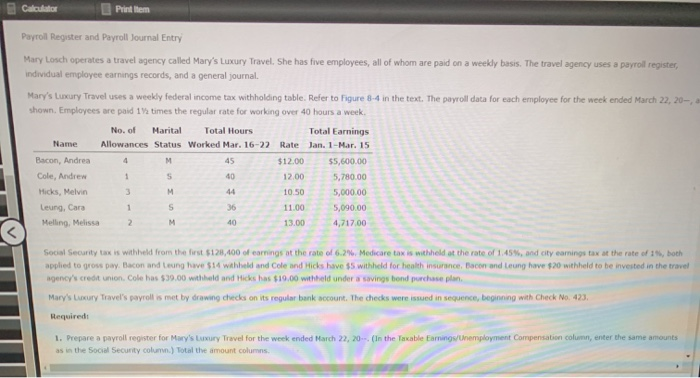

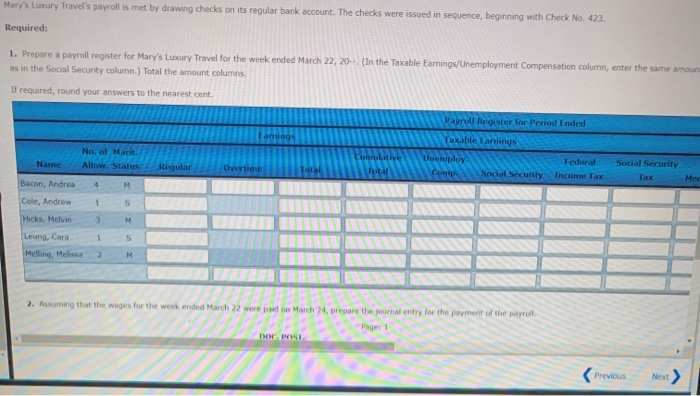

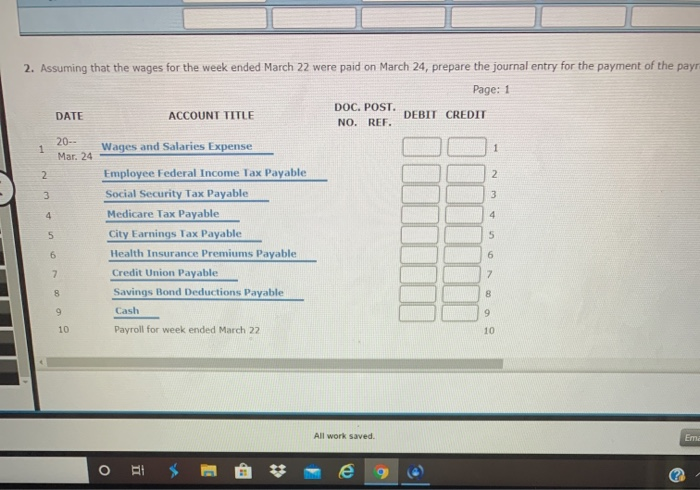

Calculator Print Item Payroll Register and Payroll Journal Entry Mary Losch operates a travel agency called Mary's Luxury Travel. She has five employees, all of whom are paid on a weekly basis. The travel agency uses a payroll register, individual employee earnings records, and a general journal. Mary's Luxury Travel uses a weekly federal income tax withholding table. Refer to figure 8-4 in the text. The payroll data for each employee for the week ended March 22, 20-,-- shown. Employees are paid 19 times the regular rate for working over 40 hours a week. No. of Marital Total Hours Total Earnings Name Allowances Status Worked Mar. 16-22 Rate Jan. 1-Mar. 15 Bacon, Andrea 4 M $12.00 $5,600.00 Cole, Andrew S 40 12.00 5,780.00 Hicks, Melvin 10.50 5,000.00 Leung, Cara 36 5,090.00 Melling, Melissa 13.00 4,717.00 45 1 M 44 1 S 11.00 2 M 40 Social Security tax is withheld from the first 5128,400 of earnings at the rate of 6.2%. Medicare tax is withheld at the rate of 1.45%, and city earnings tax at the rate of 14, both applied to gross pay. Bacon and Leong have $14 withheld and Cole and Hicks have $5 withheld for health insurance, Bacon and Leung have $20 withheld to be invested in the travel agency's credit union. Cole has $39.00 withheld and Hicks has $19.00 withheld under a savings bond purchase plan Mary's Luxury Travel's payroll is met by drawing checks on its regular bank account. The checks were issued in sequence, beginning with Check No. 423, Requiredi 1. Prepare a payroll register for Mary's Luxury Travel for the week ended March 22, 20. (In the Taxable Earnings/Unemployment Compensation column, enter the same amounts as in the Social Security column.) Total the amount columns Mary's Luxury Travel's payroll is met by drawing checks on its regular bank account. The checks were issued in sequence, beginning with Check No. 423. Required: 1. Prepare a payroll register for Mary's Luxury Travel for the week ended March 22, 20. (In the Taxable Earnings/Unemployment Compensation column, enter the same amoun as in the Social Security column.) Total the amount columns If required, round your answers to the nearest cent. Payroll Register for Period Ended Eachung No. of Marit. Allow. Status Taxable Larrings Unenploy Sodal Security Name Regular Overtime Total Federal Income Tax Social Security Tax Mer 4 M Bacon, Andrea Cole, Andrew S 1 3 Hicks, Melvin M Leung, Cara Melling, Melissa 2 M 2. Assuming that the wages for the week ended March 22 were pad on March 24, prepare the journal entry for the payment of the payroll Paget POST Previous Next 1 1 2. Assuming that the wages for the week ended March 22 were paid on March 24, prepare the journal entry for the payment of the payr Page: 1 DOC. POST. DATE ACCOUNT TITLE DEBIT CREDIT NO. REF. 20- Wages and Salaries Expense Mar. 24 2 Employee Federal Income Tax Payable 2 3 Social Security Tax Payable 3 4 Medicare Tax Payable 4 5 City Earnings Tax Payable Health Insurance Premiums Payable 6 7 Credit Union Payable 7 Savings Bond Deductions Payable 8 Cash 10 Payroll