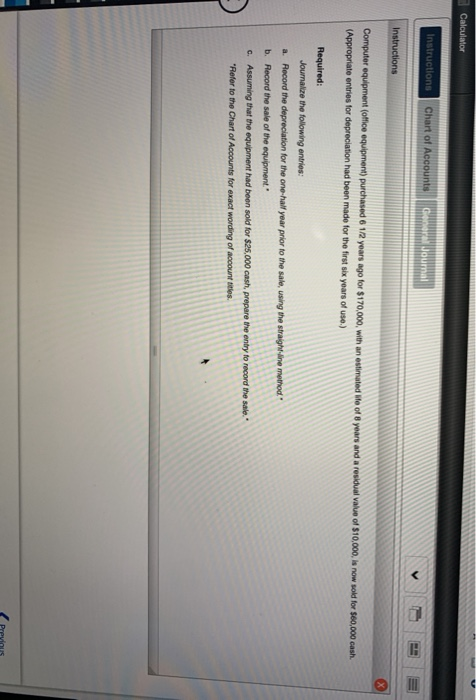

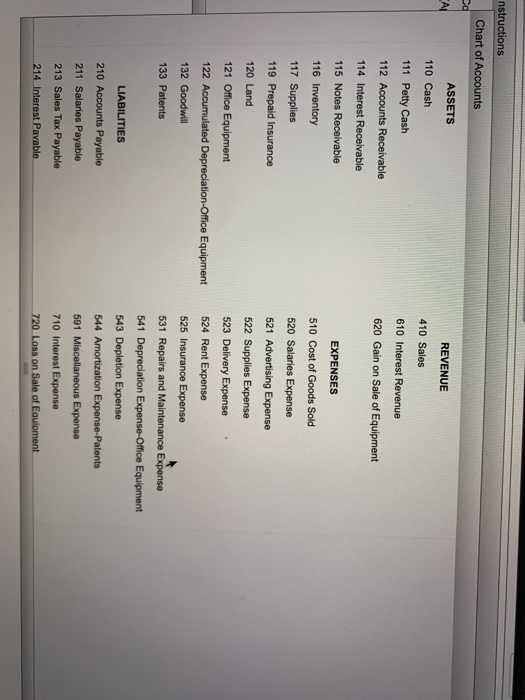

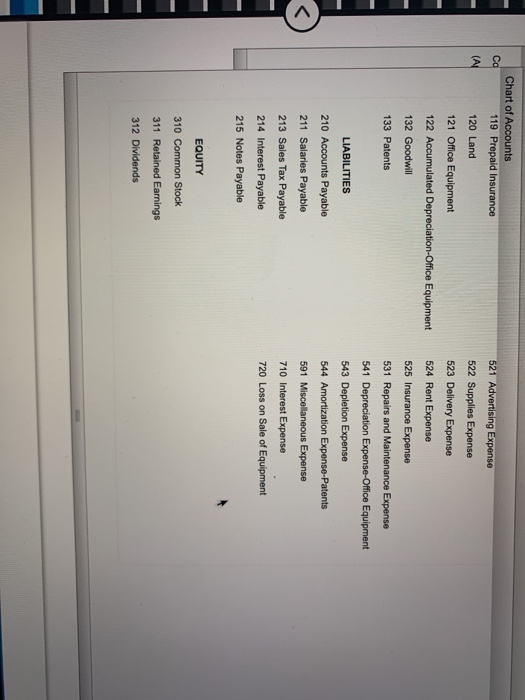

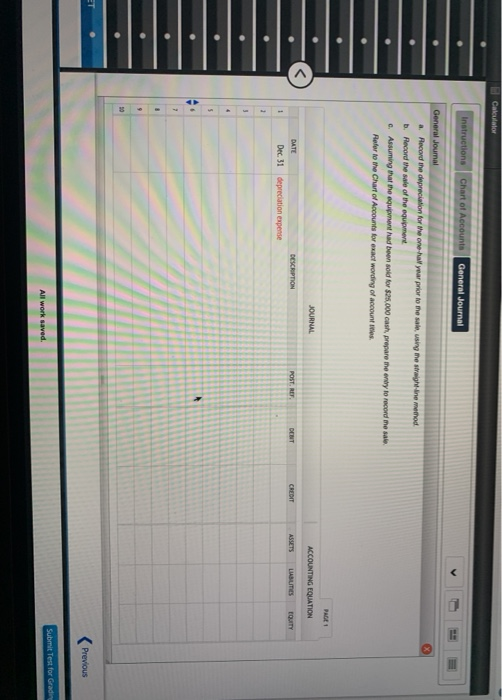

Calculator Instructions Chart of Accounts General Journal Instructions Computer equipment (office equipment) purchased 6 12 years ago for $170,000, with an estimated te of 8 years and a residual value of $10,000, is now sold for $60,000 cash. (Appropriate entries for depreciation had been made for the first six years of use.) Required: Journalize the following entries: a. Record the depreciation for the one-half year prior to the sale, using the straight line method b. Record the sale of the equipment c. Assuming that the equipment had been sold for $25,000 cash, prepare the entry to record the sale. "Refer to the Chart of Accounts for exact wording of account titles nstructions Chart of Accounts Od ASSETS REVENUE 110 Cash 410 Sales 111 Petty Cash 610 Interest Revenue 112 Accounts Receivable 620 Gain on Sale of Equipment 114 Interest Receivable 115 Notes Receivable 116 Inventory 117 Supplies 119 Prepaid Insurance 120 Land 121 Office Equipment 122 Accumulated Depreciation Office Equipment 132 Goodwill EXPENSES 510 Cost of Goods Sold 520 Salaries Expense 521 Advertising Expense 522 Supplies Expense 523 Delivery Expense 524 Rent Expense 525 Insurance Expense 531 Repairs and Maintenance Expense 541 Depreciation Expense-Office Equipment 543 Depletion Expense 544 Amortization Expense-Patents 591 Miscellaneous Expense 710 Interest Expense 720 Loss on Sale of Equipment 133 Patents LIABILITIES 210 Accounts Payable 211 Salaries Payable 213 Sales Tax Payable 214 Interest Pavable ca Chart of Accounts 119 Prepaid Insurance (AI 120 Land 121 Office Equipment 122 Accumulated Depreciation Office Equipment 521 Advertising Expense 522 Supplies Expense 523 Delivery Expense 524 Rent Expense 525 Insurance Expense 132 Goodwill 133 Patents LIABILITIES 531 Repairs and Maintenance Expense 541 Depreciation Expense-Office Equipment 543 Depletion Expense 544 Amortization Expense-Patents 591 Miscellaneous Expenso 710 Interest Expense 210 Accounts Payable 211 Salaries Payable 213 Sales Tax Payable 214 Interest Payable 215 Notes Payable 720 Loss on Sale of Equipment EQUITY 310 Common Stock 311 Retained Earnings 312 Dividends Calculator Instructions Chart of Accounts General Journal General Journal a. Record the depreciation for the one-hal year prior to the sale using the sight-line method b. Record the sale of the equipment c. Assuming that the equipment had been sold for $25.000 cash, prepare the entry to record the sale Refer to the Chart of Accounts for exact wording of account titles PAGE 1 JOURNAL ACCOUNTING EQUATION DESCRIPTION POST, RET DENT CREDIT LIABUTIES EQUITY DATE Dec 31 depreciation expense 1 1 ET Previous Submit Test for Gradine All work saved