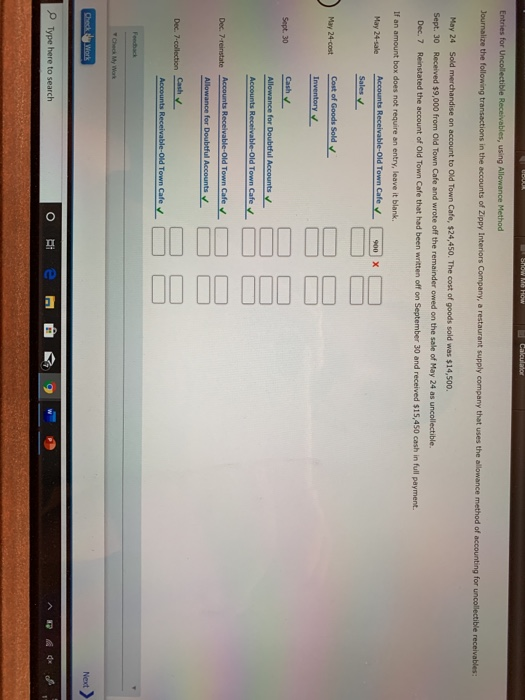

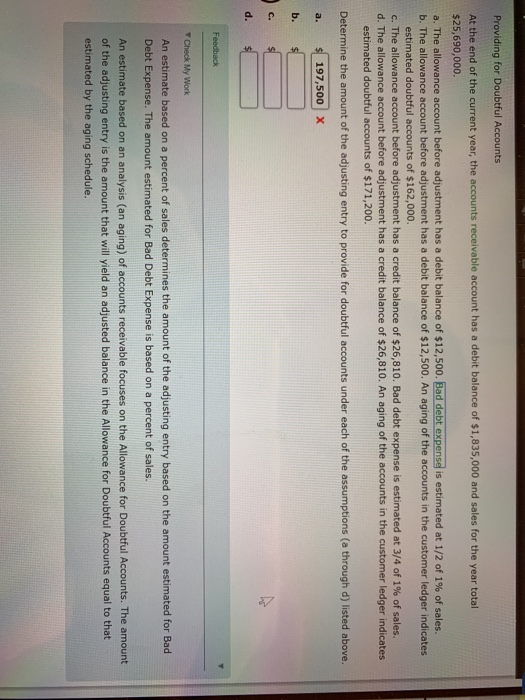

Calculator Entries for Uncollectible Receivables, using Allowance Method Journalize the following transactions in the accounts of Zippy Interiors Company, a restaurant supply company that uses the allowance method of accounting for uncollectible receivables: May 24 Sold merchandise on account to Old Town Cafe, $24,450. The cost of goods sold was $14,500. Sept. 30 Received $9,000 from Old Town Cafe and wrote off the remainder owed on the sale of May 24 as uncollectible. Dec. 7 Reinstated the account of Old Town Cafe that had been written off on September 30 and received $15,450 cash in full payment. If an amount box does not require an entry, leave it blank. May 24-sale Accounts Receivable-Old Town Cafe Sales 900 X ) May 24-cost Cost of Goods Sold Inventory Sept. 30 Cash Allowance for Doubtful Accounts Accounts Receivable-Old Town Cafe Dec. 7-reinstate Accounts Receivable-Old Town Cafe Il Allowance for Doubtful Accounts Dec. 7-collection Cash Accounts Receivable-Old Town Cafe Check y Work Next > Type here to search te m , 9W Providing for Doubtful Accounts At the end of the current year, the accounts receivable account has a debit balance of $1,835,000 and sales for the year total $25,690,000 a. The allowance account before adjustment has a debit balance of $12,500. Bad debt expense is estimated at 1/2 of 1% of sales. b. The allowance account before adjustment has a debit balance of $12,500. An aging of the accounts in the customer ledger indicates estimated doubtful accounts of $162,000. c. The allowance account before adjustment has a credit balance of $26,810. Bad debt expense is estimated at 3/4 of 1% of sales. d. The allowance account before adjustment has a credit balance of $26,810. An aging of the accounts in the customer ledger indicates estimated doubtful accounts of $171,200. Determine the amount of the adjusting entry to provide for doubtful accounts under each of the assumptions (a through d) listed above. a. $ 197,500 X Feedback Check My Work An estimate based on a percent of sales determines the amount of the adjusting entry based on the amount estimated for Bad Debt Expense. The amount estimated for Bad Debt Expense is based on a percent of sales. An estimate based on an analysis (an aging) of accounts receivable focuses on the Allowance for Doubtful Accounts. The amount of the adjusting entry is the amount that will yield an adjusted balance in the Allowance for Doubtful Accounts equal to that estimated by the aging schedule