Question

CALCULATOR PRINTER VERSION BACK NEXT Problem 5-02A a-c (Video) Ivanhoe Hardware Store completed the following merchandising transactions in the month of May. At the beginning

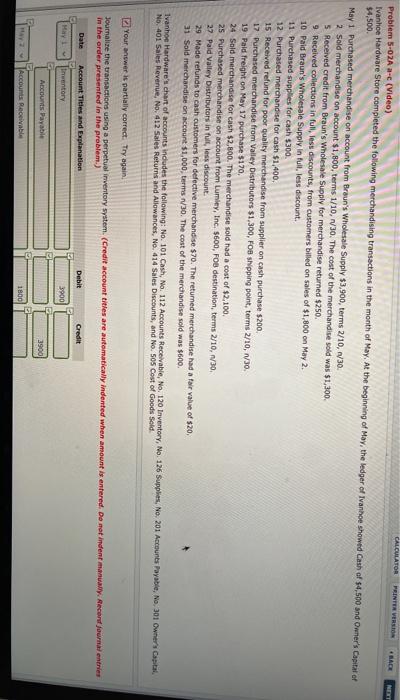

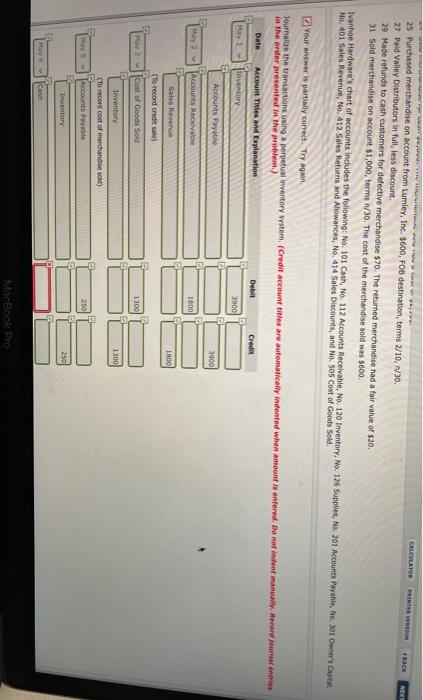

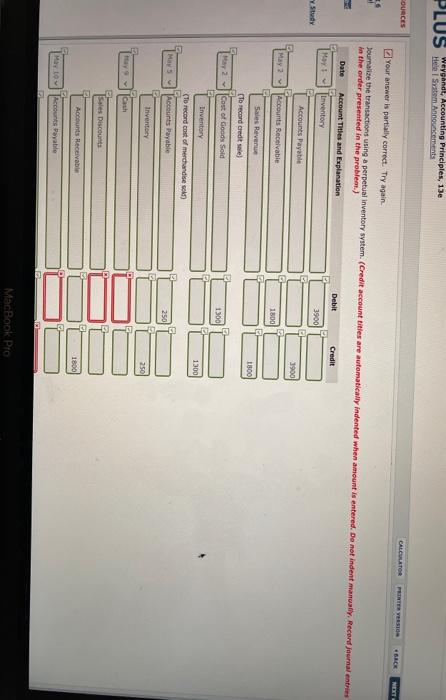

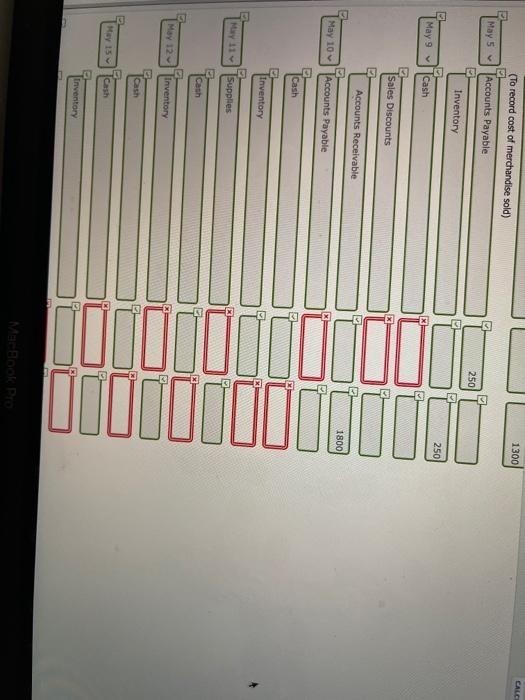

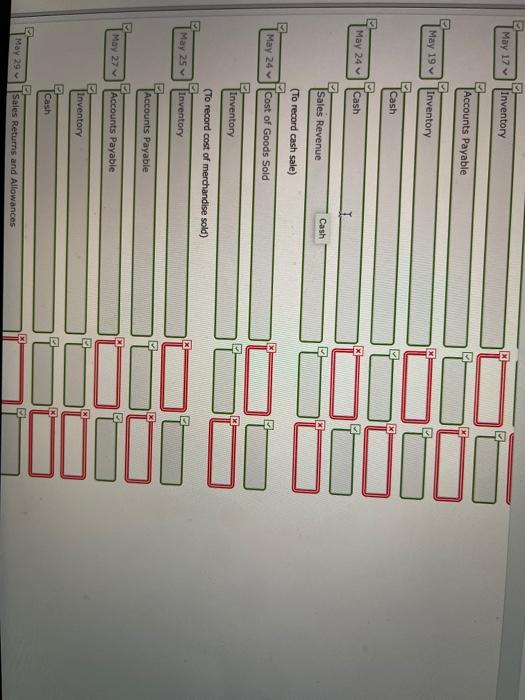

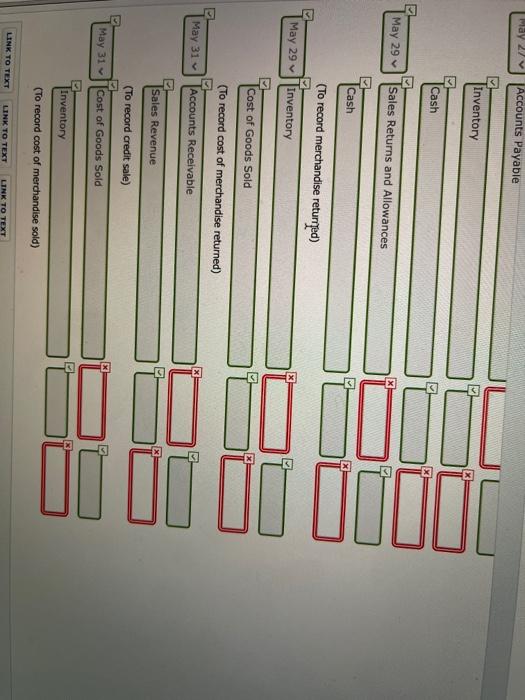

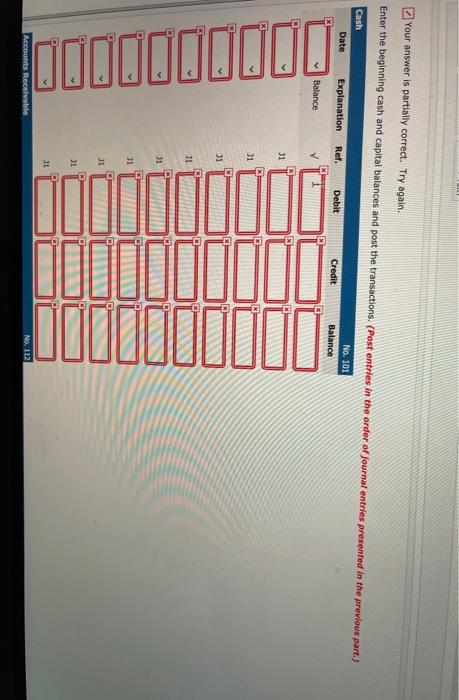

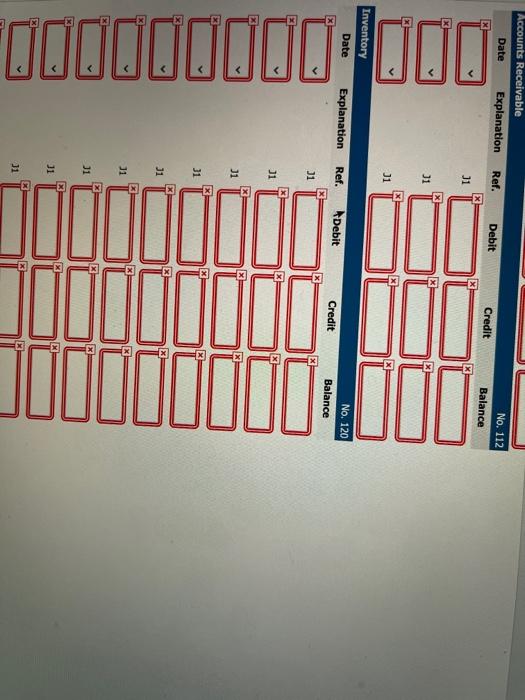

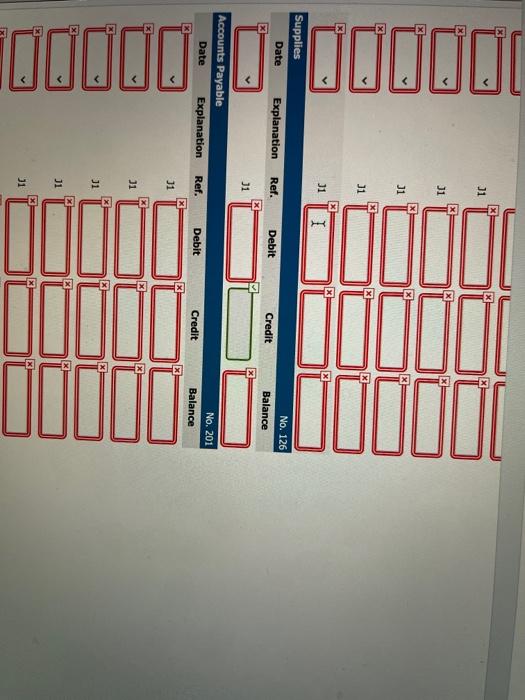

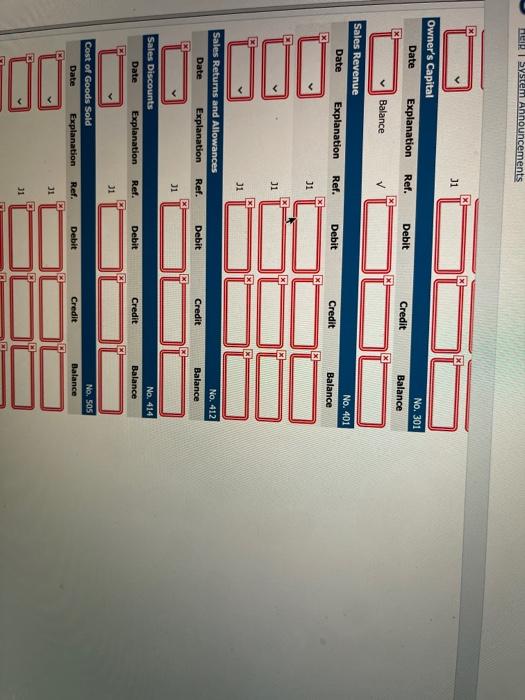

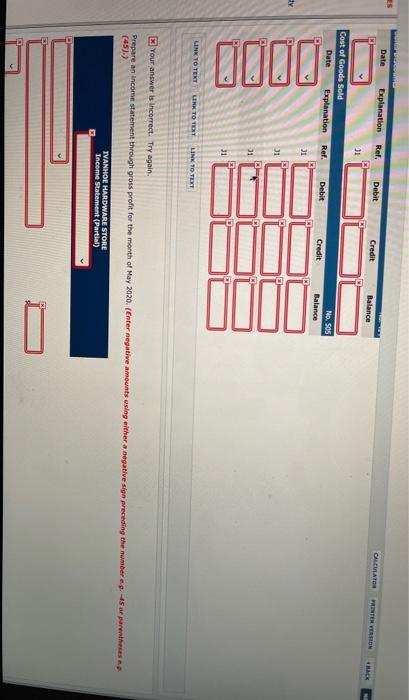

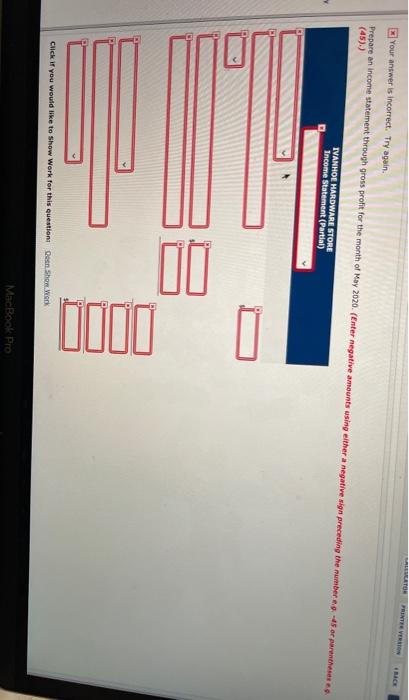

CALCULATOR PRINTER VERSION BACK NEXT Problem 5-02A a-c (Video) Ivanhoe Hardware Store completed the following merchandising transactions in the month of May. At the beginning of May, the ledger of Ivanhoe showed Cash of $4,500 and Owner's Capital of $4,500. May 1 Purchased merchandise on account from Braun's Wholesale Supply $3,900, terms 2/10, n/30. 2 Sold merchandise on account $1,800, terms 1/10, n/30. The cost of the merchandise sold was $1,300. 5 Received credit from Braun's Wholesale Supply for merchandise returned $250. 9 Received collections in full, less discounts, from customers billed on sales of $1,800 on May 2. 10 Paid Braun's Wholesale Supply in full, less discount. 11 Purchased supplies for cash $300. 12 Purchased merchandise for cash $1,400. 