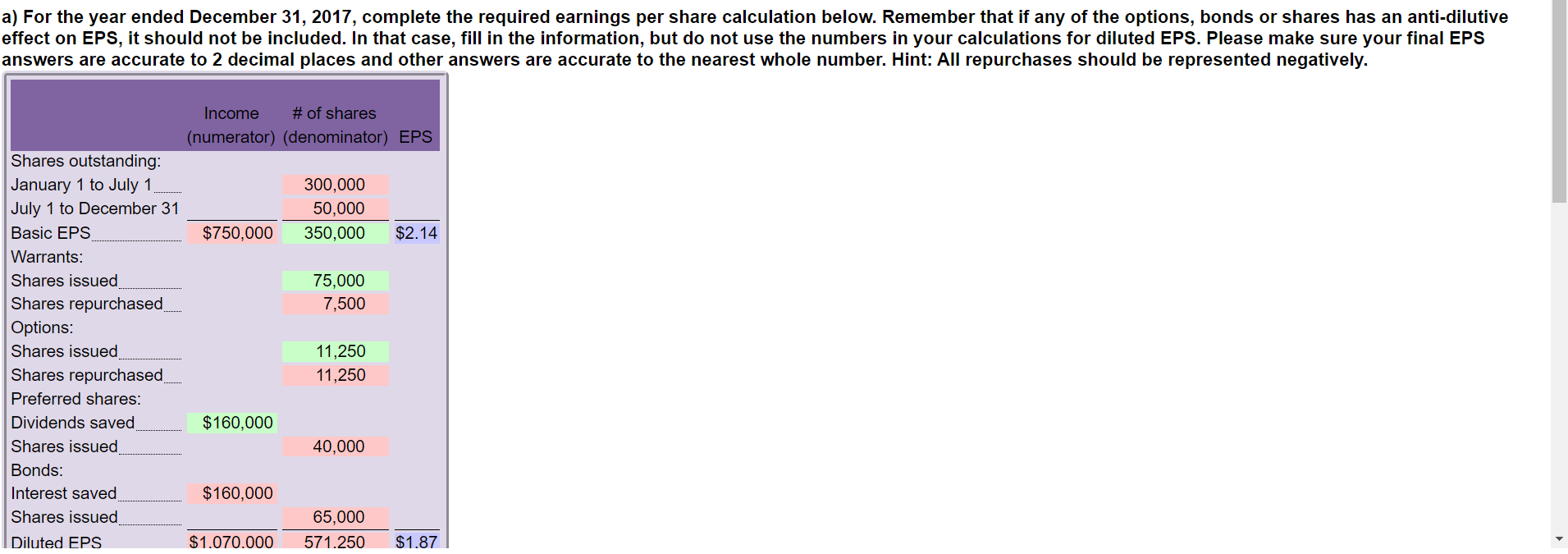

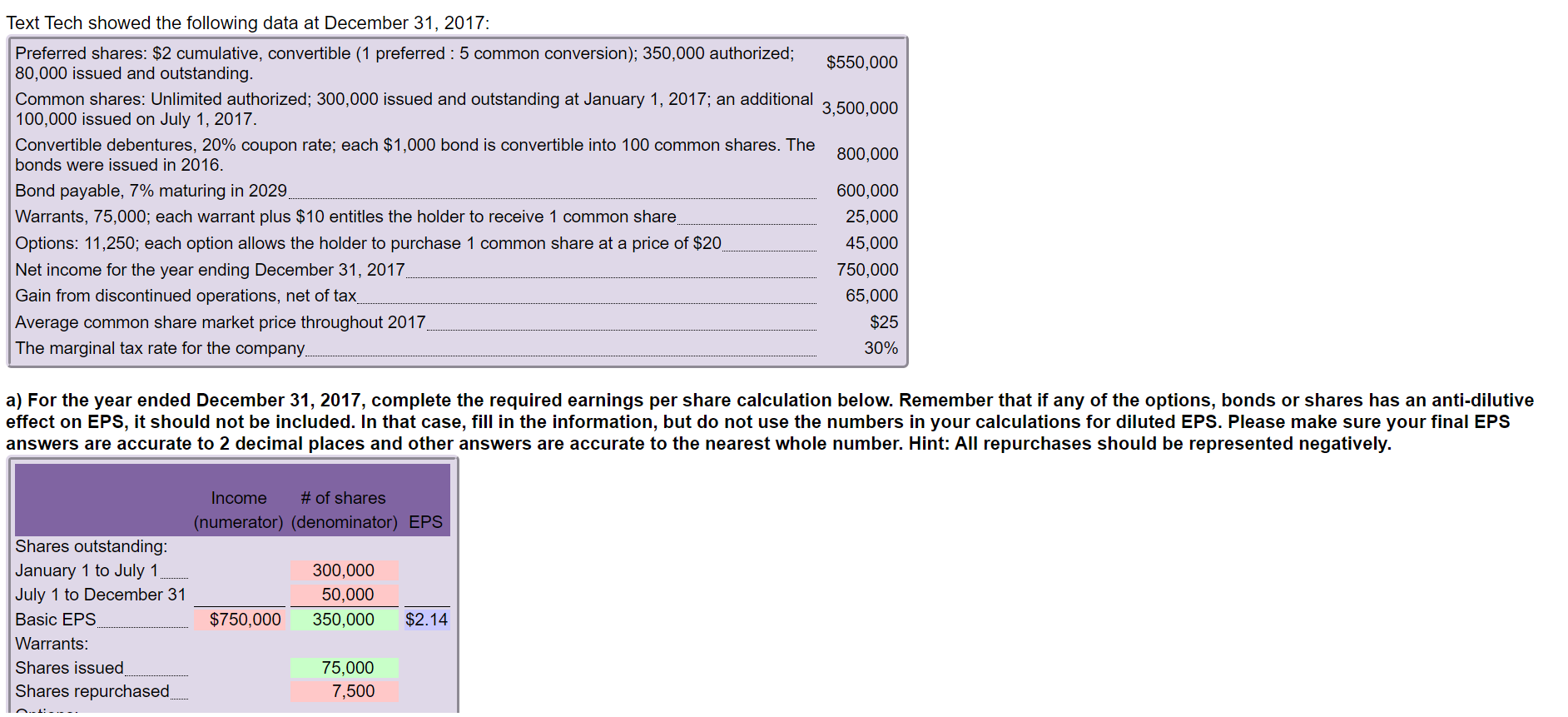

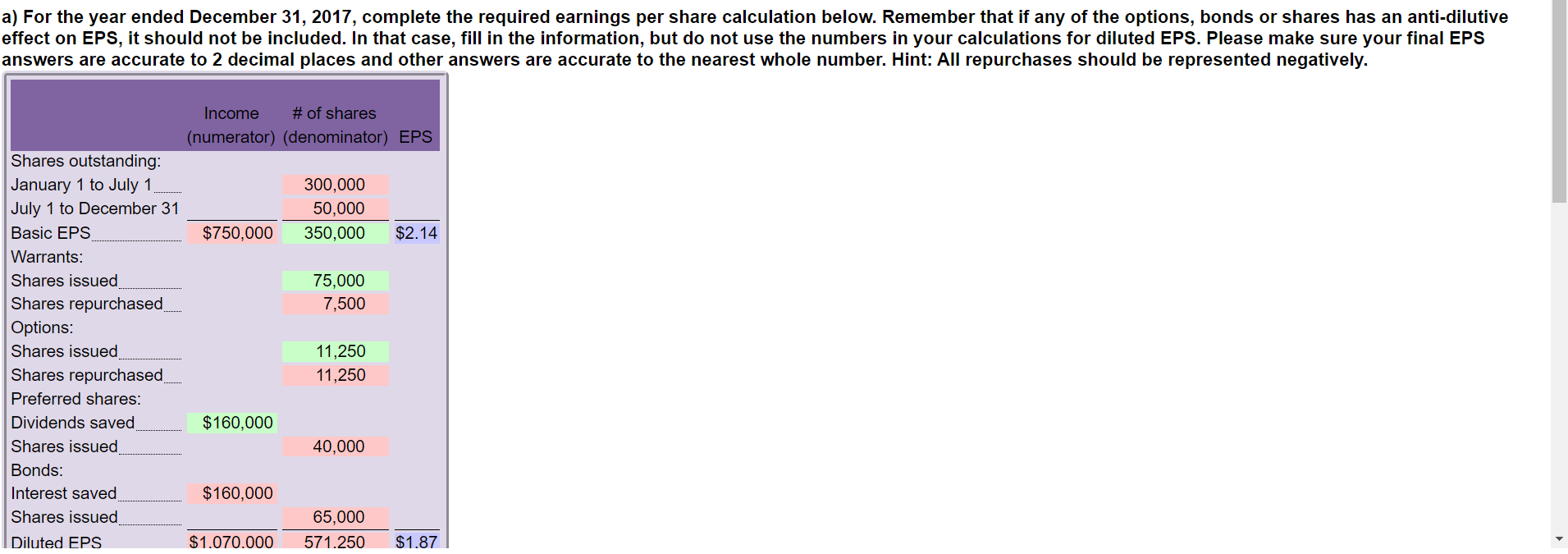

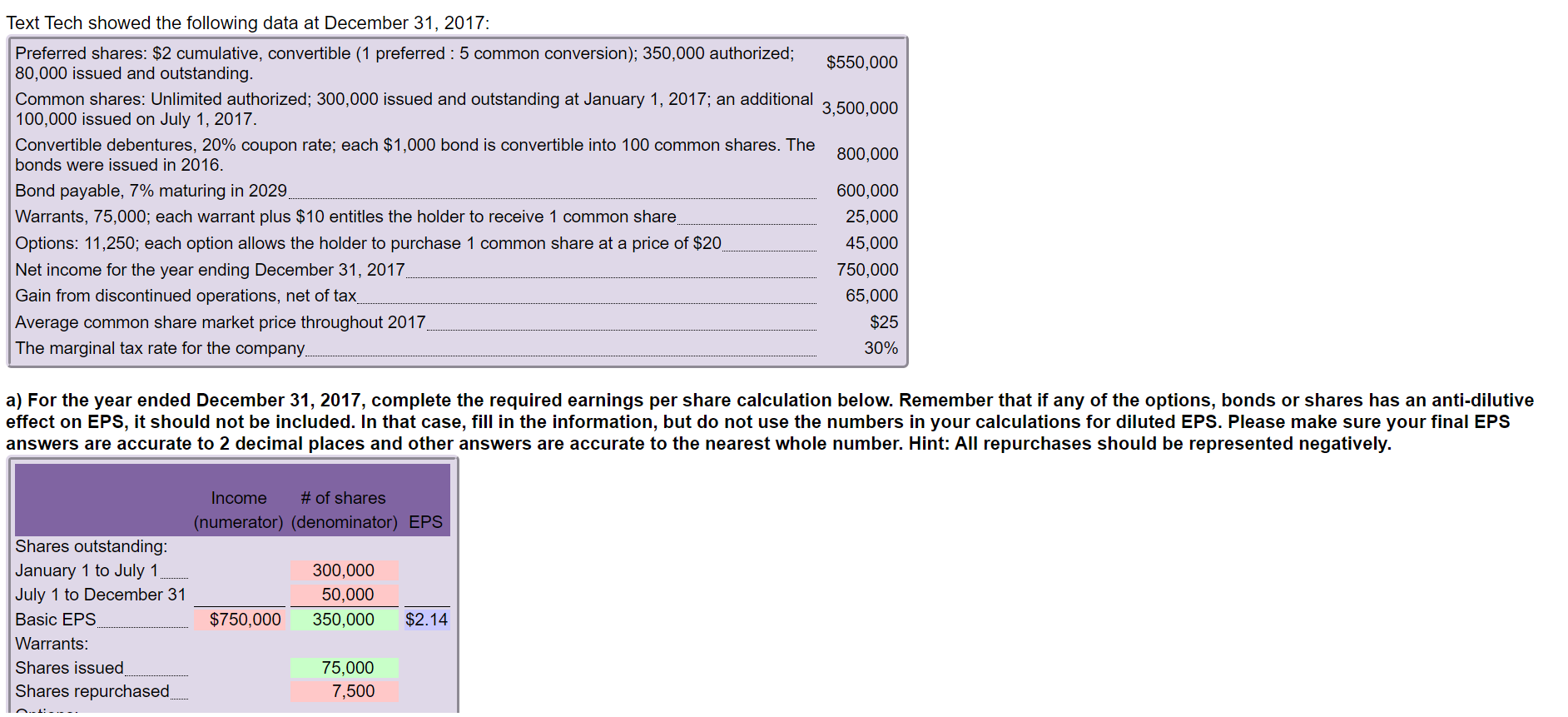

a) For the year ended December 31, 2017, complete the required earnings per share calculation below. Remember that if any of the options, bonds or shares has an anti-dilutive effect on EPS, it should not be included. In that case, fill in the information, but do not use the numbers in your calculations for diluted EPS. Please make sure your final EPS answers are accurate to 2 decimal places and other answers are accurate to the nearest whole number. Hint: All repurchases should be represented negatively. Income # of shares (numerator) (denominator) EPS 300,000 50,000 350,000 $750,000 $2.14 75,000 7,500 Shares outstanding: January 1 to July 1, July 1 to December 31 Basic EPS Warrants: Shares issued Shares repurchased Options: Shares issued Shares repurchased. Preferred shares: Dividends saved Shares issued Bonds: Interest saved Shares issued Diluted EPS 11,250 11,250 $160,000 40,000 $160,000 65,000 571.250 $1.070.000 $1.87 Text Tech showed the following data at December 31, 2017: Preferred shares: $2 cumulative, convertible (1 preferred : 5 common conversion); 350,000 authorized; $550,000 80,000 issued and outstanding. Common shares: Unlimited authorized; 300,000 