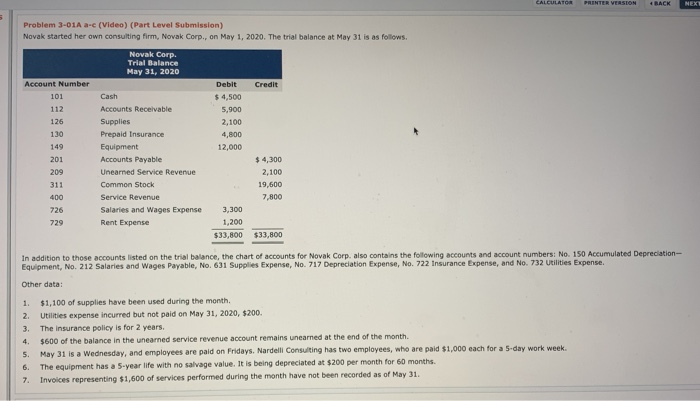

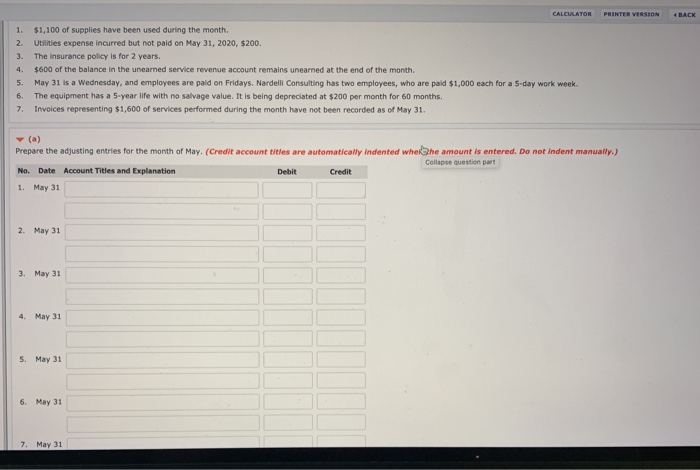

CALCULATOR PRINTER VERSION BACK NEXT Problem 3-01A a-c (Video) (Part Level Submission) Novak started her own consulting firm, Novak Corp., on May 1, 2020. The trial balance at May 31 is as follows. Novak Corp. Trial Balance May 31, 2020 Account Number Debit Credit 101 Cash $ 4,500 112 Accounts Receivable 5,900 126 Supplies 2,100 130 Prepaid Insurance 4,800 149 Equipment 12,000 201 Accounts Payable $ 4,300 209 Uneared Service Revenue 2,100 311 Common Stock 19,600 400 Service Revenue 7,800 726 Salaries and Wages Expense 3,300 729 Rent Expense 1,200 $33,800 $33,800 In addition to those accounts listed on the trial balance, the chart of accounts for Novak Corp. also contains the following accounts and account numbers: No. 150 Accumulated Depreciation- Equipment, No. 212 Salaries and Wages Payable, No. 631 Supplies Expense, No. 717 Depreciation Expense, No. 722 Insurance Expense, and No. 732 Utilities Expense. Other data: 1. 2. 3. 4. $1,100 of supplies have been used during the month. Utilities expense incurred but not paid on May 31, 2020, $200 The insurance policy is for 2 years. $600 of the balance in the unearned service revenue account remains unearned at the end of the month. May 31 is a Wednesday, and employees are paid on Fridays. Nardelli Consulting has two employees, who are paid $1,000 each for a 5-day work week. The equipment has a 5-year life with no salvage value. It is being depreciated at $200 per month for 60 months. Invoices representing $1,600 of services performed during the month have not been recorded as of May 31. 5. 6. 7. CALCULATOR PRINTER VERSION BACK 1. 2 4. $1,100 of supplies have been used during the month. Utilities expense incurred but not paid on May 31, 2020, $200. The insurance policy is for 2 years. $600 of the balance in the unearned service revenue account remains uneared at the end of the month. May 31 is a Wednesday, and employees are paid on Fridays. Nardelli Consulting has two employees, who are paid $1,000 each for a 5-day work week. The equipment has a 5-year life with no salvage value. It is being depreciated at $200 per month for 60 months. Invoices representing $1,600 of services performed during the month have not been recorded as of May 31. 5. 6. 7. (a) Prepare the adjusting entries for the month of May. (Credit account titles are automatically indented whekahe amount is entered. Do not indent manually.) Collapse question part No. Date Account Titles and Explanation Credit 1. May 31 Debit 2. May 31 3. May 31 4. May 31 5. May 31 6. May 31 7. May 31