15 Received refund for poor quality merchandise from supplier on cash purchase $200. 17 Purchased merchandise from Valley Distributors $1,300, FOB shipping point, terms 2/10, n/30. 19 Paid freight on May 17 purchase $170. 24 Sold merchandise for cash $2,800. The merchandise sold had a cost of $2,100. 25 Purchased merchandise on account from Lumley, Inc. $600, FOB destination, terms 2/10, n/30. 27 Pald Valley Distributors in full, less discount. 29 Made refunds to cash customers for defective merchandise $70. The returned merchandise had a fair value of $20. 31 Sold merchandise on account $1,000, terms n/30. The cost of the merchandise sold was $600. Ivanhoe Hardware's chart of accounts includes the following: No. 101 Cash, No. 112 Accounts Receivable, No. 120 Inventory, No. 126 Supplies, No. 201 Accounts Payable, No. 301 Owner's Capital, No. 401 Sales Revenue, No. 412 Sales Returns and Allowances, No. 414 Sales Discounts, and No. 505 Cost of Goods Sold Your answer is partially correct. Try again. Journalize the transactions using a perpetual inventory system. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation May 1 Inventory 12 May 2 Accounts Payable Accounts Receivable Debit Credit 3900 3900 18 1800 25 Purchased merchandise on account from Lumley, Inc. $600, FOB destination, terms 2/10, n/30. 27 Paid Valley Distributors in full, less discount. 29 Made refunds to cash customers for defective merchandise $70. The returned merchandise had a fair value of $20. 