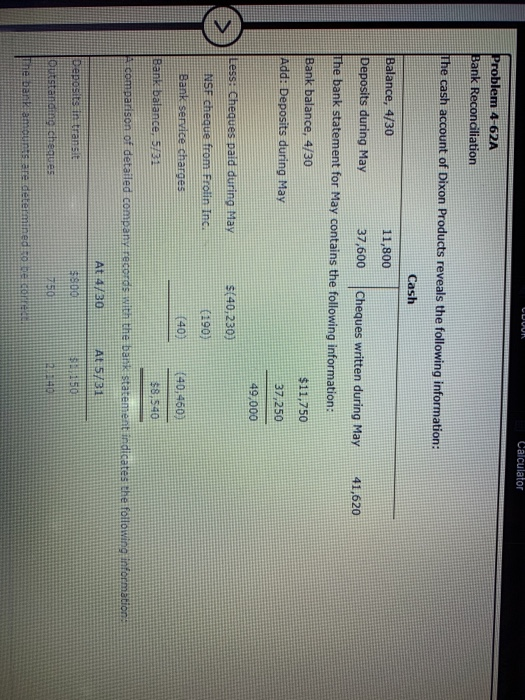

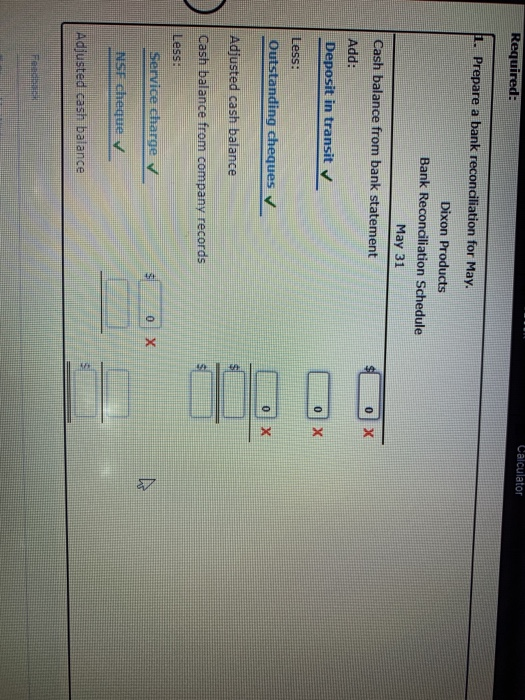

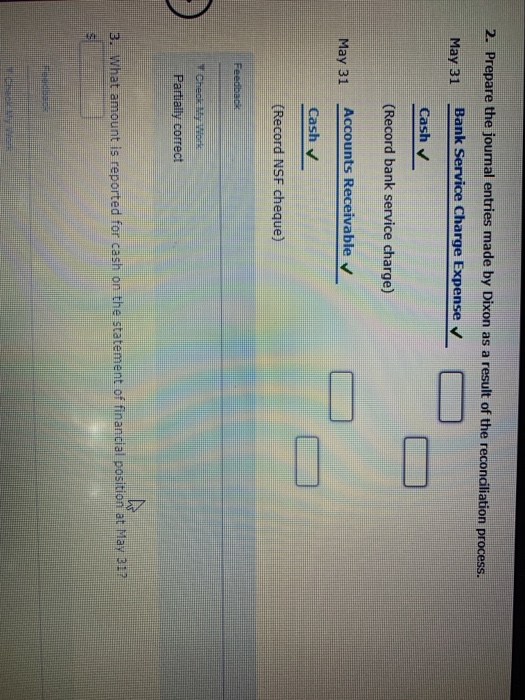

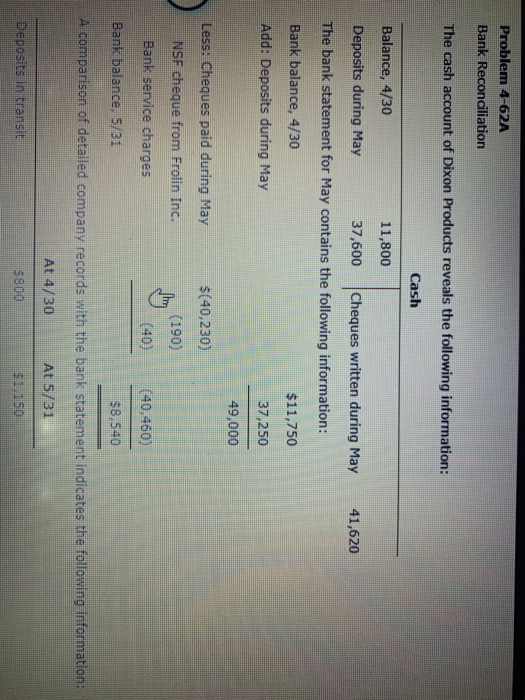

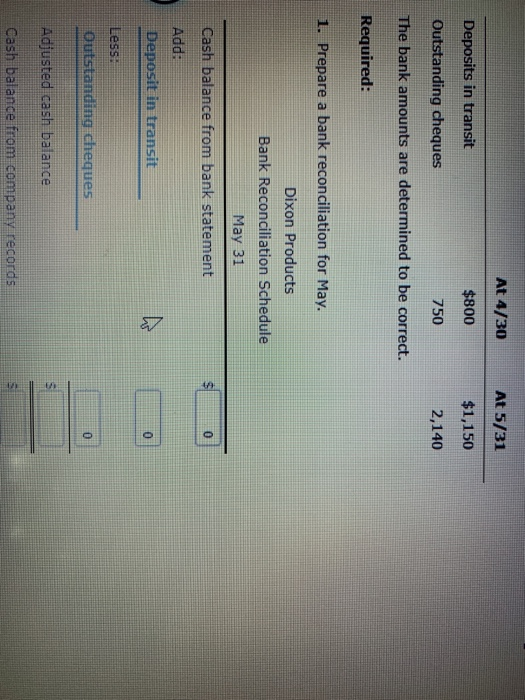

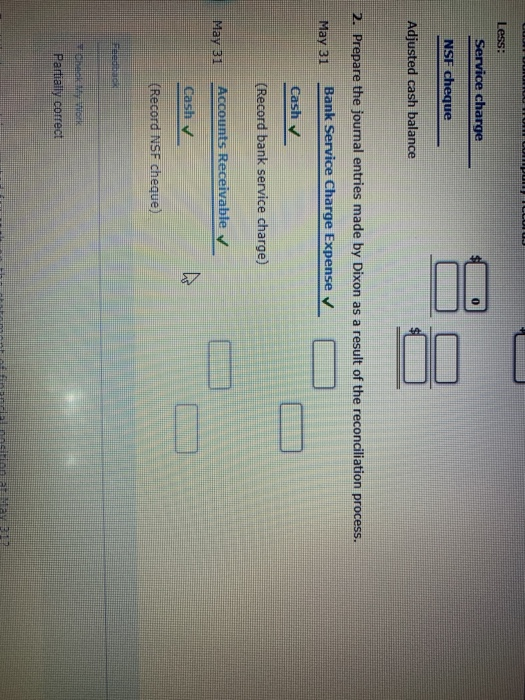

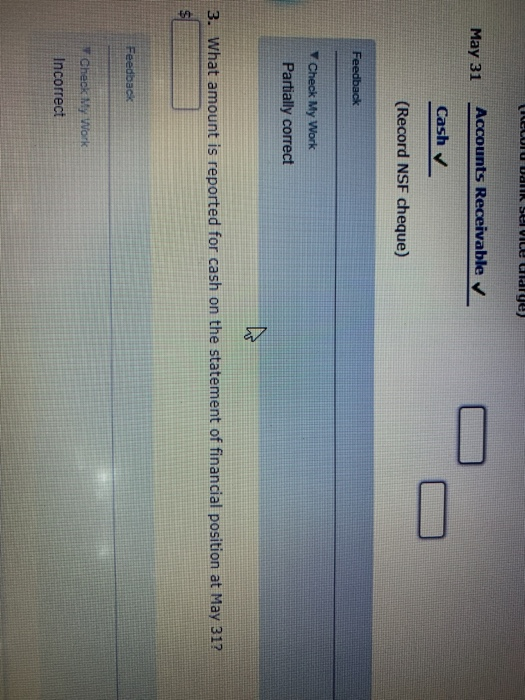

Calculator Problem 4-62A Bank Reconciliation The cash account of Dixon Products reveals the following information: Cash 41,620 Balance, 4/30 11,800 Deposits during May 37,600 Cheques written during May The bank statement for May contains the following information: Bank balance, 4/30 $11,750 Add: Deposits during May 37,250 49,000 $(40,230) (190) Less: Cheques paid during May NSF cheque from Frolin Inc. Bank service charges Bank balance, 5131 (40 (40,460) $8.540 comparison of detailed company records with the bank statement indicates the following information At 430 Al 5/31 Deposits in transit $800 $150 Outstanding cheques 30 240 The bank mantare determined Calculator Required: 1. Prepare a bank reconciliation for May. Dixon Products Bank Reconciliation Schedule May 31 0 X Cash balance from bank statement Add: Deposit in transit X Less: Outstanding cheques 0 X Adjusted cash balance Cash balance from company records $ Less: Service charge $ X NSF cheque Adjusted cash balance F 2. Prepare the journal entries made by Dixon as a result of the reconciliation process. May 31 Bank Service Charge Expense Cash (Record bank service charge) May 31 Accounts Receivable Cash (Record NSF cheque) Feedback Check on Partially correct 3. What amount is reported for cash on the