Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Caleb (72) is a widower with an adult son, Jason. Caleb sells the cottage he inherited for a gain of $250,000 after taxes and

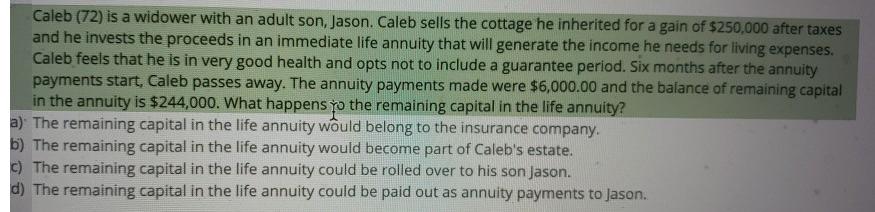

Caleb (72) is a widower with an adult son, Jason. Caleb sells the cottage he inherited for a gain of $250,000 after taxes and he invests the proceeds in an immediate life annuity that will generate the income he needs for living expenses. Caleb feels that he is in very good health and opts not to include a guarantee period. Six months after the annuity payments start, Caleb passes away. The annuity payments made were $6,000.00 and the balance of remaining capital in the annuity is $244,000. What happens yo the remaining capital in the life annuity? a) The remaining capital in the life annuity would belong to the insurance company. b) The remaining capital in the life annuity would become part of Caleb's estate. c) The remaining capital in the life annuity could be rolled over to his son Jason. d) The remaining capital in the life annuity could be paid out as annuity payments to Jason.

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Life annuity guarantees payments as long as the annuitant li...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started