31 Sold merchandise on account $1,000, terms n/30. The cost of the merchandise sold was $600. CALCULATOR PRINTER VERSION BACK NEX Ivanhoe Hardware's chart of accounts includes the following: No. 101 Cash, No. 112 Accounts Receivable, No. 120 Inventory, No. 126 Supplies, No. 201 Accounts Payable, No. 301 Owner's Capital, No. 401 Sales Revenue, No. 412 Sales Returns and Allowances, No. 414 Sales Discounts, and No. 505 Cost of Goods Sold. Your answer is partially correct. Try again Journalize the transactions using a perpetual inventory system. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation May 1 w inventory Accounts Payable May 2v Accounts Receivable Sales Revenue Debit Credit 3900 3900 1800 1800 (To record credit sale) May 2 Cost of Goods Sold Inventory 1300 1300 (To record cost of merchandise sold) May 5 Accounts Payable 250 Inventory 250 May 9 Cash MacBook Pro Weygandt, Accounting Principles, 13 PLUS Hele Svatem Announcements COURCES Your answer is partially correct. Try again. CALCULATOR PRINTER VERSION +BACK NEXT Journalize the transactions using a perpetual inventory system. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation May 1 Inventory Study Accounts Payable May 2 Accounts Receivable. Sales Revenue Debit Credit 3900 3900 1800 1800 (To record credit sale) May 2 Cost of Goods Sold Inventory 1300 1300 (To record cost of merchandise sold) May 5 ~ Accounts Payable 250 Inventory 250 May 9 Cash E Sales Discounts FL Accounts Receivable) May to Accounts Payable MacBook Pro 1800) 1300 (To