statement of financial position at May 31? My Wom Problem 4-62A Bank Reconciliation The cash account of Dixon Products reveals the following information: Cash Balance, 4/30 11,800 Deposits during May 37,600 Cheques written during May 41,620 The bank statement for May contains the following information: Bank balance, 4/30 $11,750 Add: Deposits during May 37,250 49,000 Less: Cheques paid during May $(40,230) NSF cheque from Frolin Inc. (190) Bank service charges (40) (40,460) Bank balance, 5/31 $8,540 A comparison of detailed company records with the bank statement indicates the following information: At 4/30 At 5/31 Deposits in transit $800 $1,150 At 4/30 At 5/31 Deposits in transit $800 $1,150 Outstanding cheques 750 2,140 The bank amounts are determined to be correct. Required: 1. Prepare a bank reconciliation for May. Dixon Products Bank Reconciliation Schedule May 31 Cash balance from bank statement Add: Deposit in transit 0 Less: Outstanding cheques 0 Adjusted cash balance $ $ Cash balance from company records PU IU Tess: Service charge DO NSF cheque Adjusted cash balance 2. Prepare the journal entries made by Dixon as a result of the reconciliation process. May 31 Bank Service Charge Expense Cash (Record bank service charge) May 31 Accounts Receivable Cash (Record NSF cheque) Bed Check My Partially correct LULU Uall service clarge May 31 Accounts Receivable Cash (Record NSF cheque) Feedback Check My Work Partially correct 3. What amount is reported for cash on the statement of financial position at May 31? $ Feedback Check My Work Incorrect