for week ended March 22 10 5 6 8 9 9 All work saved Ema O E e Calculator Print Item Payroll Register and Payroll Journal Entry Mary Losch operates a travel agency called Mary's Luxury Travel. She has five employees, all of whom are paid on a weekly basis. The travel agency uses a payroll register, individual employee earnings records, and a general journal. Mary's Luxury Travel uses a weekly federal income tax withholding table. Refer to figure 8-4 in the text. The payroll data for each employee for the week ended March 22, 20-,-- shown. Employees are paid 19 times the regular rate for working over 40 hours a week. No. of Marital Total Hours Total Earnings Name Allowances Status Worked Mar. 16-22 Rate Jan. 1-Mar. 15 Bacon, Andrea 4 M $12.00 $5,600.00 Cole, Andrew S 40 12.00 5,780.00 Hicks, Melvin 10.50 5,000.00 Leung, Cara 36 5,090.00 Melling, Melissa 13.00 4,717.00 45 1 M 44 1 S 11.00 2 M 40 Social Security tax is withheld from the first 5128,400 of earnings at the rate of 6.2%. Medicare tax is withheld at the rate of 1.45%, and city earnings tax at the rate of 14, both applied to gross pay. Bacon and Leong have $14 withheld and Cole and Hicks have $5 withheld for health insurance, Bacon and Leung have $20 withheld to be invested in the travel agency's credit union. Cole has $39.00 withheld and Hicks has $19.00 withheld under a savings bond purchase plan Mary's Luxury Travel's payroll is met by drawing checks on its regular bank account. The checks were issued in sequence, beginning with Check No. 423, Requiredi 1. Prepare a payroll register for Mary's Luxury Travel for the week ended March 22, 20. (In the Taxable Earnings/Unemployment Compensation column, enter the same amounts as in the Social Security column.) Total the amount columns Mary's Luxury Travel's payroll is met by drawing checks on its regular bank account. The checks were issued in sequence, beginning with Check No. 423. Required: 1. Prepare a payroll register for Mary's Luxury Travel for the week ended March 22, 20. (In the Taxable Earnings/Unemployment Compensation column, enter the same amoun as in the Social Security column.) Total the amount columns If required, round your answers to the nearest cent. Payroll Register for Period Ended Eachung No. of Marit. Allow. Status Taxable Larrings Unenploy Sodal Security Name Regular Overtime Total Federal Income Tax Social Security Tax Mer 4 M Bacon, Andrea Cole, Andrew S 1 3 Hicks, Melvin M Leung, Cara Melling, Melissa 2 M 2. Assuming that the wages for the week ended March 22 were pad on March 24, prepare the journal entry for the payment of the payroll Paget POST Previous Next 1 1 2. Assuming that the wages for the week ended March 22 were paid on March 24, prepare the journal entry for the payment of the payr Page: 1 DOC. POST. DATE ACCOUNT TITLE DEBIT CREDIT NO. REF. 20- Wages and Salaries Expense Mar. 24 2 Employee Federal Income Tax Payable 2 3 Social Security Tax Payable 3 4 Medicare Tax Payable 4 5 City Earnings Tax Payable Health Insurance Premiums Payable 6 7 Credit Union Payable 7 Savings Bond Deductions Payable 8 Cash 10 Payroll for week ended March 22 10 5 6 8 9 9 All work saved Ema O E e