record cost of merchandise sold) May 5 ~ Accounts Payable 250 Inventory 250 May 9 v Cash Sales Discounts Accounts Receivable Accounts Payable May 10 E Cash Inventory May 11 EV Supplies Cash May 12 Inventory E Cash May 15 Cash Inventory MacBook Pro 1800 CALC May 17 v Inventory Accounts Payable May 19 Inventory 5 Cash E May 24 Cash May 24 May 25 Cash Sales Revenue (To record cash sale) Cost of Goods Sold Inventory (To record cost of merchandise sold) FL Inventory Accounts Payable E May 27 Accounts Payable P Inventory Cash May 29 Sales Returns and Allowances 00000000 May 29 Accounts Payable Inventory May 29 Cash Sales Returns and Allowances Cash (To record merchandise returned) Inventory Cost of Goods Sold (To record cost of merchandise returned) Accounts Receivable May 31 Sales Revenue (To record credit sale) May 31 Cost of Goods Sold Inventory (To record cost of merchandise sold) LINK TO TEXT LINK TO TEXT LINK TO TEXT 0000 00 00 Your answer is partially correct. Try again. Enter the beginning cash and capital balances and post the transactions. (Post entries in the order of journal entries presented in the previous part.) Cash No. 101 Date Explanation Ref. Debit Credit Balance Balance 31 31 31 31 31 31 31 31 31 Accounts Receivable No. 112 Accounts Receivable Date No. 112 Explanation Ref. Debit Credit Balance x 31 Explanation 0 0 0 0 0 0 0 0 0 0 0 0 Inventory 31 x 31 No. 120 Ref. Debit Credit Balance X 31 11 31 31 x 31 X 31 11 31 31 x 000000 31 31 J1 31 X 31 I Supplies No. 