issued and outstanding at January 1, 2017; an additional 3,500,000 100,000 issued on July 1, 2017. Convertible debentures, 20% coupon rate; each $1,000 bond is convertible into 100 common shares. The 800,000 bonds were issued in 2016. Bond payable, 7% maturing in 2029 600,000 Warrants, 75,000; each warrant plus $10 entitles the holder to receive 1 common share 25,000 Options: 11,250; each option allows the holder to purchase 1 common share at a price of $20. 45,000 Net income for the year ending December 31, 2017 750,000 Gain from discontinued operations, net of tax 65,000 Average common share market price throughout 2017 $25 The marginal tax rate for the company 30% a) For the year ended December 31, 2017, complete the required earnings per share calculation below. Remember that if any of the options, bonds or shares has an anti-dilutive effect on EPS, it should not be included. In that case, fill in the information, but do not use the numbers in your calculations for diluted EPS. Please make sure your final EPS answers are accurate to 2 decimal places and other answers are accurate to the nearest whole number. Hint: All repurchases should be represented negatively. Income # of shares (numerator) (denominator) EPS Shares outstanding: January 1 to July 1 July 1 to December 31 Basic EPS Warrants: Shares issued Shares repurchased 300,000 50,000 350,000 $750,000 $2.14 75,000 7,500 ..1! - a) For the year ended December 31, 2017, complete the required earnings per share calculation below. Remember that if any of the options, bonds or shares has an anti-dilutive effect on EPS, it should not be included. In that case, fill in the information, but do not use the numbers in your calculations for diluted EPS. Please make sure your final EPS answers are accurate to 2 decimal places and other answers are accurate to the nearest whole number. Hint: All repurchases should be represented negatively. Income # of shares (numerator) (denominator) EPS 300,000 50,000 350,000 $750,000 $2.14 75,000 7,500 Shares outstanding: January 1 to July 1, July 1 to December 31 Basic EPS Warrants: Shares issued Shares repurchased Options: Shares issued Shares repurchased. Preferred shares: Dividends saved Shares issued Bonds: Interest saved Shares issued Diluted EPS 11,250 11,250 $160,000 40,000 $160,000 65,000 571.250 $1.070.000 $1.87 Text Tech showed the following data at December 31, 2017: Preferred shares: $2 cumulative, convertible (1 preferred : 5 common conversion); 350,000 authorized; $550,000 80,000 issued and outstanding. Common shares: Unlimited authorized; 300,000 issued and outstanding at January 1, 2017; an additional 3,500,000 100,000 issued on July 1, 2017. Convertible debentures, 20% coupon rate; each $1,000 bond is convertible into 100 common shares. The 800,000 bonds were issued in 2016. Bond payable, 7% maturing in 2029 600,000 Warrants, 75,000; each warrant plus $10 entitles the holder to receive 1 common share 25,000 Options: 11,250; each option allows the holder to purchase 1 common share at a price of $20. 45,000 Net income for the year ending December 31, 2017 750,000 Gain from discontinued operations, net of tax 65,000 Average common share market price throughout 2017 $25 The marginal tax rate for the company 30% a) For the year ended December 31, 2017, complete the required earnings per share calculation below. Remember that if any of the options, bonds or shares has an anti-dilutive effect on EPS, it should not be included. In that case, fill in the information, but do not use the numbers in your calculations for diluted EPS. Please make sure your final EPS answers are accurate to 2 decimal places and other answers are accurate to the nearest whole number. Hint: All repurchases should be represented negatively. Income # of shares (numerator) (denominator) EPS Shares outstanding: January 1 to July 1 July 1 to December 31 Basic EPS Warrants: Shares issued Shares repurchased 300,000 50,000 350,000 $750,000 $2.14 75,000 7,500 ..1

Calculations please

Calculations please