Answered step by step

Verified Expert Solution

Question

1 Approved Answer

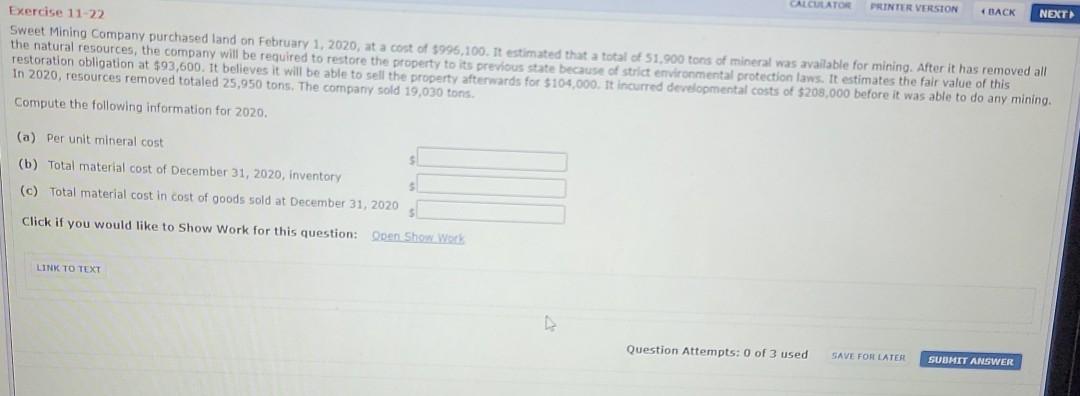

CALCULATO PRINTER VERSION BACK NEXT Exercise 11-22 Sweet Mining Company purchased land on February 1, 2020, at a cost of $996,100. It estimated that a

CALCULATO PRINTER VERSION BACK NEXT Exercise 11-22 Sweet Mining Company purchased land on February 1, 2020, at a cost of $996,100. It estimated that a total of 51.900 tons of mineral was available for mining. After it has removed all the natural resources, the company will be required to restore the property to its previous state because of strict environmental protection laws. It estimates the fair value of this restoration obligation at $93,600. It believes it will be able to sell the property afterwards for $104,000. It incurred developmental costs of $200,000 before it was able to do any mining, In 2020, resources removed totaled 25,950 tons. The company sold 19,030 tons, Compute the following information for 2020, (a) Per unit mineral cost $ (b) Total material cost of December 31, 2020, inventory (c) Total material cost in cost of goods sold at December 31, 2020 SE Click if you would like to Show Work for this question: Open Show Work LINK TO TEXT Question Attempts: 0 of 3 used

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started