126 Date Explanation Ref. Debit Credit Balance X 31 Accounts Payable Date No. 201 Explanation Ref. Debit Credit Balance x x 31 31 31 J1 31 X System Announcements 31 Owner's Capital Date No. 301 Explanation Ref. Debit Credit Balance Balance Sales Revenue No. 401 Date Explanation Ref. Debit Credit Balance 31 31 31 x Sales Returns and Allowances No. 412 Date Explanation Ref. Debit Credit Balance 31 Sales Discounts Date No. 414 Explanation Ref. Debit Credit Balance 31 " Cost of Goods Sold No. 505 Date Explanation Ref. Debit Credit Balance 31 31 F X ES Date Explanation Ref. Debit Credit Balance 31 dy Cost of Goods Sold Date Explanation Ref. Debit Credit 31 0000 31 31 31 LINK TO TEXT LINK TO TEXT LINK TO TEXT No. 505 Balance CALCULATOR PRINTER VERSION + BACK NEW Your answer is incorrect. Try again. Prepare an income statement through gross profit for the month of May 2020. (Enter negative amounts using either a negative sign preceding the number eg. -45 ar parentheses eg (45).) IVANHOE HARDWARE STORE Income Statement (Partial) CATOR PRINTER VERSION + BACK Your answer is incorrect. Try again. Prepare an income statement through gross profit for the month of May 2020. (Enter negative amounts using either a negative sign preceding the number eg. -45 or parentheses eg (45).) IVANHOE HARDWARE STORE Income Statement (Partial) 00 0 0000, MacBook Pro Click if you would like to Show Work for this question: Qeen Show. Work

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started