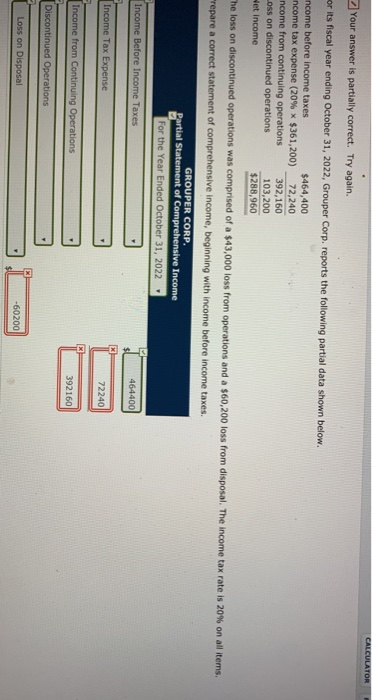

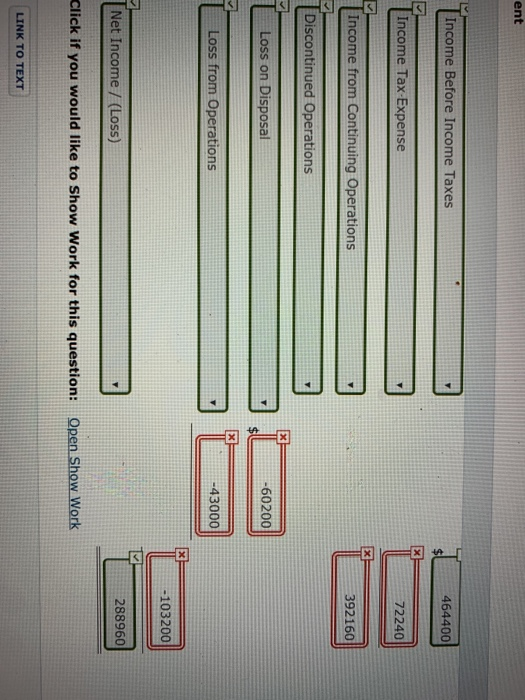

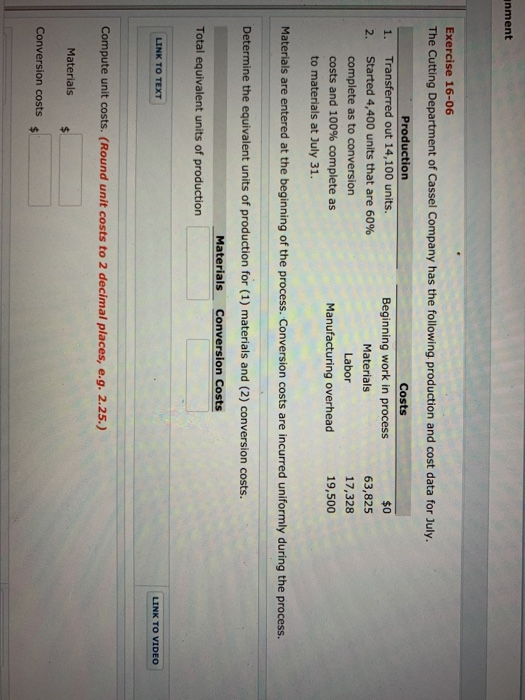

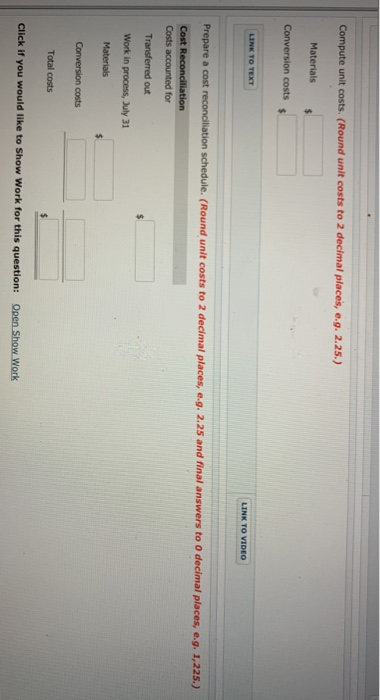

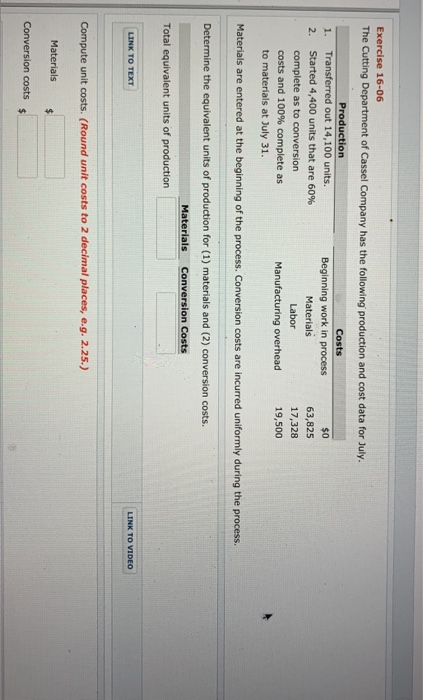

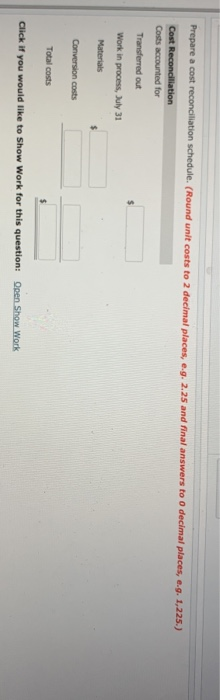

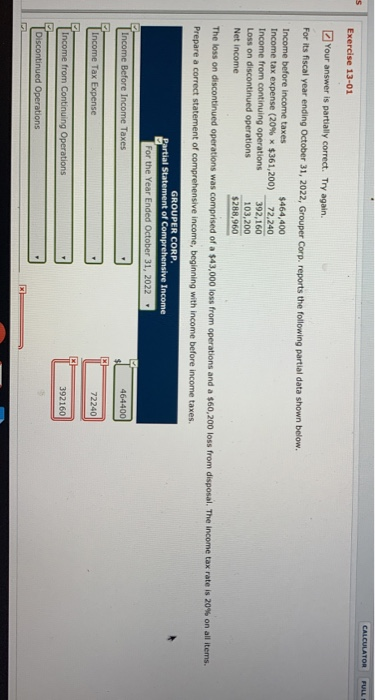

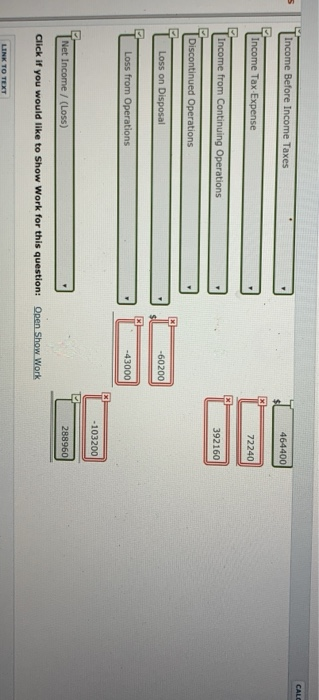

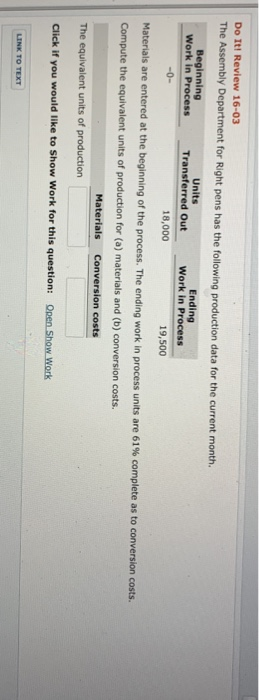

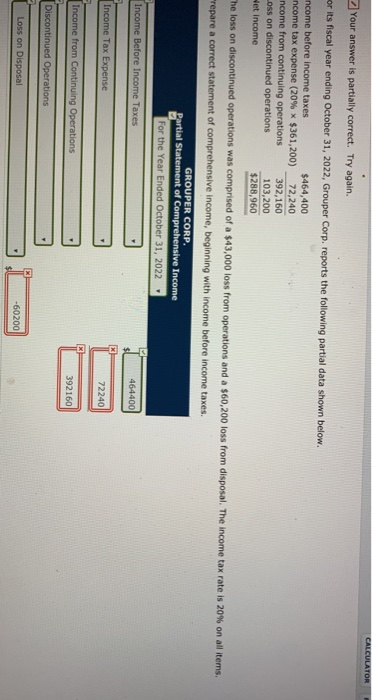

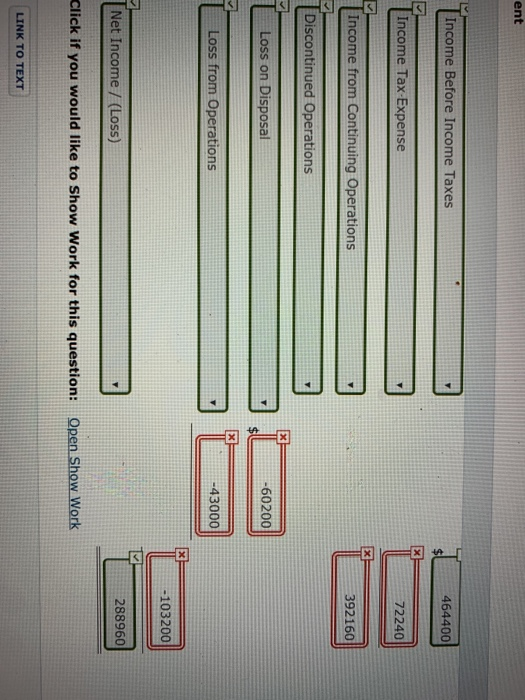

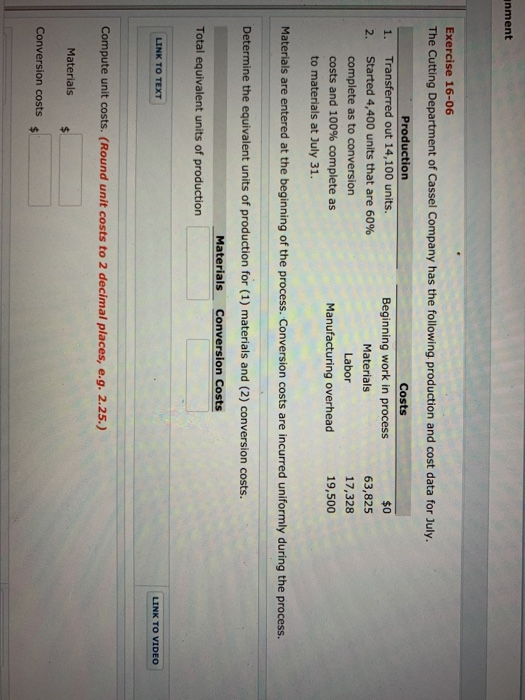

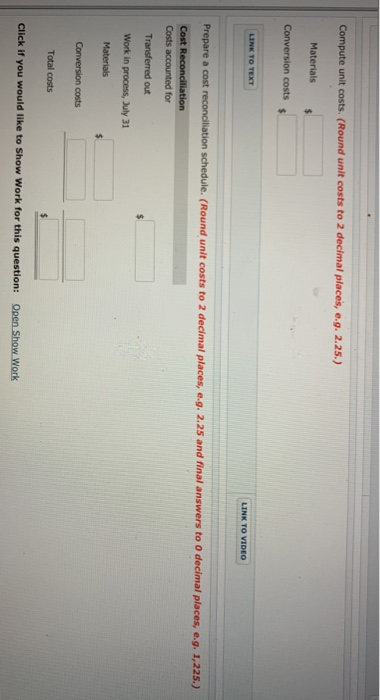

CALCULATOR Your answer is partially correct. Try again. or its fiscal year ending October 31, 2022, Grouper Corp. reports the following partial data shown below. income before income taxes income tax expense (20% * $361,200) ncome from continuing operations Loss on discontinued operations Wet income $464,400 72,240 392,160 103,200 $288,960 he loss on discontinued operations was comprised of a $43,000 loss from operations and a $60,200 loss from disposal. The income tax rate is 20% on all items "repare a correct statement of comprehensive income, beginning with income before income taxes. GROUPER CORP. Partial Statement of Comprehensive Income For the Year Ended October 31, 2022 Income Before Income Taxes 464400 Income Tax Expense 72240 Income from Continuing Operations 392160 Discontinued Operations Loss on Disposal -60200 ent Income Before Income Taxes 464400 Income Tax-Expense 72240 Income from Continuing Operations 392160 Discontinued Operations * Loss on Disposal -60200 Loss from Operations -43000 -103200 Net Income / (Loss) 288960 Click if you would like to Show Work for this question: Open Show Work LINK TO TEXT inment Exercise 16-06 The Cutting Department of Cassel Company has the following production and cost data for July. Production Costs 1. Transferred out 14,100 units. Beginning work in process $0 2. Started 4,400 units that are 60% Materials 63,825 complete as to conversion Labor 17,328 costs and 100% complete as Manufacturing overhead 19,500 to materials at July 31. SP Materials are entered at the beginning of the process. Conversion costs are incurred uniformly during the process. Determine the equivalent units of production for (1) materials and (2) conversion costs. Materials Conversion Costs Total equivalent units of production LINK TO TEXT LINK TO VIDEO Compute unit costs. (Round unit costs to 2 decimal places, e.g. 2.25.) Materials Conversion costs Compute unit costs. (Round unit costs to 2 decimal places, e.g. 2.25.) Materials Conversion costs $ LINK TO TEXT LINK TO VIDEO Prepare a cost reconciliation schedule. (Round unit costs to 2 decimal places, e.g. 2.25 and final answers to o decimal places, e.g. 1,225.) Cost Reconciliation Costs accounted for Transferred out Work in process, July 31 Materials Conversion costs Total costs Click if you would like to Show Work for this question: Open Show Work Exercise 16-06 The Cutting Department of Cassel Company has the following production and cost data for July. Production Costs 1. Transferred out 14,100 units. Beginning work in process $0 2. Started 4,400 units that are 60% Materials 63,825 complete as to conversion Labor 17,328 costs and 100% complete as Manufacturing overhead 19,500 to materials at July 31. Materials are entered at the beginning of the process. Conversion costs are incurred uniformly during the process. Determine the equivalent units of production for (1) materials and (2) conversion costs. Materials Conversion Costs Total equivalent units of production LINK TO TEXT LINK TO VIDEO Compute unit costs. (Round unit costs to 2 decimal places, e.g. 2.25.) Materials Conversion costs $ Prepare a cost reconciliation schedule. (Round unit costs to 2 decimal places, e.g. 2.25 and final answers to o decimal places, e.g. 1,225.) Cost Reconciliation Costs accounted for Transferred out Work in process, July 31 Materials Conversion costs Total costs Click if you would like to Show Work for this question: Open Show Work CALCULATOR FULL Exercise 13-01 Your answer is partially correct. Try again. For its fiscal year ending October 31, 2022, Grouper Corp. reports the following partial data shown below. Income before income taxes $464,400 Income tax expense (20% * $361,200) 72,240 Income from continuing operations 392,160 Loss on discontinued operations 103,200 Net income $268,960 The loss on discontinued operations was comprised of a $43,000 loss from operations and a $60,200 loss from disposal. The income tax rate is 20% on all items. Prepare a correct statement of comprehensive income, beginning with income before income taxes. GROUPER CORP. Partial Statement of Comprehensive Income For the Year Ended October 31, 2022 Income Before Income Taxes 464400 Income Tax Expense 72240 Income from Continuing Operations 392160 Discontinued Operations CALO Income Before Income Taxes 464400 Income Tax-Expense 72240 Income from Continuing Operations 392160 Discontinued Operations Loss on Disposal -60200 Loss from Operations -43000 -103200 Net Income / (Loss) 288960 Click if you would like to Show Work for this question: Open Show Work LINK TO TEXT Do It! Review 16-03 The Assembly Department for Right pens has the following production data for the current month. Beginning Units Ending Work in Process Transferred Out Work in Process -0- 18,000 19,500 Materials are entered at the beginning of the process. The ending work in process units are 61% complete as to conversion costs. Compute the equivalent units of production for (a) materials and (b) conversion costs. Materials Conversion costs The equivalent units of production Click if you would like to Show Work for this question: Open Show Work LINK TO TEXT